FX Daily Strategy: Asia, Sep 30th

USD continues to follow Trump 1.0

Payroll data a focus, if it is released

European currencies may be most vulnerable to further USD gains

CHF could come under some pressure

AUD focus on the RBA

US government shutdown could be USD negative

JPY has most scope to benefit

EUR unlikely to move on CPI data

GBP vulnerable

Tuesday should see some more clarity on whether the US government shutdown is happening this week. Monday saw the USD decline slightly, likely because of some concerns around the shutdown. Should Congress fail to pass a funding bill before the fiscal year ends on Tuesday, parts of the government would close on Wednesday, the first day of its 2026 fiscal year. The last government shutdown was during Trump's first term, spanning 34 days from December 22 2018 to January 25 2019. The equity market did decline ahead of the shutdown, but recovered in January while the government was shut, and USD/JPY fell sharply at the end of 2018 in sympathy before recovering. Thus far, the market has been largely unconcerned, but we would expect to see some USD/JPY and equity market weakness if the shutdown goes ahead.

Certainly, if a bill isn’t passed by the end of Tuesday, the employment report due on Friday is unlikely to be released. This might increase the interest in the ADP report due on Wednesday, which will be released in any case as it is published by a private agency. But this will still carry less weight than the official data, and without the official data the chances of the Fed easing at the October 29th meeting are likely reduced. Nevertheless, this is unlikely to be USD positive in these circumstances.

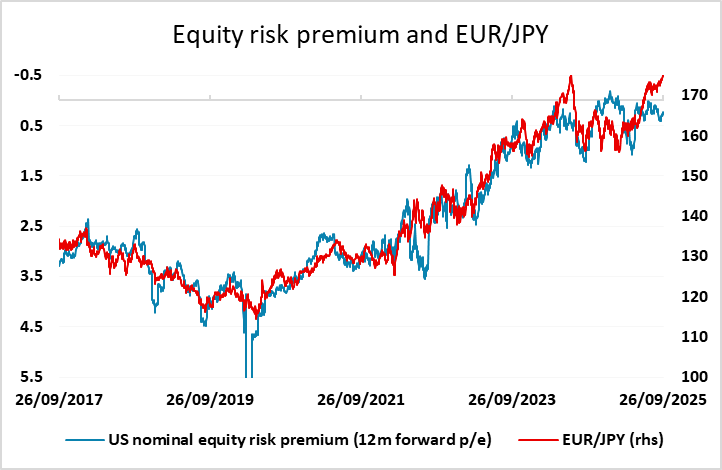

Otherwise, Tuesday is relatively quiet with preliminary September inflation data from France and Germany a focus in Europe, after slightly softer than expected Spanish CPI data yesterday. Even so, it will take a lot for the data to move the markets, as the ECB looks to be determinedly neutral for the foreseeable future. We do see some EUR vulnerability after the weaker IFO survey last week, especially if there is some softening in equity markets, with EUR/JPY continuing to look the most out of line with fundamentals.

There is also final Q2 GDP data from the UK. The preliminary gain of 0.3% q/q is unlikely to be revised, but the data will provide more detail. GBP weakened a little through the afternoon in Europe on Monday, perhaps responding a little negatively to the speech from Chancellor Reeves at the Labour Party conference. While she said little that was concrete, she did restate the policy of no income tax or VAT hikes at the November budget, and this suggests that either the problematic UK fiscal position will not be properly addressed, or there will be new taxes that are less reliable generators of revenue (or perhaps both). The year’s high on EUR/GBP at 0.8763 remains a target and could come under threat if the GDP data disappoints either with a headline revision or an unfavourable breakdown.