Published: 2025-08-26T18:57:19.000Z

Preview: Due August 5 - U.S. August ISM Services - Holding above neutral, with stronger prices

Senior Economist , North America

-

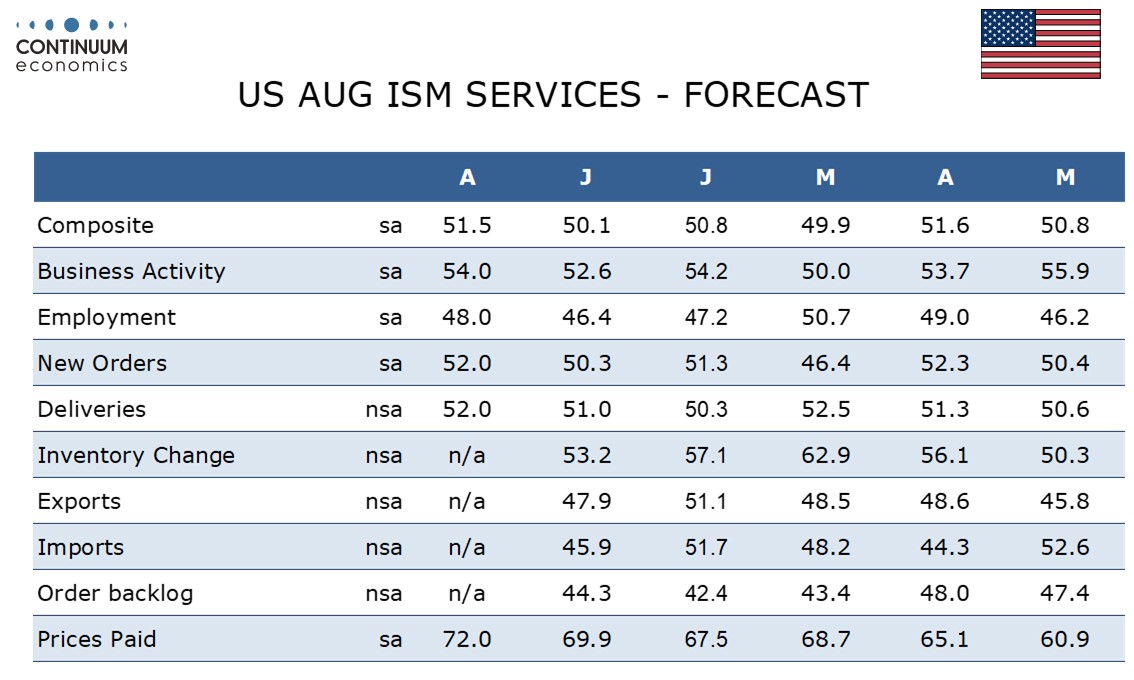

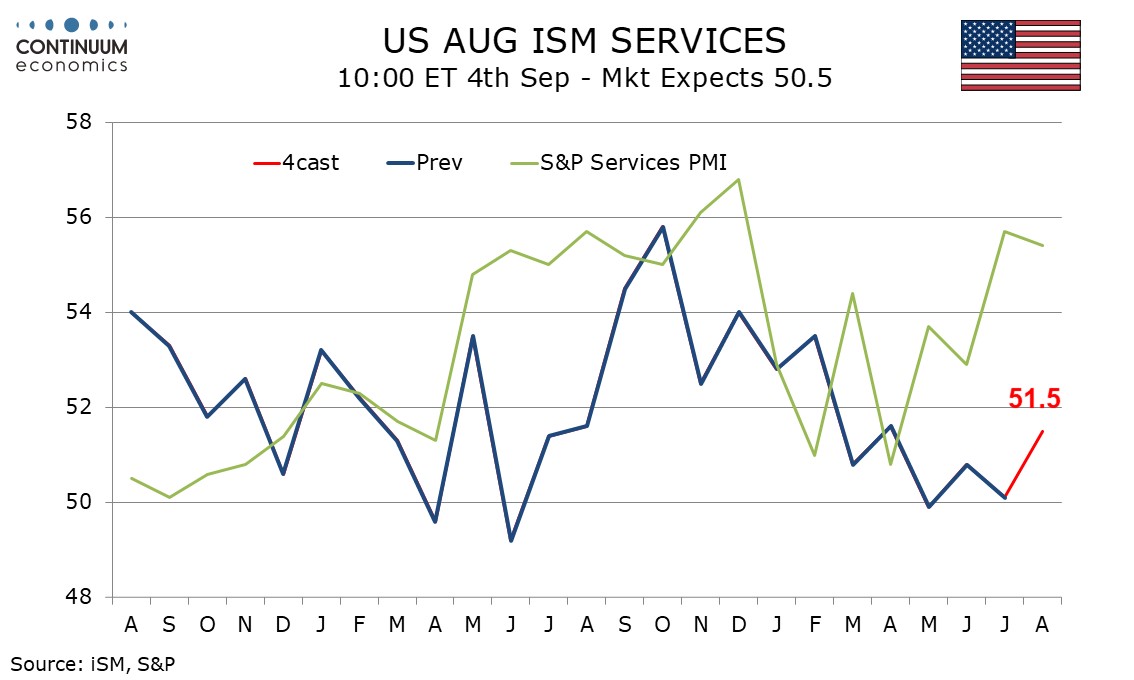

We expect an increase in August’s ISM services index to 51.5, up from 50.1 in July but still keeping the index in the subdued 49.9 to 51.6 range that has been seen since March.

Regional service sector surveys are mixed with the Dallas and Richmond Fed surveys slightly improved and slightly positive but the Philly Fed and Empire State surveys increasingly negative. The S and P services PMI has however been quite strong, above 55 in both July and August, and while not a reliable guide to the ISM index does suggest a move below the neutral 50 is unlikely.

We expect all four components of the composite to see some improvement, with business activity in particular likely to get support from seasonal adjustments. New orders, employment and deliveries complete the composite breakdown. Prices paid do not contribute to the composite and here we expect a rise to 72.0 from 69.9, also supported by seasonal adjustments, and reaching the highest level since August 2022.