FX Daily Strategy: Asia, February 16th

UK retail sales to bounce, but GBP still vulnerable

US PPI unlikely to have a market impact

USD to stay firm for now

JPY weakness on the crosses is stretched

UK retail sales to bounce, but GBP still vulnerable

US PPI unlikely to have a market impact

USD to stay firm for now

JPY weakness on the crosses is stretched

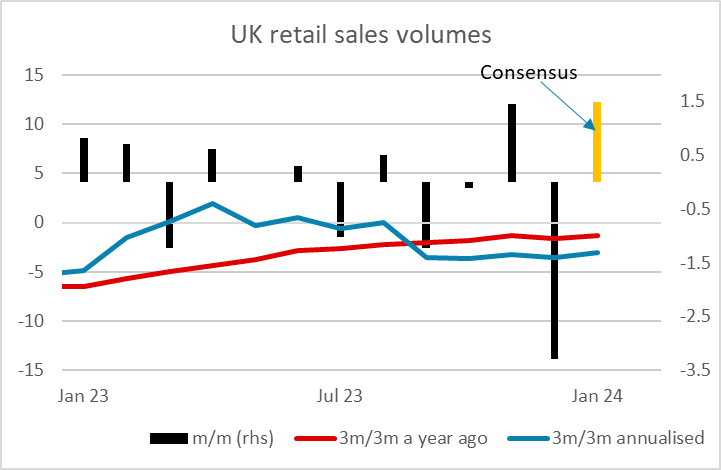

After a week full of UK data we finish the week with UK January retail sales. After the big 3.2% decline in December, a bounce of at least 1% is on the cards. The market consensus is for a rise of 1.5%. This would still indicate the weak underlying trend, which ensured consumer spending fell in Q4, was continuing, with the 3m/3m annualised rate still less than -3%. GBP will not doubt react depending on whether sales rise more or less than 1.5%, but the underliyng picture is quite weak, and we would see more scope for declines to be sustained.

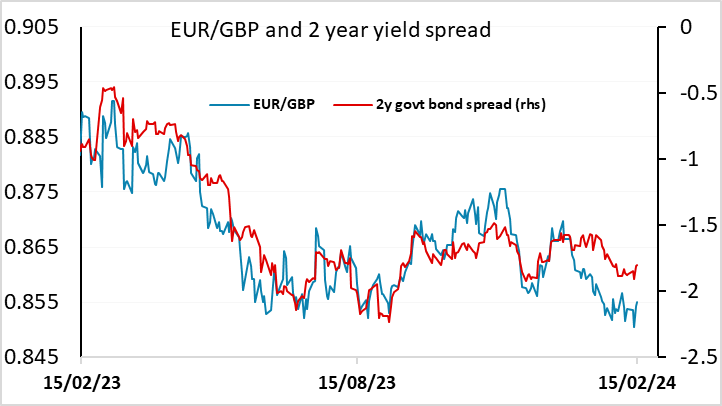

The week so far has seen slightly stronger than expected labour market data and slightly weaker than expected CPI and GDP data. While the hawks on the MPC will still argue that average earnings growth remains too strong and has to come down to justify any rate cuts, the still high y/y rates disguise a flat picture in recent months. Meanwhile, the weakness of GDP is striking, with the 0.3% decline in Q4 GDP especially notable given the rise in the PMIs in the quarter, underlining that the PMIs aren’t a very good guide to UK GDP. CPI, like the earnings data, is showing annualised rates that are consistent with the 2% inflation target. So the modest rate cuts priced into the UK curve this year look a little cautious. Just 3 rate cuts are priced for the year as a whole with the first not fully priced until August. GBP should therefore have further to fall, especially given its outperformance of yield spreads so far this year.

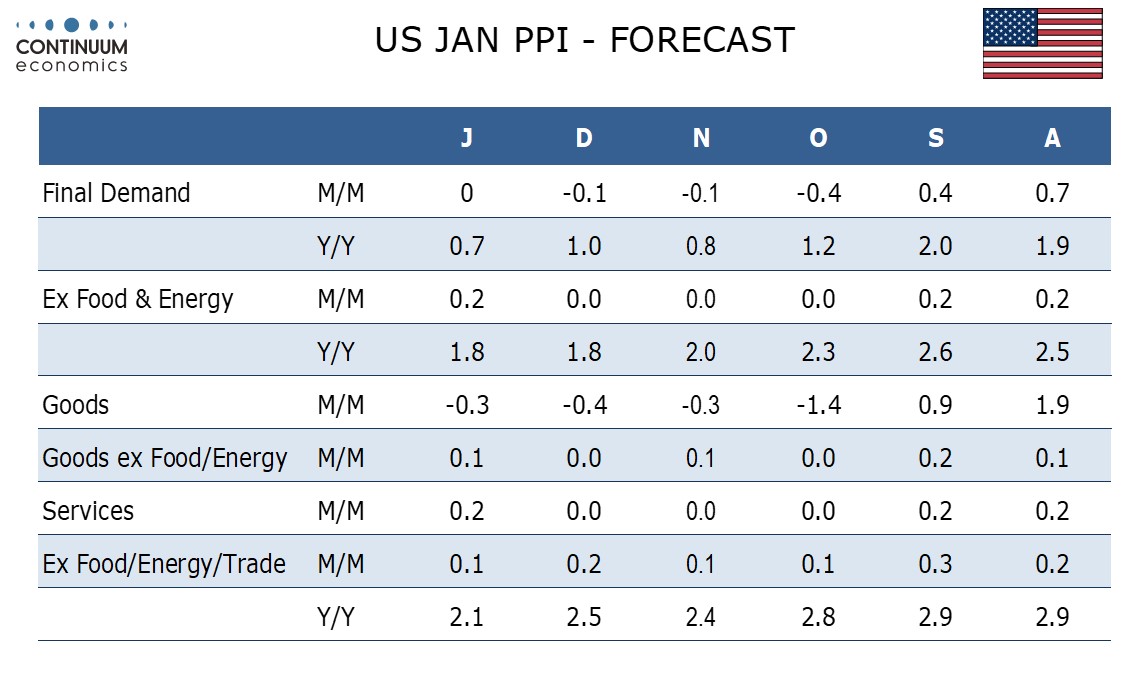

Otherwise the calendar is fairly quiet, with US PPI the main US data. This is usually of minor interest after CPI, but we have seen some significant reactions in recent months, so the data may be o some interest. We expect an unchanged outcome from January’s PPI to follow three straight declines, and a 0.2% increase ex food and energy to follow three straight unchanged outcomes. Ex food, energy and trade we expect a 0.1% increase, to confirm the underlying picture remains subdued. This is broadly in line with market consensus, so shouldn’t have a major impact.

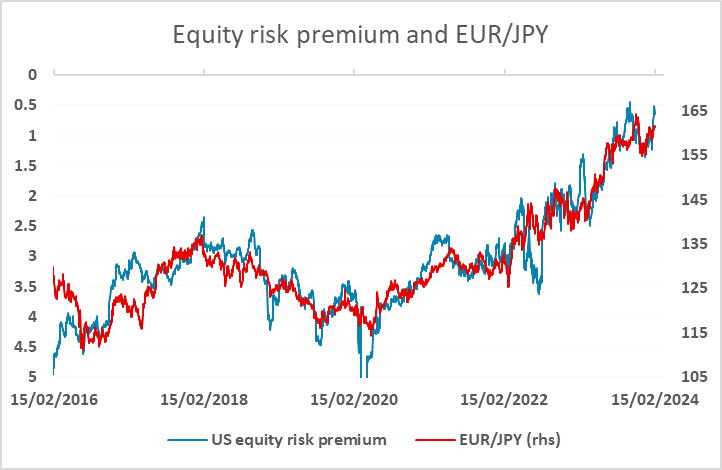

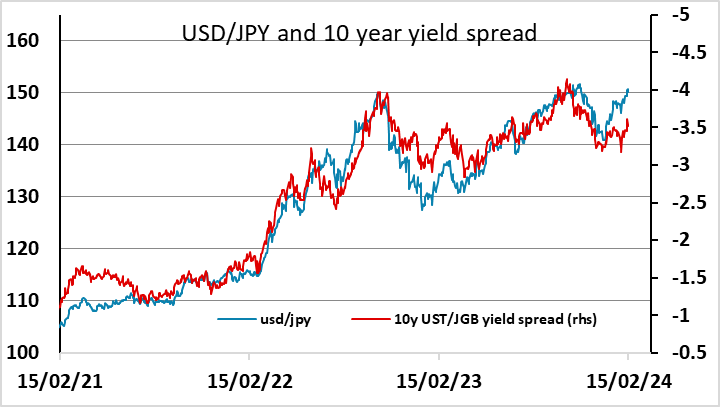

In general, the USD has had a strong week due to the strength of the CPI data, and is likely to remain reasonably firm through Friday. There was a mild decline after weak retail sales data on Thursday, but one weak month after a strong Q4 (though Q4 did see downward revisions with this report) does not make a trend, and January’s weakness may be in part weather-induced. The riskier currencies have been relatively resilient to USD strength, helped by the fact that rises in US yields have been largely matched in Europe, and by the resilience of equities, with US equities still pressing on the highs. EUR/JPY hit a new high for February on Thursday, and is approaching the January highs. We would expect JPY weakness on the crosses to continue as long as US equity risk premia continue to decline, but we are becoming quite concerned about the extremely low level of US equity risk premia, which are now below pre-GFC levels. We still a lot of JPY upside in the medium term, and If the US retail sales data prove to be the first sign of slowdown, the JPY recovery may start soon.