FX Daily Strategy: APAC, February 1st

Downside risks for GBP on the BoE

SEK vulnerable against the NOK

USD still stretched against the JPY

Downside risks for GBP on the BoE

SEK vulnerable against the NOK

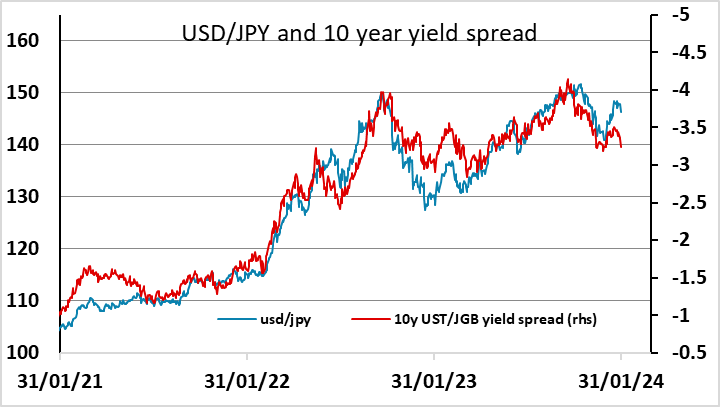

USD still stretched against the JPY

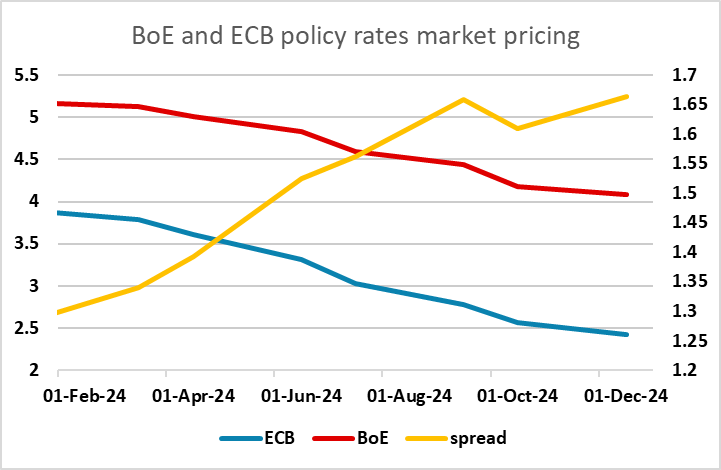

Thursday features monetary policy meetings at the Bank of England and the Riksbank. Neither is expected to change policy, but as with other DM central banks the interest is less on what is done, but more on what is said, especially given the manner in which market interest rates have fallen. Notably, and despite the softer interest rate assumption, the updated Bank of England Monetary Policy Report may see the inflation outlook even softer, possibly embracing our view of the headline rate falling below target by mid-year. If so, it will become a lot harder for the three hawks on the MPC to continue voting for a rate hike. The market median expectation is for two out of the three hawks to continue voting for a hike. But even though the Bank distrusts its own forecasts, the softer inflation and wage data since the last meeting ought to be enough to turn to committee towards easing. We would not rule out one vote (Dhingra) for an ease, while it may be that only one or none of the hawks vote for a hike.

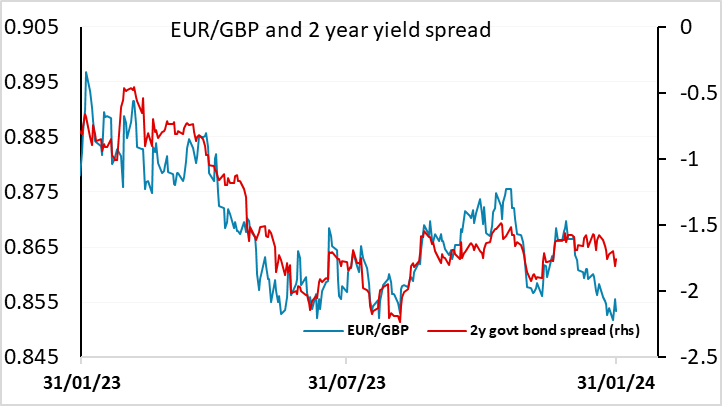

For GBP, this suggests some downside risks. Not only is the market pricing in a more hawkish policy stance for the BoE than for the Fed or the ECB, EUR/GBP is already below the levels that would be expected from the current yield spreads based on recent history. A more dovish BoE stance shold consequently lead to some general GBP losses.

For the Riksbank, it is ever clearer that the Riksbank has finished its hiking, borne out by the unchanged policy decision last month and the same decision is all but certain this time around. The question now turns to policy easing. Recent data have continued to be been mixed, but the much weaker underlying inflation picture and growing weakness in bank lending and deposits have argued for the policy rate staying at the 4.0% level it rose to in September. Indeed, they argue for an easing in policy, something we think may occur in by the next quarter, this made all the more possible by the more frequent Board meetings that the Riksbank Board has reverted to.

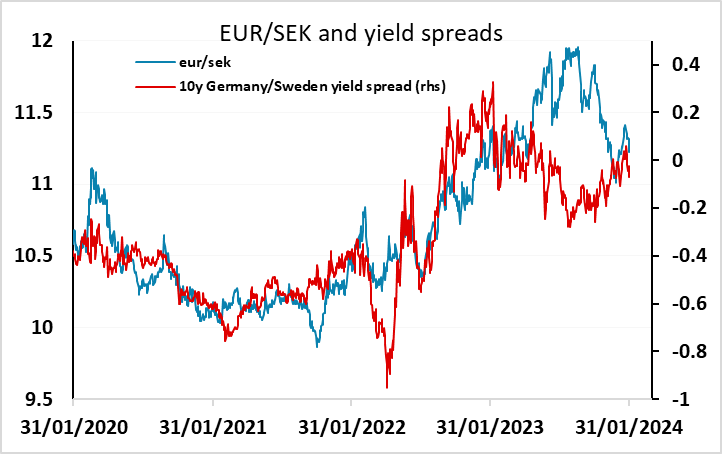

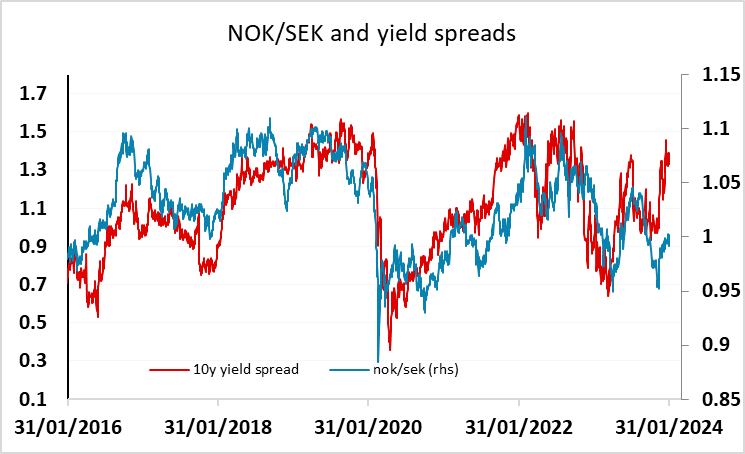

For the SEK, EUR/SEK has now moved back broadly in line with the yield spread correlation seen in recent years, after a period of SEK weakness. However, the SEK does look quite clearly on the strong side against the NOK, where the yield spread correlation is more reliable. We would see the risks as being biased to the dovish side in any case at the Riksbank meeting, so see upside risks for NOK/SEK.

Otherwise, there is the usual Thursday set of claims data in the US, and the ISM manufacturing survey. But given the Wednesday Fed statement and the upcoming employment report, these are unlikely to have a lot of impact, with the market digesting the Fed and preparing for payrolls. We continue to see downside risks for the USD against the JPY, due to the big narrowing we have seen in yield spreads, but less scope for movement against the riskier currencies.