FX Weekly Strategy: Europe , November 4th-8th

Trump victory close to priced in but without a Republican clean sweep

USD likely to benefit if Republicans win the House…

…while Harris win would lead to USD dip

GBP to suffer further if BoE cut rates

Strategy for the week ahead

Trump victory close to priced in but without a Republican clean sweep

USD likely to benefit if Republicans win the House…

…while Harris win would lead to USD dip

GBP to suffer further if BoE cut rates

The US election is the main focus for the week. The polls suggests the race is too close to call, but the betting odds significantly favour a Trump victory, while the odds also suggest that a Republican clean sweep (presidency, House and Senate) is the most likely outcome. The betting odds may not be completely in line with what is priced into the financial markets, and we would see the chances of a Harris win and a Democrat win in the House as more likely than the odds suggest. Nevertheless, we would see the markets as being close to pricing in a Trump win, but not pricing in a clean sweep.

What would be the impact of each of these outcomes?

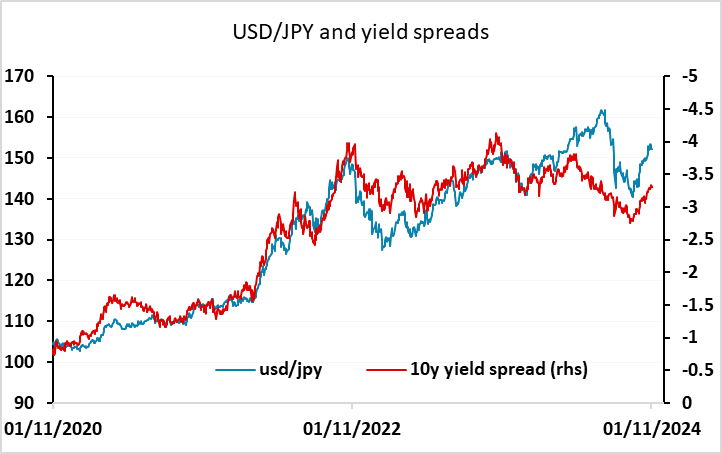

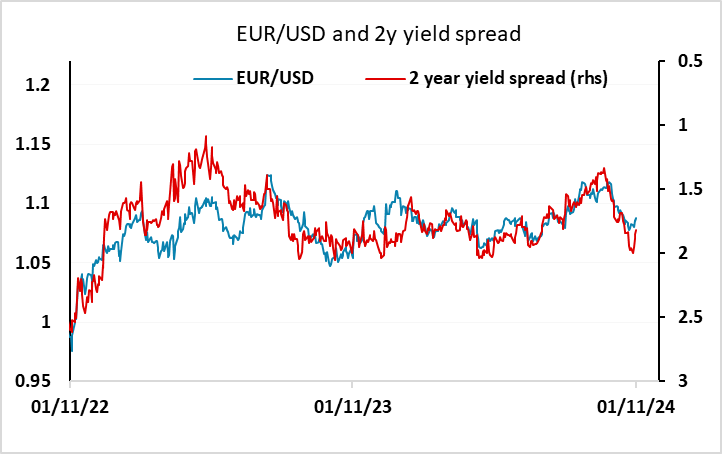

1) A Republican clean sweep would likely mean Trump not only extends the lapsing 2017 tax cuts but adds further corporate tax cuts. He could also be expected to institute new tariffs. From a growth perspective this might be viewed as positive due to the tax cuts, even if the net budgetary impact is more neutral because of the tariffs. However, it is a combination that would likely lead to higher inflation, less Fed easing and consequently a stronger USD.

2) A Trump victory and a split Congress could be expected to mean higher tariffs, as Trump is able to put these in place without Congressional support, but is less likely to mean new tax cuts, although we would still expect the 2017 cuts to be extended. This is probably broadly priced into the market at this stage, so should be close to USD neutral, even though we might see an initial positive USD reaction.

3) A Harris victory and a split Congress should be the most USD negative outcome, although the 2017 tax cuts might still be extended. Without tariffs inflation could be expected to be lower and Fed policy relatively easier (although it will depend on the general stance of fiscal policy). This outcome should therefore be USD negative as US yields might fall from current levels. Trump could be expected to contest the result, and this might also be seen as independently USD negative.

See here for a more detailed analysis of the likely economic scenarios.

Inasmuch as we see the betting market and the financial markets of slightly overpricing the chances of a Trump victory, the risks for the USD should be weighted to the downside. But in practice the initial market reaction is unlikely to be robust, with a lot of uncertainties whatever the outcome.

Other events will be of secondary importance. The FOMC meeting should deliver the expected 25bp rate cut, but given the lack of certainty on fiscal policy going forward, it will be hard for the Fed to provide much forward guidance, especially after the latest employment report which left a lot of questions about the state of the labour market which will not be clearly answered until at least the next report and probably beyond.

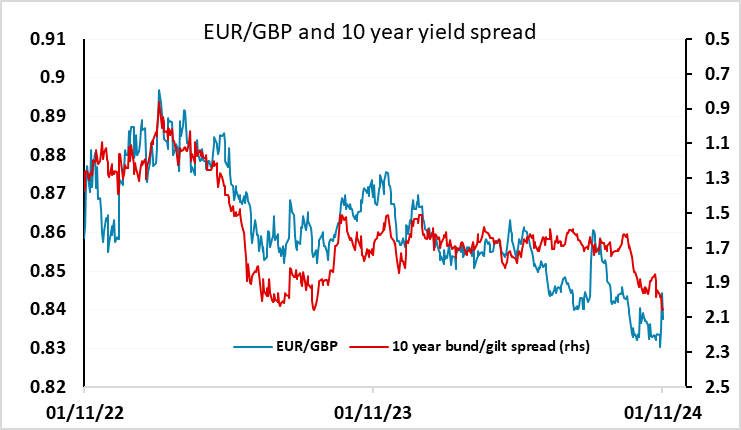

The BoE meeting will be a focus for GBP. The pound came under pressure in the aftermath of the budget, even though the markets have somewhat reduced expectations of BoE easing in response to the promised near term fiscal boost. As it stands, a 25bp rate cut is 80% priced in, so GBOP may see some more weakness if the Bank delivers the cut. The reaction to Budget indicates some loss of confidence in the pound, albeit not on the scale that was seen after the Truss/Kwarteng budget in 2022, with the simultaneous decline in gilts and GBP suggesting foreign selling of UK assets. But GBP can still be expected to react negatively if the BoE retains a dovish stance, and we see prospects to 0.85 in EUR/GBP near term.

Data and events for the week ahead

USA

While the US data calendar is relatively quiet, it will be a busy week with the election on Tuesday and FOMC meeting on Thursday. The election is too close to call, and while a decisive victory for either candidate is not to be ruled out with polls far from reliable, it is more likely that the election will take a few days at least for close counts in the swing states to be resolved. Any Harris win is likely to be disputed by Trump. The race for the House may also take some time to be resolved, but the Republicans look likely, if far from sure, to retake control of the Senate.

The FOMC is excepted to ease by 25bps, though generally positive data, outside temporary negatives from hurricanes and strikes, will have the FOMC less concerned about downside risk than at the last meeting on September 18, which delivered a 50bps easing. This time the debate is likely to be between a 25bps easing and no change, though post-election uncertainty could provide a fresh downside risk.

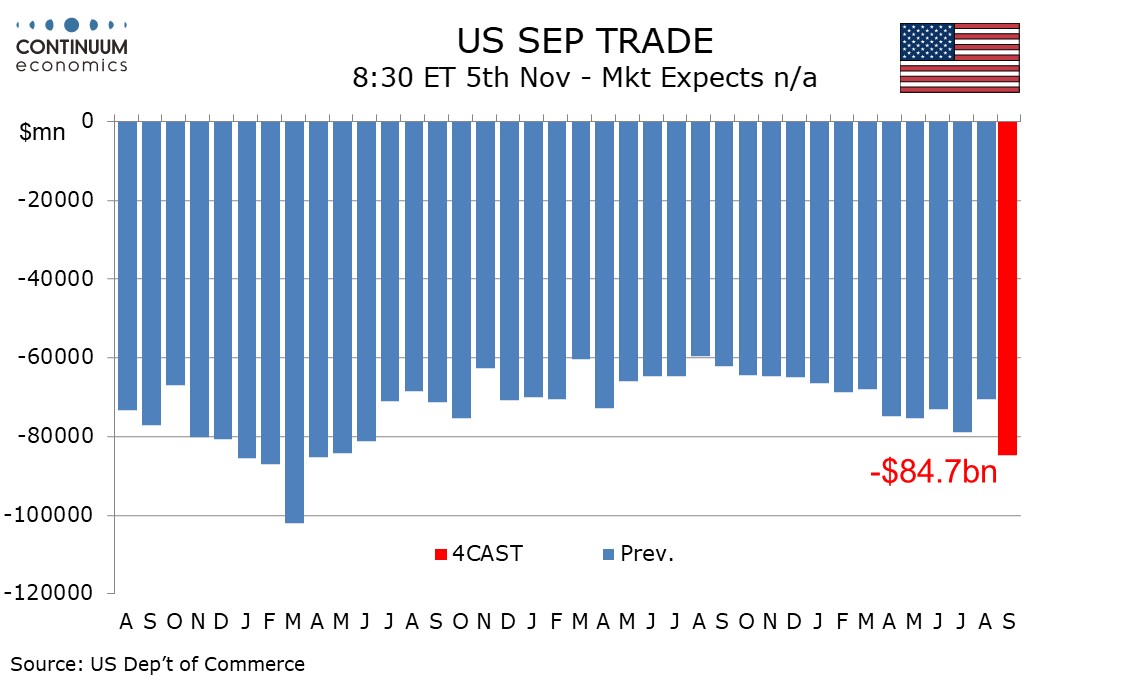

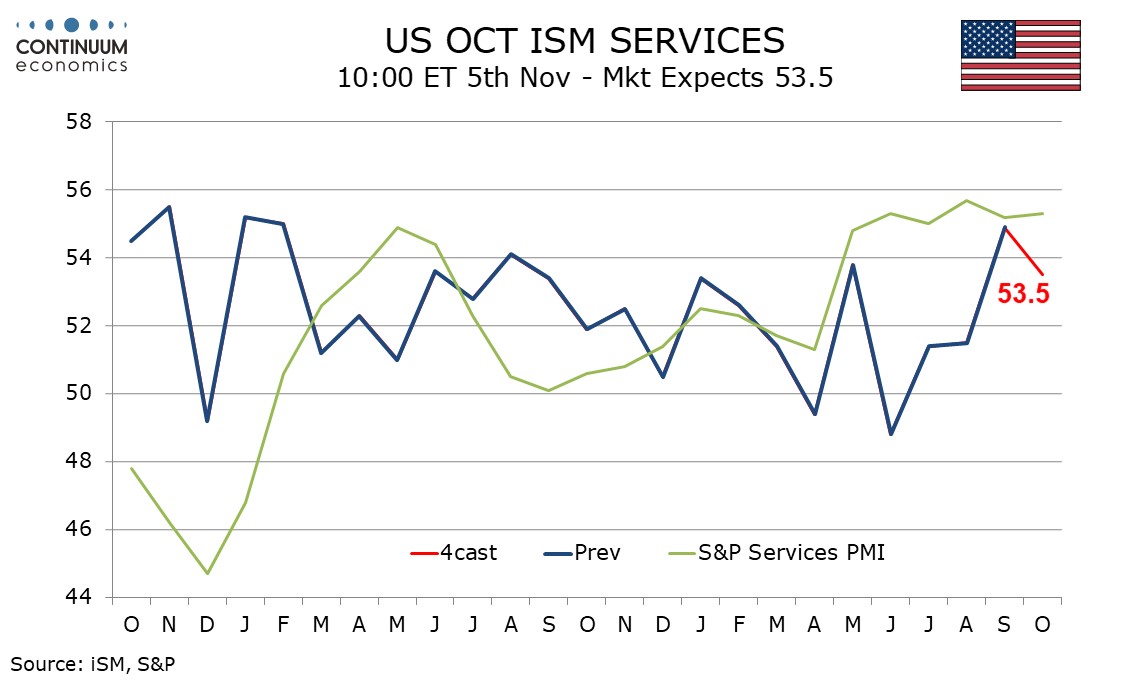

The data calendar starts with September factory orders on Monday. On Tuesday we expect September’s trade deficit to increase to $84.7bn, the widest since April 2022, from $70.4bn and October’s ISM services index to correct lower to 53.5 after a significantly improved 54.9 in September. Thursday sees weekly initial claims, Q3 productivity and costs, September wholesale trade and September consumer credit. The preliminary November Michigan CSI is due on Friday.

Canada

Canada’s data highlight is October’s employment report on Friday, and markets will be watching to see whether an improved September picture can be sustained. Also due are September’s trade balance on Tuesday, and on Wednesday October PMIs from Ivey for manufacturing and S and P for services.

UK

That a 25 bp rate cut will come at the BoE policy verdict next Thursday is almost certain. The question is to what degree any splits and the updated Monetary Policy Report suggest how fast further easing beyond may occur, in particular, whether a move in December will occur – especially afte what has been a very expansionary Budget. The BoE will release its Decision Maker’s Survey alongside. Final PMI data (Tue) may highlight downside risks, the question being whether they have spread elsewhere which the Construction PMI (Wed) may reveal.

Eurozone

ECB comments are on the agenda, most notably from Chief Economist Lane (Thu). He may point to signs of a consumer revival which may make EZ retail sales data (Thu) all the more interesting. The week also has several PMI updates, including final composite numbers Wed) and the construction equivalent (Thu). Key services production data arrive on Friday. German industrial production (Thu) is likely to see a fresh m/m correction back as may manufacturing orders numbers the day earlier.

Rest of Western Europe

There are key events in Sweden. A fourth successive 25 bp rate cut (to 3.0%) is widely seen at the looming Riksbank meeting (Thu), with the risk that it may even be the 50 bp move that was hinted at as part of the two further cuts advertised at the last (September) meeting. What seems clear is that inflation worries have subsided against a backdrop on below target recent CPI readings only to be replaced by clearer worries about the (still contracting) real economy – CPI flash numbers (Thu) may see the CPIF measure move back to around the 2% target while Prospera survey numbers (Wed) shouls show anchored expectations.

In Norway, back in September, and as with the five previous policy meetings, the Norges Bank kept its policy rate at 4.5% and it did drop its recent stress of ‘policy to stay on hold for some time ahead’, instead noting that ‘the time to ease monetary policy is approaching’, albeit suggesting policy will remain on hold until year end. We see policy remaining on hold this time around and no clear flagging of a December move save for the Board tinkering with its rhetoric to suggest policy ‘probably’ staying on hold to year end, ie to give itself policy flexibility.