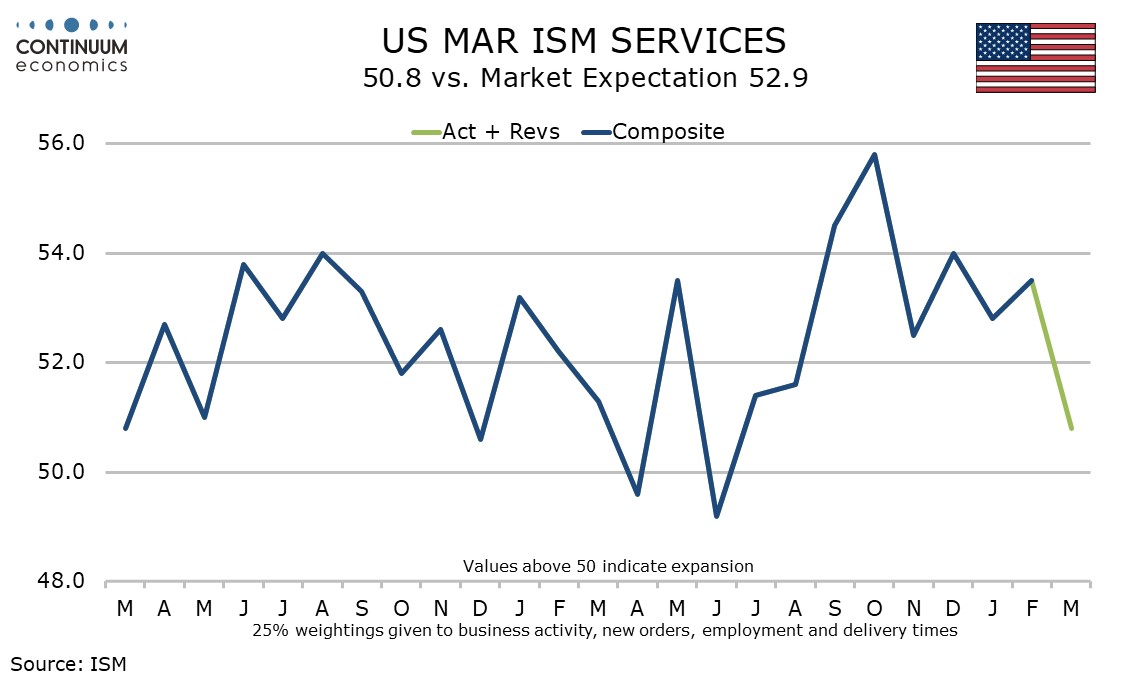

U.S. March ISM Services - Slowing consistent with regional surveys

March’s ISM services index of 50.8, down from 53.5, is the weakest since June 2024, and contrasting a healthy S and P services PMI of 54.4. The weakness of the ISM data is however consistent with weak messages from most regional Fed surveys of the service sector.

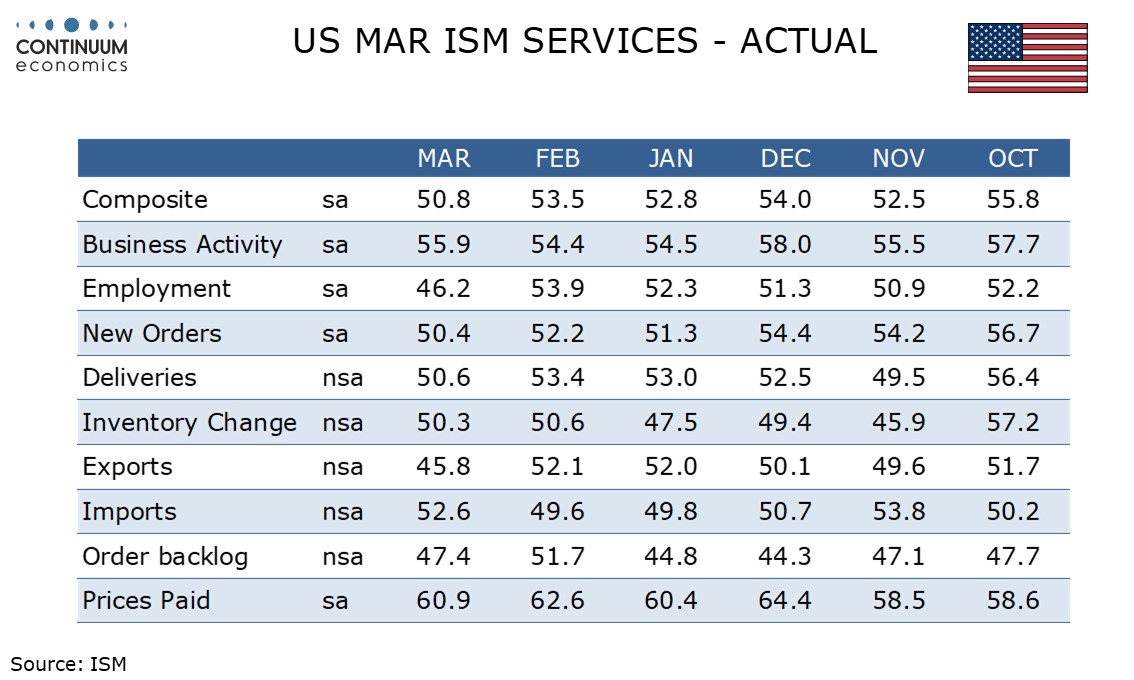

Details are mixed, with employment very weak at 46.2 from 53.9, and slippage in new orders to 50.4 from 50.2 and deliveries to 50.6 from 53.4. Business activity however is resilient, rising to 55.9 from 54.4, suggesting the negative risks lie ahead rather than showing weakness in March. We expect a strong march retail sales report, led by autos as consumers attempt to beat tariff-led price hikes.

One piece of relief is a slower prices paid index of 60.9 from 62.6, contrasting a strong manufacturing prices paid index to conform that tariffs will hit goods rather than services. Prices paid are not a contributor to the composite. Nor are exports, weak at 45.8 from 52.1, or imports, stronger at 52.6 from 49.6.