Published: 2024-01-19T17:00:48.000Z

Preview: Due January 31 - U.S. Q4 Employment Cost Index - A little slower

Senior Economist , North America

-

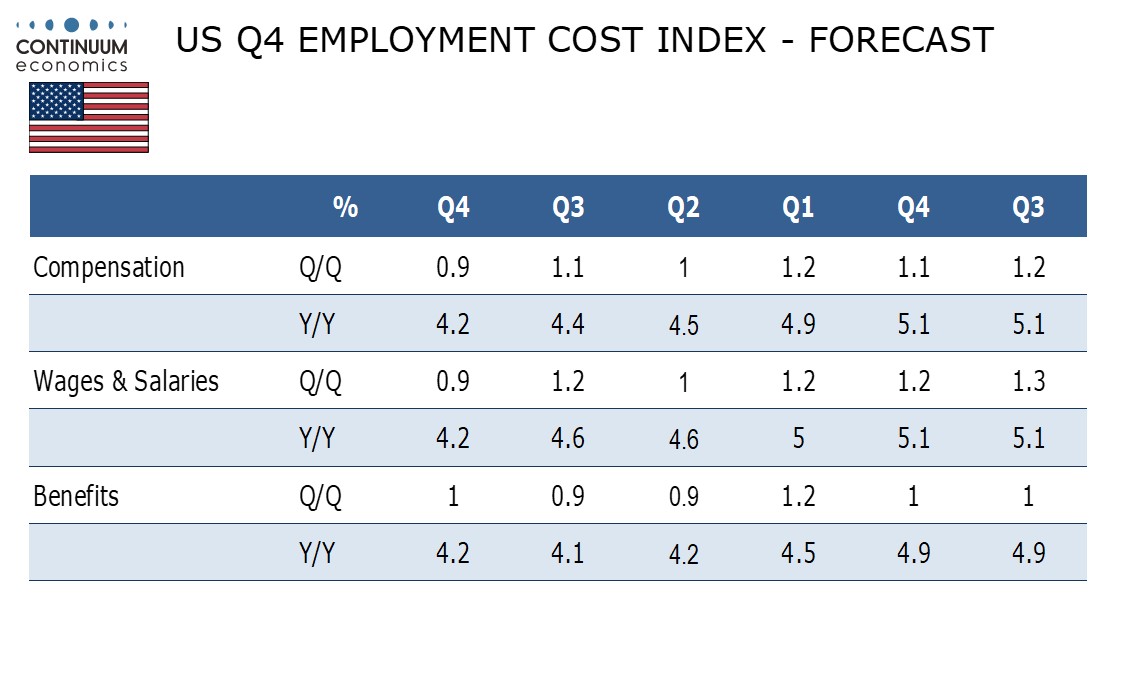

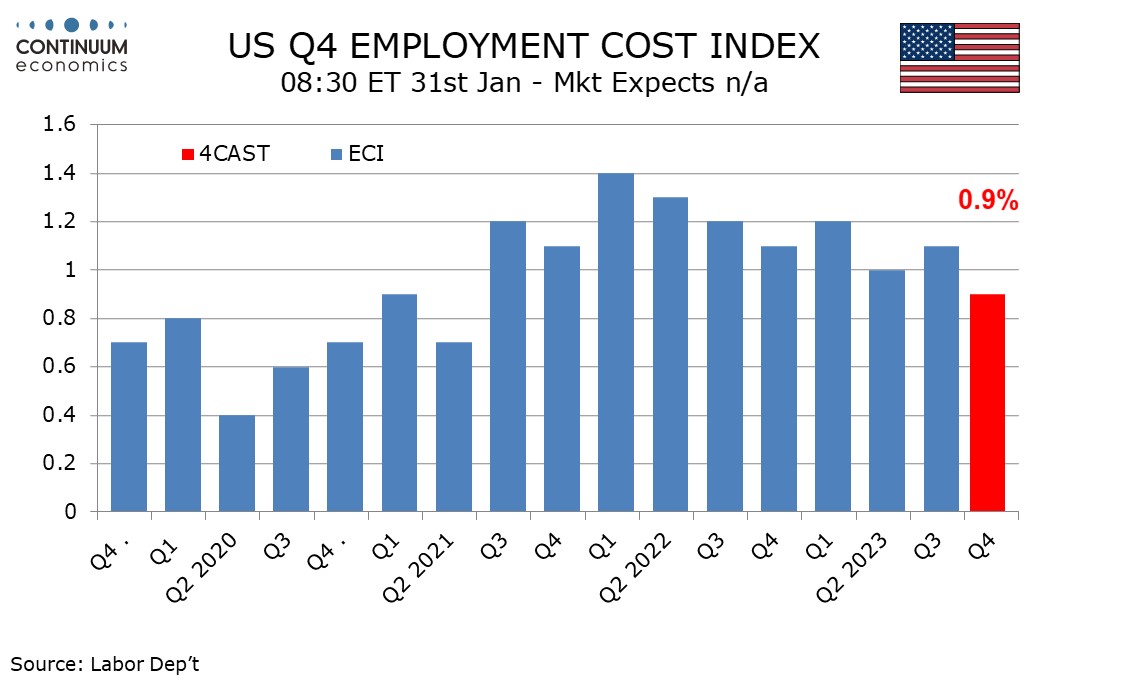

We look for the Q4 employment cost index (ECI) to increase by 0.9%, down from 1.1% in Q3 and the slowest since Q2 2021. Yr/yr growth at 4.2%, while likely to see a 2-year low, would however remain well above the pre-pandemic trend which was trending slightly below 3.0%.

We expect wages and salaries to increase by 0.9% and benefits to rise by 1.0%. For the former this would be a slowing from an above trend 1.2% in Q3 and be consistent with a moderate slowing in average hourly earnings trend in the non-farm payroll detail.

There are some upside risks to benefit costs with health care CPI having accelerated in Q4, but volatility in benefit costs is usually seen in Q1 as health premiums tend to see annual updates in that quarter. A 1.0% increase would be a marginal acceleration from two straight gains of 0.9%.