FX Daily Strategy: N America, December 15th

EUR suffers from softer PMI

GBP/USD may be due a recovery

JPY strength may switch to crosses

EUR suffers from softer PMI

GBP/USD may be due a recovery

JPY strength may switch to crosses

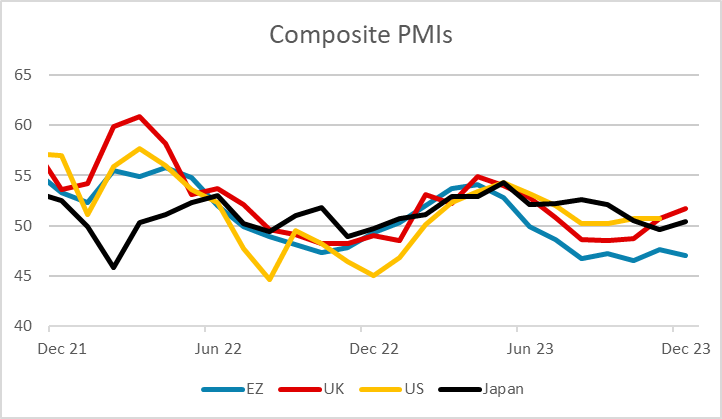

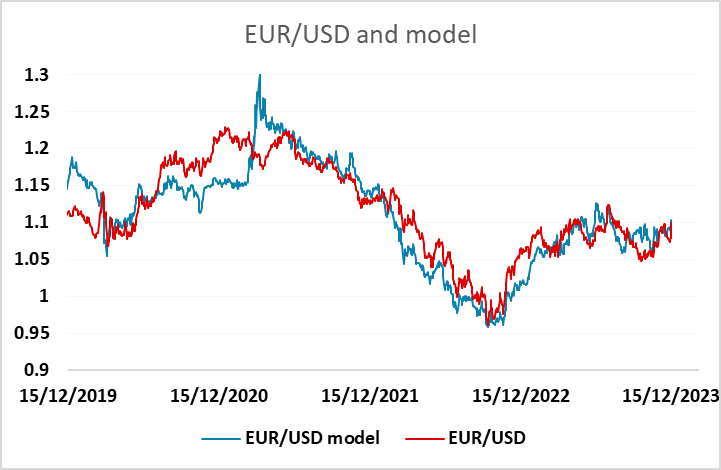

Weak PMIs from the Eurozone have knocked EUR/USD lower, undermining the credibility of yesterday’s attempt at hawkishness form Lagarde. While EUR yields remain slightly above the levels seen before the ECB, the market hasn’t really bought the view of an extended plateau to rates, and is still pricing a very similar path for Fed and ECB cuts over the next year, despite the Fed’s more obvious acceptance of the necessity of easing. EUR/USD seems unlikely to regain 1.10 today, and may have some more downside towards 1.09 if European equities extend their decline after yesterday’s reversal day.

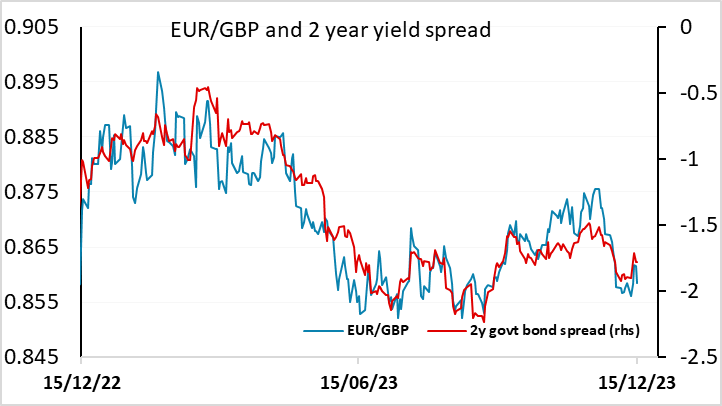

Another strong UK PMI in contrast to the weaker reading in the Eurozone. We don’t have a huge amount of trust in the composite PMIs as a growth indicator, not least because they exclude retail and construction, which are both weak and being significantly affected by tight monetary policy. But the market will note the UK outperformance, and EUR/GBP may now push towards the 0.8550 area, even though there hasn’t been much initial reaction in UK short dated yields.

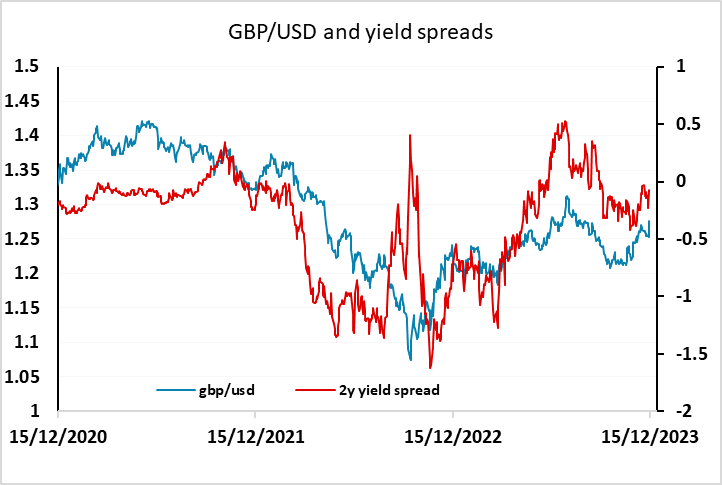

EUR/USD gains look a little extended relative to short term rate spreads, but for the UK, the picture is less clear-cut. Although short term rate spreads have been well correlated with EUR/GBP over the last year, EUR/GBP still looks high relative to longer term correlations with yield spreads, and GBP/USD looks clearly too low. There may still be some risk premium in GBP reflecting uncertainty about the fiscal and political outlook, as the break with historical yield spreads coincided with the brief Truss administration. But if the strong December UK PMIs are sustained, there is a case for any risk premium to be eroded and GBP/USD to make gains towards 1.30.

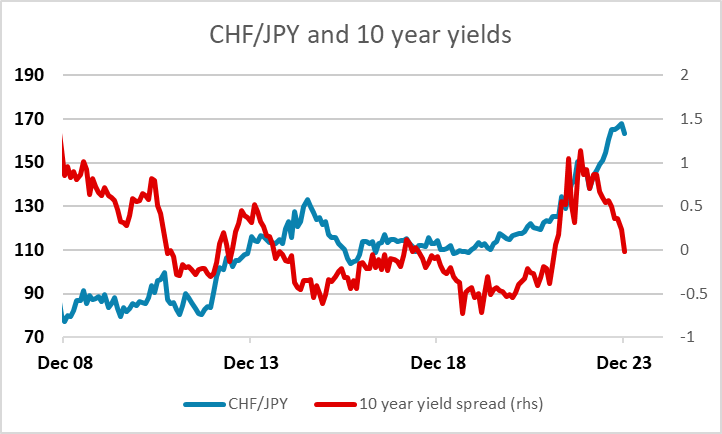

The sharp JPY gains seen after the FOMC faded slightly through the day on Thursday, and the gains against the USD have taken USD/JPY close to the levels consistent with the recent USD/JPY correlation with yield spreads. However, we would still argue that JPY gains are likely to exceed the implications of this correlation longer term, as the real USD/JPY rise has been around 13% larger than the nominal rise since the beginning of 2021. Nevertheless, from here the next phase of JPY gains may require some weakening of risk sentiment. We have already seen some of this on Thursday, with European equities not taking kindly to the hawkish ECB tone, and this suggests to us that JPY crosses may now be more vulnerable than USD/JPY. CHF/JPY, where the nominal moves are very similar to the real moves, remains the most obvious value for JPY bulls, given that there is no CHF yield advantage and the SNB indicated that they are winding down their programme of CHF buying/FX selling at yesterday's SNB meeting, while also adopting a more dovish tone.