USD, EUR, JPY, AUD, CAD flows: Fairly neutral picture ahead of central bank meetings

German production data recovers but trend remains weak. USD steady awaiting FOMC

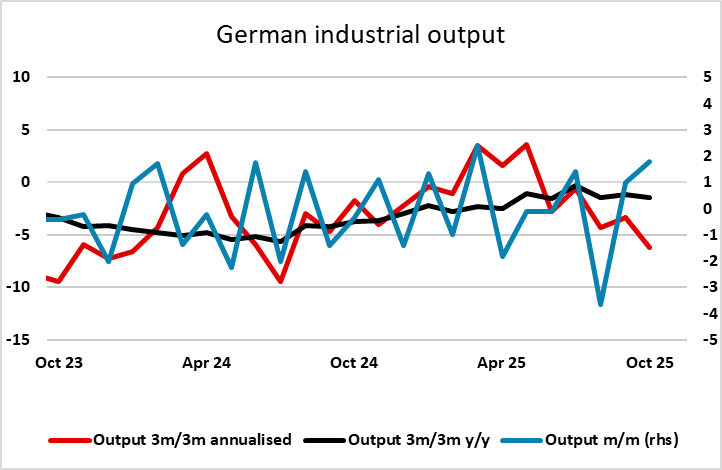

German industrial output data for October released this morning is stronger than expected, but the underlying trend is unclear as the gains of the last two months follow significant weakness in August. The October level of production is still below the March level, so at this stage the trend still looks weak. However, there has been no significant impact on the EUR. Currencies were fairly steady in Asia with a mild USD downside bias, but early European trading is seeing the USD move back gently towards Asian opening levels.

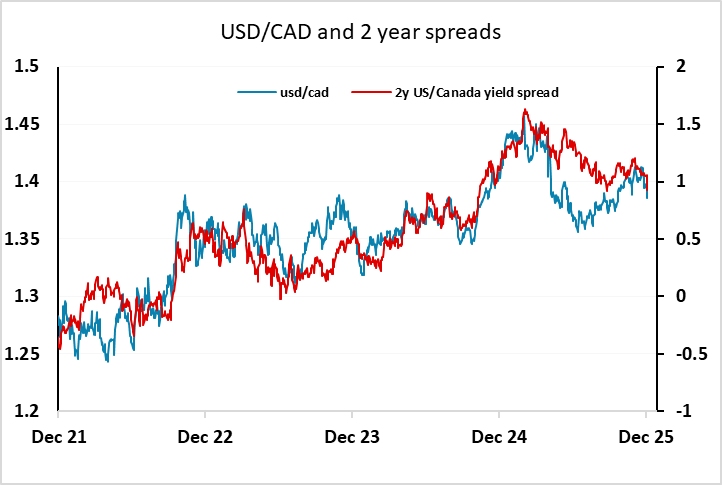

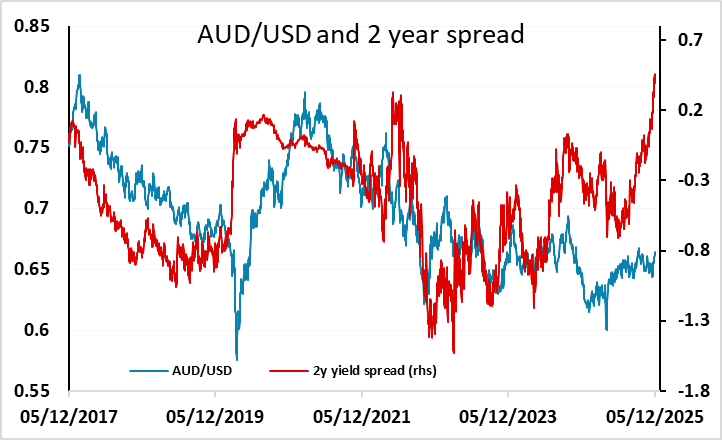

There isn’t a great deal on the calendar for today, and the focus will be on the Fed (and BoC) meetings on Wednesday. Overnight the Japanese Q3 GDP data was revised down to -0.6% q/q, but the wage income data showed a slightly stronger than expected gain of 2.6% y/y, and the GDP price index was also strong, so the numbers still provide some support for a BoJ tightening next week. But FX markets may well take their cue from equities. If equities hold up, the strength in the Canadian and Australian data of late suggesting commodity currencies may continue to be the best performers, although AUD looks more clearly undervalued based on yield spread moves.