USD, EUR, JPY flows: Market static ahead of US CPI

Little change in the main FX pairs. European bank lending survey and NFIB survey may be of interest today

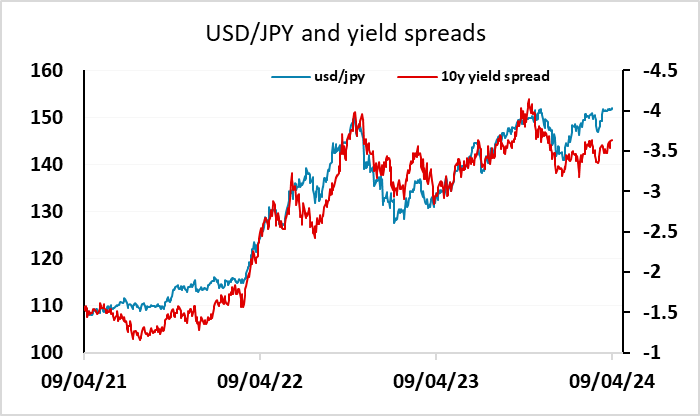

A fairly quiet overnight session sees most currencies little changed from last night’s European closing levels, and there isn’t much on today’s calendar to suggest significant moves are likely today. USD/JPY continues to bash up against the 34 year high of 151.97, but has yet to breach it. The ECB Bank lending survey is probably the release of most interest, but while it might provide some material for discussion at this week’s ECB meeting, it’s unlikely to be a market mover.

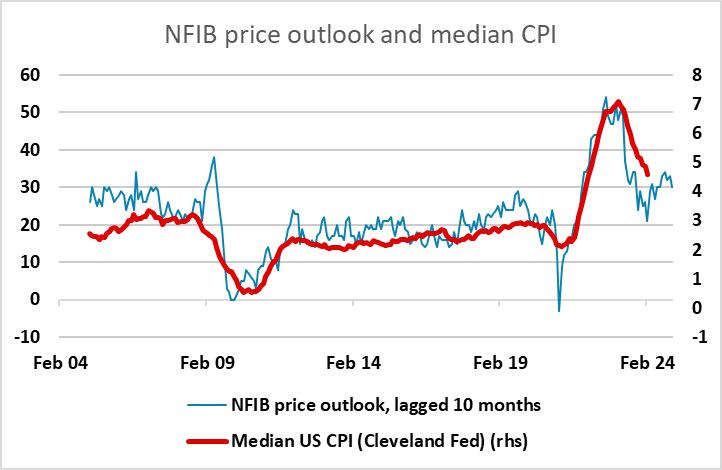

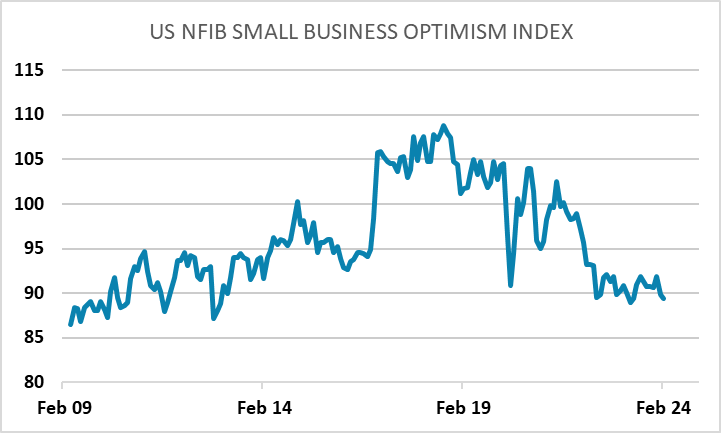

There is the release of the US NFIB small business optimism index later, which will be of some interest as despite the solid US growth numbers we have seen, this index has been bumping along the bottom at the lowest levels for 10 years. There is also the NFIB price outlook, which tends to lead US CPI, and has been ticking up since the lows in April last year, although there has been a modest softening since November. Further declines in this index would create some optimism about the prospects for future inflation declines and tend to sustain expectations of Fed easing as a result, especially if the optimism index hits a new 11 year low as the consensus expectation expects.