FX Daily Strategy: APAC, April 11th

GBP downside risk on UK GDP

SEK favoured as CPI set to pop higher

USD to maintain recent strength

GBP downside risk on UK GDP

SEK favoured as CPI set to pop higher

USD to maintain recent strength

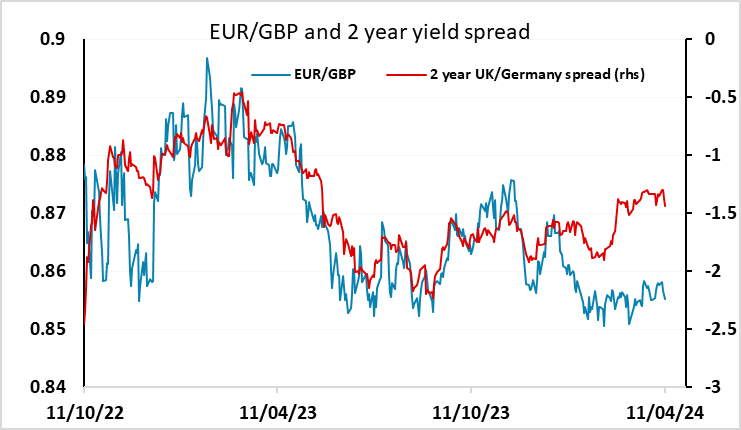

Friday sees UK February GDP data. The economy may have been in only mild recession in H2 last year, but the ‘recovery’ now evident is hardly going to feel much better with GDP growth hardly positive. Admittedly, coming in as largely expected, and despite industrial action, GDP rose by 0.2% m/m in January, more than reversing the 0.1% drop in December data, a result that nevertheless is nothing more than a continuation of the monthly swings seen of late, which may result in fresh drop of 0.1% in the upcoming February data. We are more negative than the market consensus, which is looking for a 0.1% rise in February, so we see the initial risks for GBP as being on the downside.

Even so, policy is being shaped more by price and cost developments than by real activity, so it will take a notable miss in the GDP data to have much impact on policy expectations or GBP. The hawkish comments from MPC member Greene yesterday provided GBP with some support, and over the last couple of days GBP yields have risen more than EUR yields in response to the rise in US yields since the CPI data. But the recent correlation with yield spreads doesn’t suggest there is much more downside for EUR/GBP and with the first UK rate cut now not fully priced in until September, there shouldn’t be much more upside for UK yields. So we would expect EUR/GBP to find support at 0.8550.

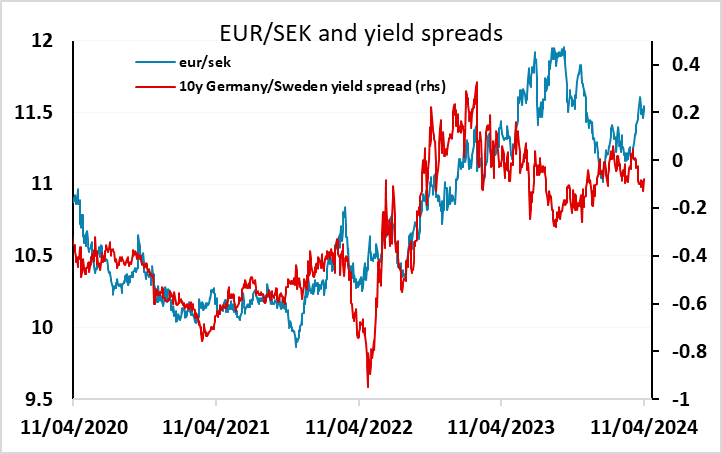

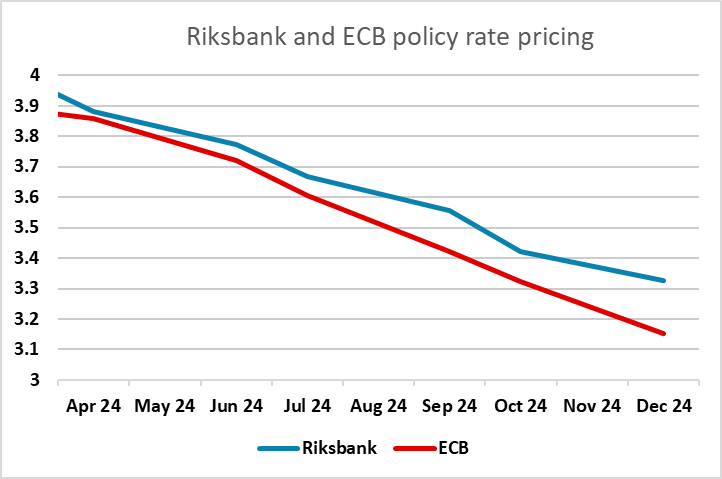

We also see Swedish CPI data for March, with the market consensus looking for a small rise in the core rate to 2.6% from 2.5% in February. We expect something similar, and although there might be limited knee jerk reaction to the data, we see downside risks for EUR/SEK as the recent rise doesn’t look well supported by yield spread moves. Recent Swedish confidence data has also shown some improvement, and although the market has slightly reduced expectations of a June ECB rate cut after Thursday’s ECB meeting, the Riksbank are unlikely to cut ahead of the ECB and we still see scope for EUR/SEK to fall back to 11.

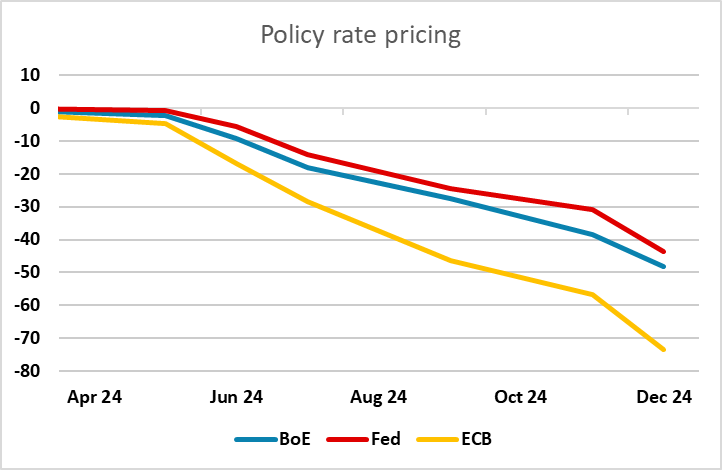

The USD looks likely to at least hang onto the gains made post-CPI, with the market finally starting to see some differential between Fed and ECB policy. While we aren’t entirely convinced that the Fed will be leaving the first hike until September as the market is currently pricing in, as the CPI data are still open to interpretation, it does seem as if the relative strength of the US economy is starting to lead to a relatively more hawkish view of the Fed. While this continues, expect downside pressure on EUR/USD, with a break to new lows for the year below 1.0695 likely to be seen.