FX Weekly Strategy: April 28th - May 2nd

General risk recovery may be near an end

US GDP to be more significant than employment data

JPY correction likely to be near complete

EUR could benefit from relative GDP strength

CAD may be vulnerable if Liberals retain power

NOK has scope to return to end March levels

Last week saw a general recovery in risk sentiment, with most of the riskier currencies performing better and the safe havens falling back as equities edged higher and volatility declined. The USD is now included as one of the riskier currencies, given the uncertainty surrounding Trump’s policies. However, we believe the corrective gains in equities are likely to be nearly complete. The top of the range in the S&P 500 is at 5800, and we doubt this will be seriously tested in the short run unless all the Trump tariffs are removed, which seems out of the question. For the FX market, the position is a little more complex, as some of the risky currency declines were overdone and not based on any fundamental weakness, and may consequently still see further recoveries. We may be entering a period of more fundamental differentiation.

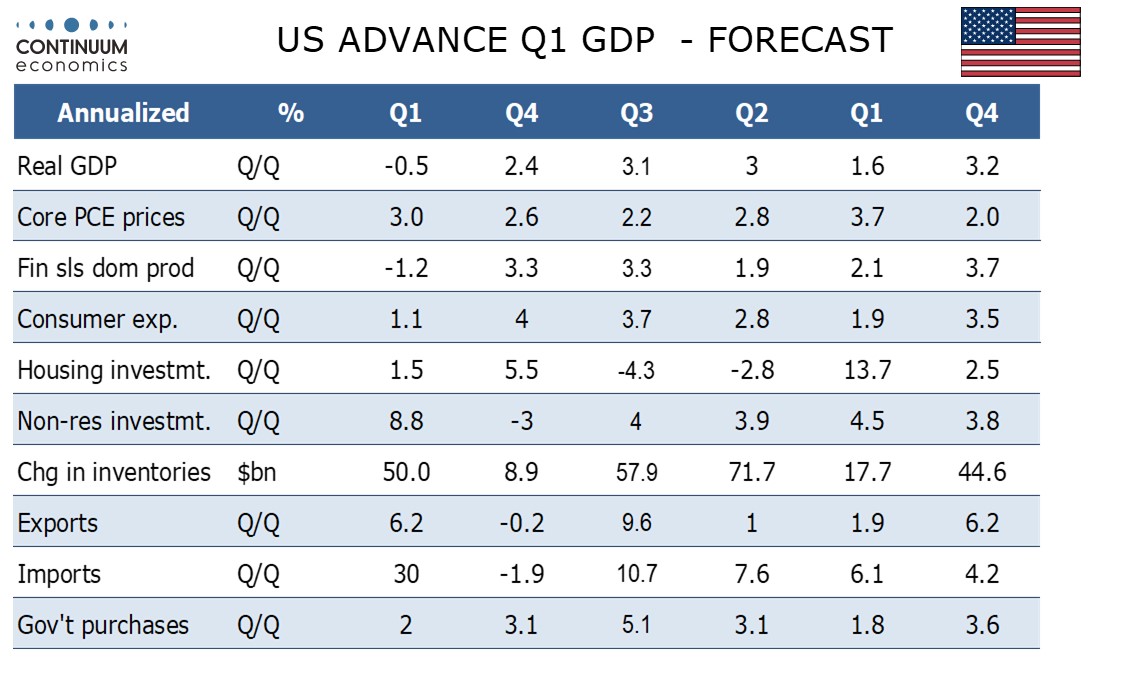

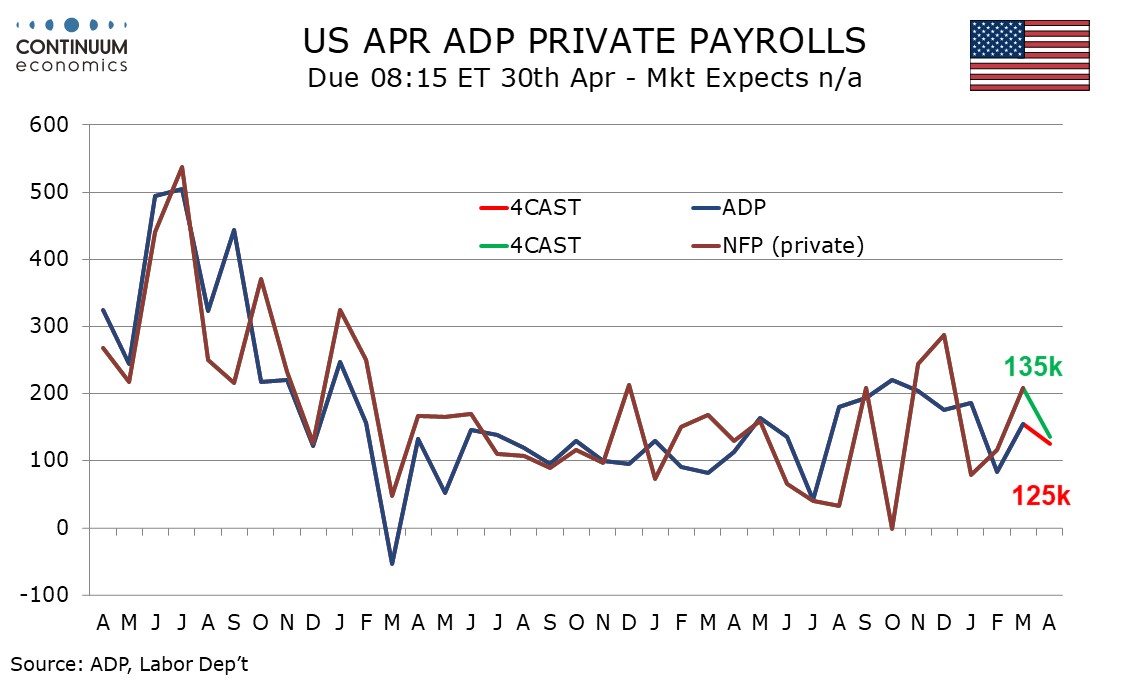

This may mean that the data start to become more of a focus. The main data focus of the week will probably not be the US employment report on Friday, as employment tends to be a lagging indicator and there is little evidence form the claims data that the tariff concerns are yet showing up I the labour market. The Q1 US GDP data on Wednesday could therefore be more significant, although this too will not tell us a great deal about the underlying picture of the US economy, as it is distorted by the timing effects of the tariff increases. Calculations based on the components suggest a significant decline. The Atlanta Fed nowcast shows an annualized fall of 2.2% largely due to a surge in imports. However with non-farm payrolls showing a 0.5% rise in aggregate hours worked such a steep fall looks unlikely. We predict a modest GDP decline of 0.5%, which is nevertheless somewhat weaker than the consensus estimate of a 0.4% rise. A negative number could be the trigger for renewed USD weakness, particularly against the safe havens.

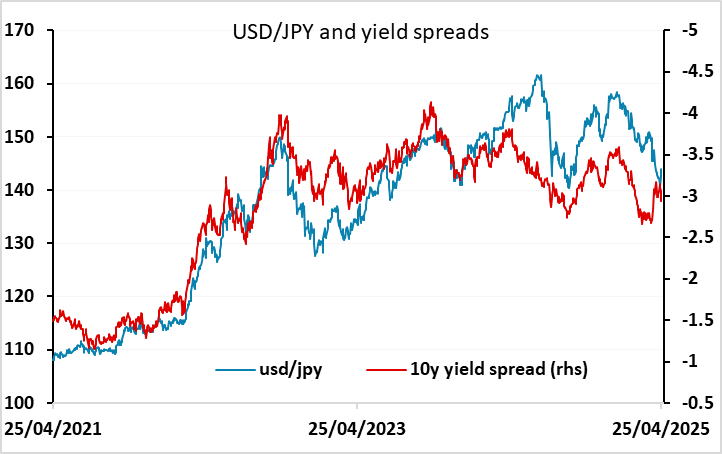

For USD/JPY the 144 area looks like a good medium term selling area. However, nominal yield spreads no longer point to a substantial USD/JPY decline, and speculative positioning is reportedly at record long JPY levels, so there is still a risk of a further extension to the JPY correction. But with reports of Japanese investor selling of US assets in the last week, we doubt there is much more USD upside, and while the JPY is now more in line with nominal yield spreads, any assessment of real values indicates there should be substantially more JPY upside from here, both against the USD and on the crosses. The BoJ meeting is unlikely to impact matters significantly, with no policy change likely given current uncertianties.

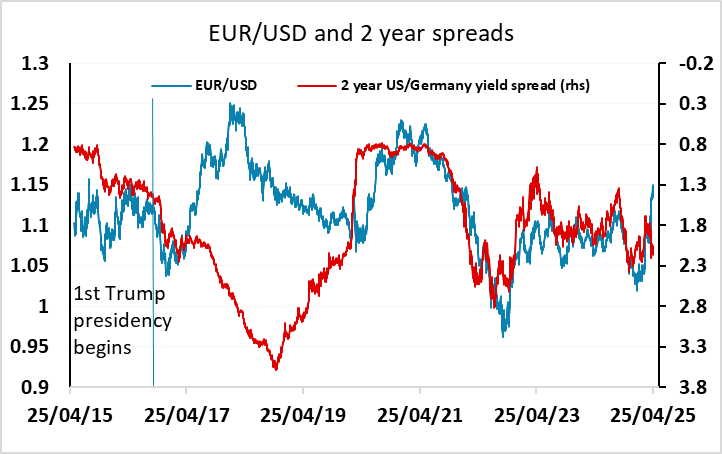

Yield spreads similarly don’t support more EUR gains. However, this was also the case when EUR/USD surged during the first Trump presidency, and there was much less of a case for a paradigm shift then than there is now. We would see more upside for the JPY than the EUR from here, but any evidence of US economic weakness is likely to see the USD weaken to some extent against the EUR as well. The EUR may benefit if European Q1 GDP data show a rare outperformance of the US

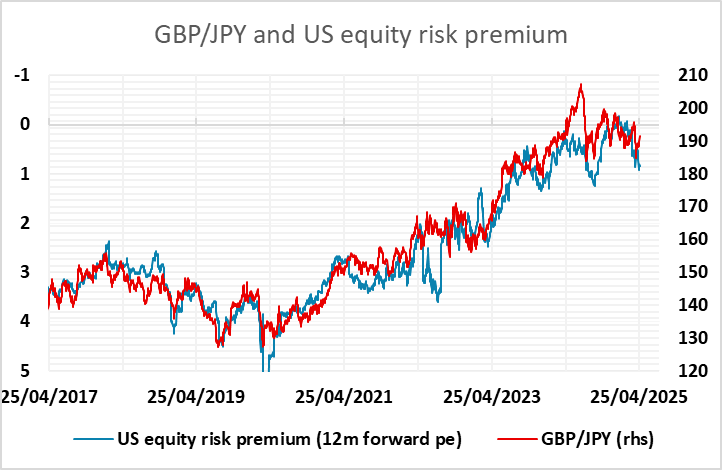

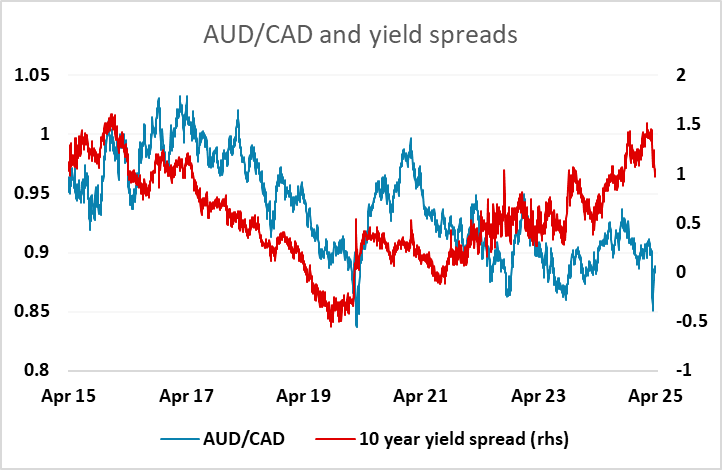

Outside the US, there will be interest in the Canadian election on Monday. The Liberals are expected to win, but it is likely to be close and a win for the Conservatives might be seen as CAD positive due to some expectation of a friendlier attitude from Trump, although that is far from assured. We continue to see the CAD as vulnerable on the crosses, having somewhat outperformed the AUD in the risk downturn despite the economy being more vulnerable to the tariff increases.

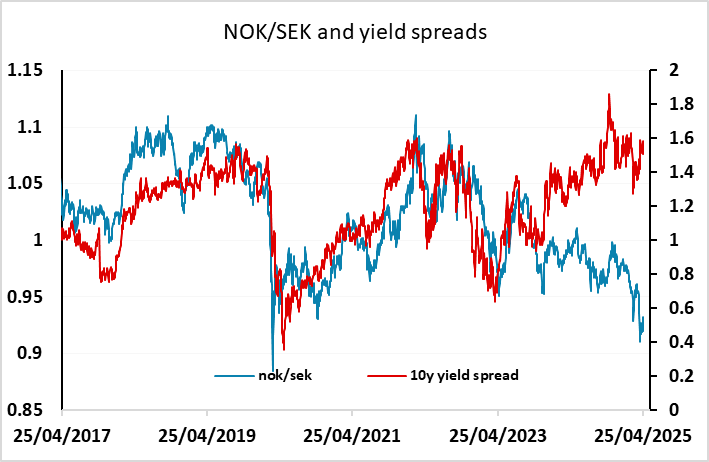

Outside all the events, we continue to see scope for some recovery in the NOK, which has been the biggest loser on the tariff inspired risk sell off. We have seen a modest recovery in the last week, but it isn’t clear that any of the decline against the other European currencies seen in April is likely to persist in the longer run.

Data and events for the week ahead

USA

Fed speakers will be quiet ahead of the May 7 policy decision, but with the exception of a quiet Monday, it is a busy week for US data. Q1 GDP on Wednesday and April’s non-farm payroll on Friday will be the highlights.

GDP forecasts could be influenced by Tuesday’s advance goods trade deficit for March, where we expect slippage to a still very high $139.5bn from $147.8bn in February. Advance retail and wholesale inventory data are also due. Tuesday also sees February house price data from FHFA and S and P Case-Shiller, and March’s JOLTS report on job openings.

On Wednesday we expect Q1 GDP to decline by 0.5% annualized, with very high trade deficits ahead of the tariffs suggesting downside risk. We expect a 3.0% annualized increase in the core PCE price index and at the same time a 0.8% increase in the Q1 Employment Cost Index. March personal income and spending data follow, but will be largely old news after the Q1 GDP report. Despite expecting a firm Q1, we expect March to see a rise of only 0.1% in core PCE prices. We also expect a 0.8% rise in personal spending to comfortably outpace a 0.2% rise in personal income.

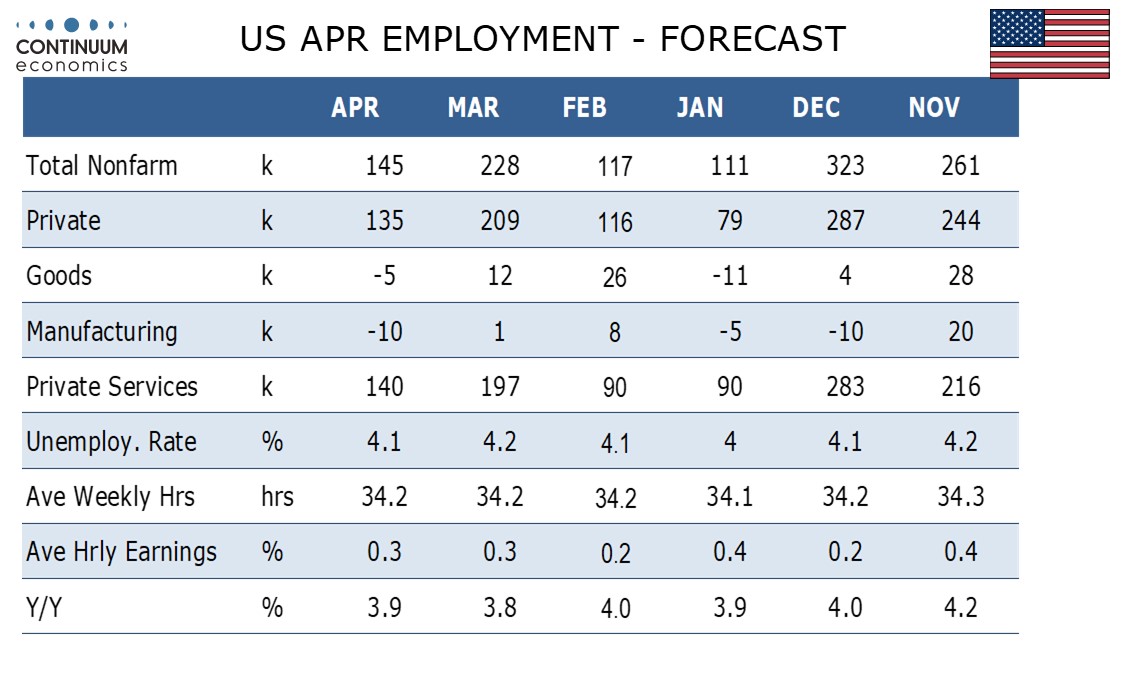

Thursday sees weekly jobless claims, March construction spending, and April’s ISM manufacturing index, which we expect to fall to 48.0 from 49.0. We expect April’s non-farm payroll on Friday to show the labor market still healthy with a 145k increase, with unemployment slipping to 4.1% from 4.2% and a 0.3% rise in average hourly earnings. We expect private payrolls to increase by 135k, slightly above the 125k we expect from Wednesday’s ADP estimate for private sector employment. Later on Friday, March factory orders are due.

Canada

Canada’s election takes place on Monday. A victory for the ruling Liberals looks likely, but polls are close enough to mean that a hung parliament or even a majority for the opposition Conservatives is not to be ruled out. Should the Conservatives spring a surprise, a more conciliatory stance on trade could be seen from US President Trump, but is far from assured. The Conservatives also promise tighter fiscal policy, but whether they would find the spending cuts to deliver on this is uncertain, while Canada does not appear to need tighter fiscal policy with the budget deficit manageable and downside economic risks large.

The most significant Canadian data release is February GDP on Wednesday. Here we expect a flat February to follow a strong January, with preliminary signals for March likely to be negative as tariff risks build. April’s S and P Manufacturing PMI is due on Thursday.

UK

BoE Dep Governor’s speak with Ramsden on Tuesday and Lombardelli the following day. But the main data interest will be the BoE money and credit data where housing market volatility and distortions may be the order of the day. Final Manufacturing PMI data arrive on Thursday.

Eurozone

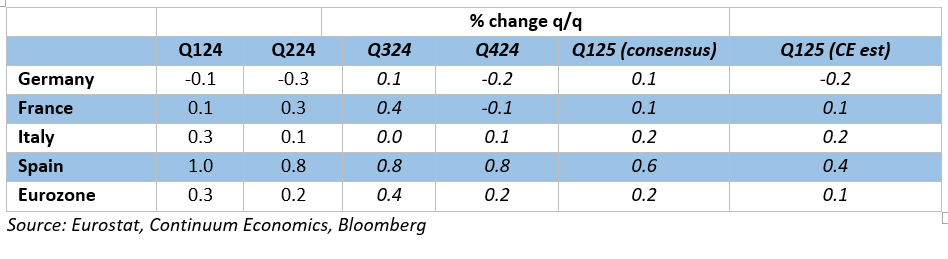

A Busy week data wise starts with European Commission survey data and ECB money/credit on Tuesday, the former watched to see if they echo the last set of PMI data where final figures of the latter arrive on Friday. The same day sees the ECB consumer expectations survey update. There are also Q1 GDP figures beginning with Spain’s numbers on Tuesday and then the EZ and Big 3 on Wednesday. Continuing a series of upside surprises, EZ GDP overshot both consensus and ECB expectations in Q4), albeit only after what was a cumulative 0.2 ppt upward revisions compared to the flash. We see a further rise in Q1 data but at 0.1% this would be half the consensus and would partly reflecting recent m/m increases in both manufacturing and services that both conflict with softer survey messages but still show geographical divergences.

Divergent EZ GDP Picture Continues?

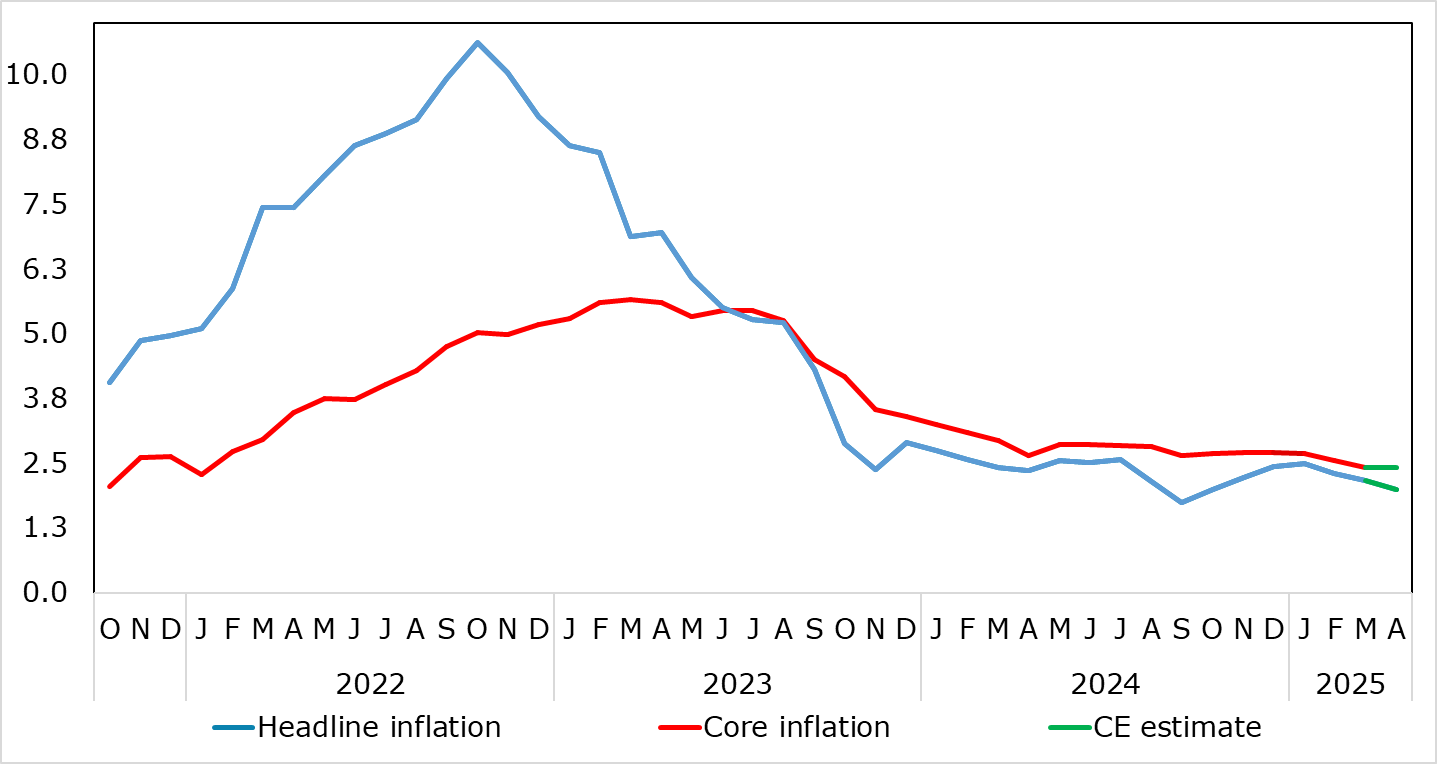

Friday sees EZ HICP inflation which is likely to fall back to the 2% target in flash April data, this six-month low would largely reflect a fall in fuel prices, but with services largely consolidating the clear fall seen last time around. All of which would mean a stable core reading of 2.4% but where the late Easter may pose some upside risks to the headline, most notably in a further rise in food inflation. The HICP data will arrive alongside March labor market numbers which may also consolidate the fresh drop to new record-low jobless seen in the last set of such data, but where that drop largely reflects a further increase in the workforce.

Headline to Slip Back Further as Services Drop Consolidates

Source: Eurostat, CE, ECB

Rest of Western Europe

There are a few key events in Sweden, most notably what have been volatile monthly GDP indicator numbers, this coming alongside a glimpse at Q1 numbers too (Tue). The same day sees the monthly Economic Tendency Survey.

Japan

Not much action until we see the BoJ interest rate decision on Thursday, when we expect there will be no change to the current rate. We have delayed our call for another 25bps hike to July as the BoJ will likely take their time to assess the impact of tariffs even when inflation flares up. It will be a hawkish surprise if we hear any changes to forward guidance. Retail trade on Tuesday could tell more about consumer sentiment while unemployment rate will likely be overshadowed by BoJ on Thursday.

Australia

The critical CPI will be released on Wednesday. We continue to see Australian Q1 CPI to remain within the target range and likely in the lower half of range. However, the RBA trimmed mean CPI will be more important as we are unlikely to see another RBA cut before trimmed mean tread below 2.5% y/y. Trade Balance will be revealed on Thursday and Retail Sales on Friday, could be useful in assess the pace of consumption recovery.

NZ

ANZ business outlook & confidence and consumer confidence on Wednesday is the only release for NZ next week.