CHF flows: CHF softer after rate cut

CHF weaker after SNB cut rates as generally expected. More scope for CHF/JPY decline than EUR/CHF gain

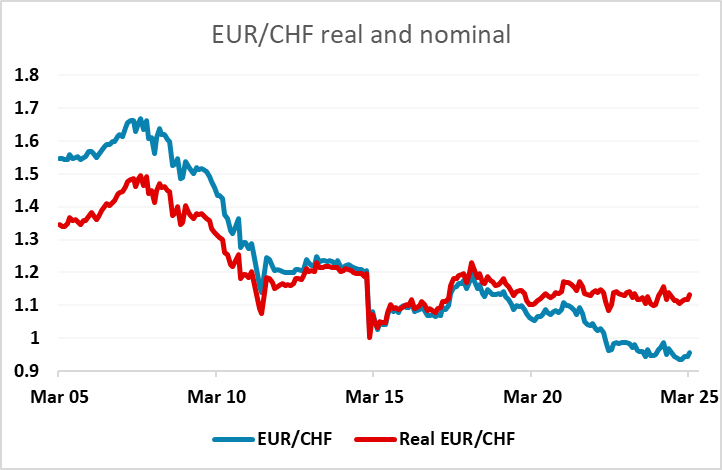

As generally expected, the SNB cut their policy rate to 25bp at today’s meeting. This was mostly priced in, but there were still some who were expecting no change so EUR/CHF has moved higher in response, gaining around 40 pips to 0.9570, although much of this gain reversed declines seen in early trading. EUR/CHF doesn’t have a strong correlation with yield spreads, so the cut will probably not have a major impact. EUR/CHF continues to be determined more by risk sentiment, particularly on the strength of the Eurozone economy. The recent rise in EUR/CHF reflects some improvement in sentiment due to the expectations of increased defence and infrastructure spending, and if Eurozone growth does pick up there is some scope for further EUR/CHF gains. However, the historically low nominal level of EUR/CHF is misleading in terms of real value. In real terms, EUR/CHF is essentially mid-range for the last 15 years, so we wouldn’t see scope for major gains.

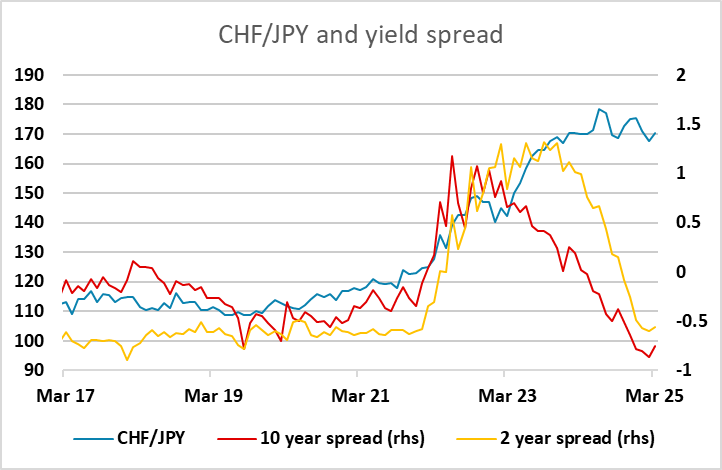

We see more reason for the CHF to lose some ground against the JPY. CHF/JPY is much more clearly overvalued after the sharp gains seen in recent years, and the latest rate cut takes the Swiss policy rate below the Japanese policy rate for the first time since August 2022. Yield spread further out on the curve are already favourable for the JPY, and from a trading perspective, the similar risk characteristics of the CHF and JPY make CHF/JPY less vulnerable to shifts in risks sentiment.