NOK, SEK, JPY flows: SEK still firm after GDP decline, JPY weakness continues

SEK still strong despite drop in October GDP. JPY weakness continues, intervention likely necessary soon.

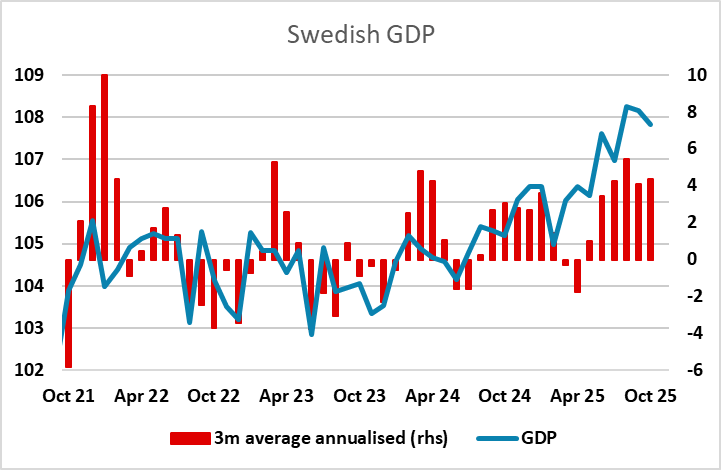

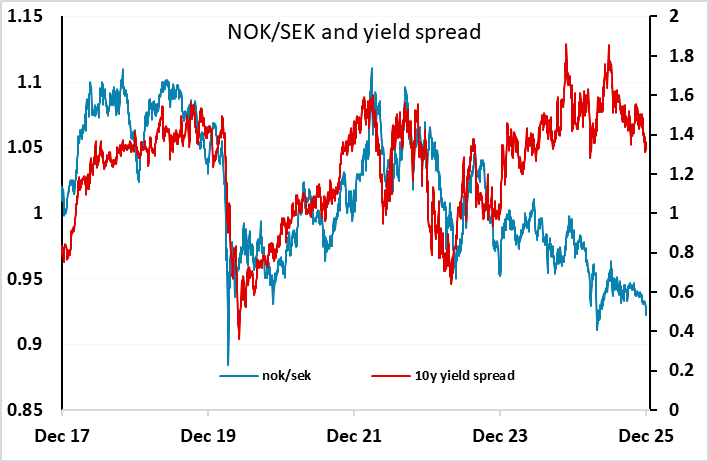

This morning’s Norwegian CPI data is a tad below consensus at 3.0% for the targeted core measure, although the headline measure was stronger than expected, though also at 3.0%. Little impact on the NOK, and the SEK is similarly unaffected by a 0.3% decline reported in October GDP. This follows a 0.1% decline in September but a 1.2% rise in August, so the underlying trend is still positive. NOK/SEK continues to trade heavily, well below the levels historically related to current yield spreads. This relationship now looks to have well and truly broken down, but we still see levels near 0.92 as likely to prove good value for the NOK, with yield spreads still supportive, despite the dsolid performance of the Swedish economy.

Overnight in late US we saw another new all time high in EUR/JPY. Comments from Japanese PM Takaichi protesting JPY weakness helped trigger a correction in early Asia, but these levels are once again being tested. We continue to see BoJ intervention as likely to be necessary to turn the JPY downtrend, with a BoJ rate hike unlikely to be enough.