FX Daily Strategy: N America, January 24th

NZ CPI Bang on Estimate

EUR/GBP slips as UK PMI continues to outperform

CAD still has scope to fall modestly on neutral BoC meeting

NZ CPI Bang on Estimate

EUR/GBP slips as UK PMI continues to outperform

CAD still has scope to fall modestly on neutral BoC meeting

NZ CPI, S&P PMIs, and the BoC monetary policy decision are the main events on Wednesday’s calendar.

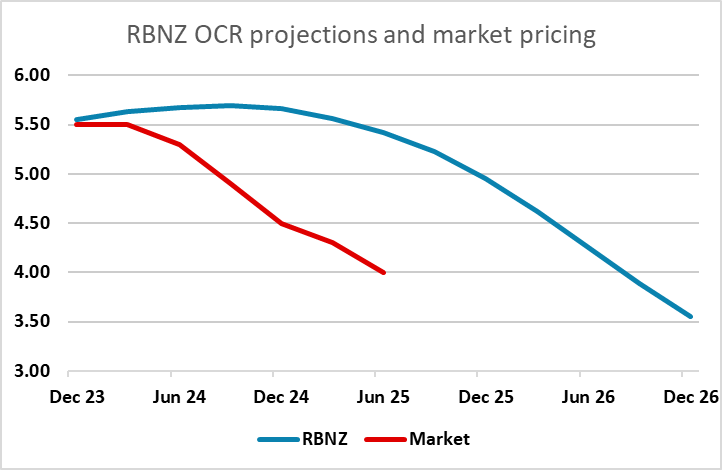

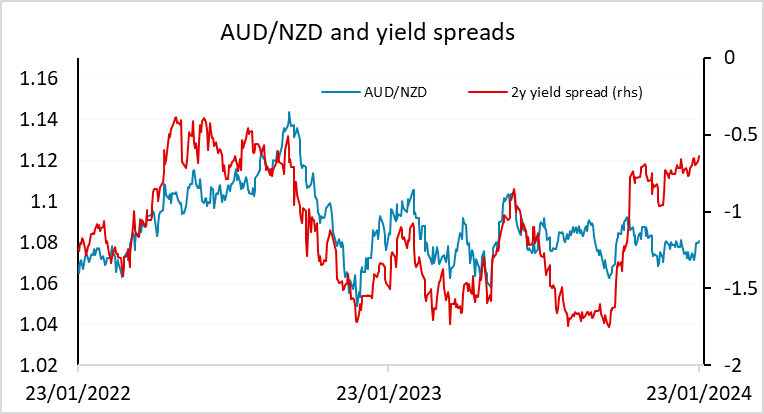

The market consensus for NZ CPI was for a drop in the y/y rate to 4.7% in Q4 from 5.5% in Q3, based in part on weaker data in the new monthly selected price index, and the numbers came in bang on estimate. The NZD initially made some small gains n the news, but soon settled back, although it has advanced in European hours. The market is already pricing a much easier path for policy than projected by the RBNZ, so there isn’t a lot of scope for furtehr declines in NZ yields without some change in RBNZ stance. Going forward, there is likely to be more NZD FX sensitivity to stronger than expected data. However, AUD/NZD has been underperforming relative to yield spreads, so AUD should be favoured over NZD, unless we see a furtehr deterioration in China sentiment.

The market consensus for NZ CPI was for a drop in the y/y rate to 4.7% in Q4 from 5.5% in Q3, based in part on weaker data in the new monthly selected price index, and the numbers came in bang on estimate. The NZD initially made some small gains n the news, but soon settled back, although it has advanced in European hours. The market is already pricing a much easier path for policy than projected by the RBNZ, so there isn’t a lot of scope for furtehr declines in NZ yields without some change in RBNZ stance. Going forward, there is likely to be more NZD FX sensitivity to stronger than expected data. However, AUD/NZD has been underperforming relative to yield spreads, so AUD should be favoured over NZD, unless we see a furtehr deterioration in China sentiment.

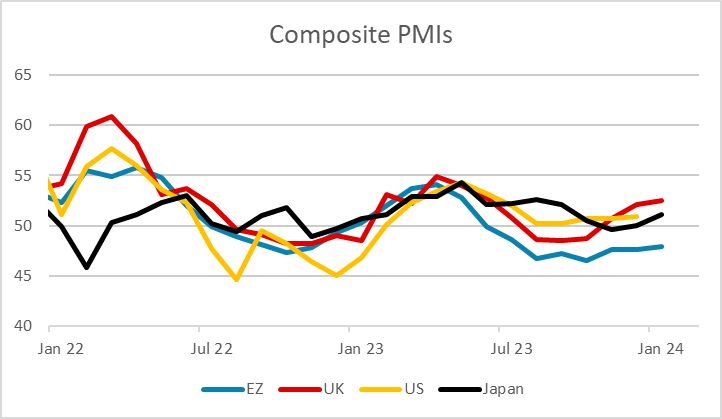

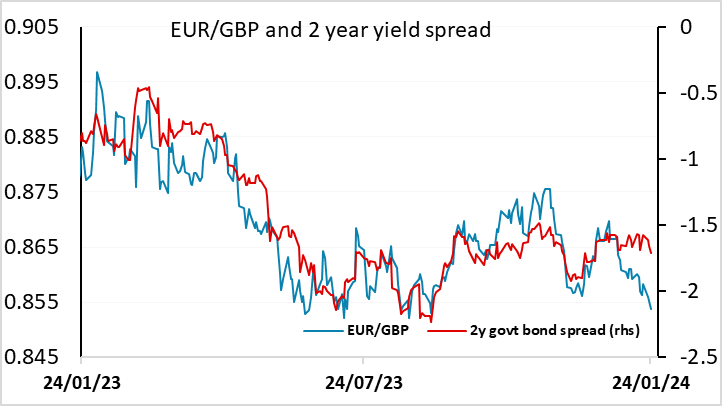

Another strong UK PMI number has put GBP on the front foot across the board this morning, with the EUR also recovering after an initial dip when the Eurozone PMI showed a rise in the composite despite declines in both France and Germany.

The UK composite PMI is now the highest since July, but we would still be wary of too much optimism on the UK economy. After all, in spite of PMIs above current levels from March to July, UK GDP was flat in Q2 and -0.1% in Q3, so the PMIs are not necessarily a reliable guide to growth. Also, even though UK yields are marginally higher after the data, while EUR yields remain lower on the day, yield spreads still don’t really support the current level of GBP, never mind further gains. GBP will nevertheless likely remain firm through today, but upside should be quite modest.

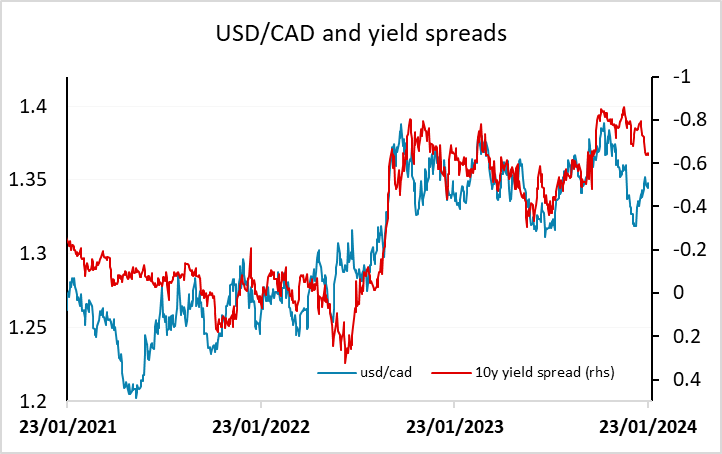

The Bank of Canada meeting seems unlikely to have much impact. With data showing subdued activity but stubbornly high inflation, rates look highly likely to remain unchanged at 5.0%. The statement is likely to see a similar tone to that on December 6 which no longer saw the economy as in excess demand but remained willing to raise the policy rate further if needed. USD/CAD was trading strong relative to yield spreads at the beginning of the year, but has gradually moved back in line. There may be a little further to go, especially if the BoC sounds any less likely to raise rates again. However, the market isn’t pricing any risk of a rate hike, so may be more vulnerable to hawkish comments which would be CAD positive.