FX Daily Strategy: APAC, June 27th

Preliminary CPI data of limited relevance, but could extend JPY weakness

EUR/USD gains may not be over, but market is stretched near term

CAD could slip further on weak GDP

Preliminary CPI data of limited relevance, but could extend JPY weakness

EUR/USD gains may not be over, but market is stretched near term

CAD could slip further on weak GDP

Friday sees preliminary CPI data for June from Japan, France and Spain, while the US sees the May PCE price index and Canada has the May monthly GDP data.

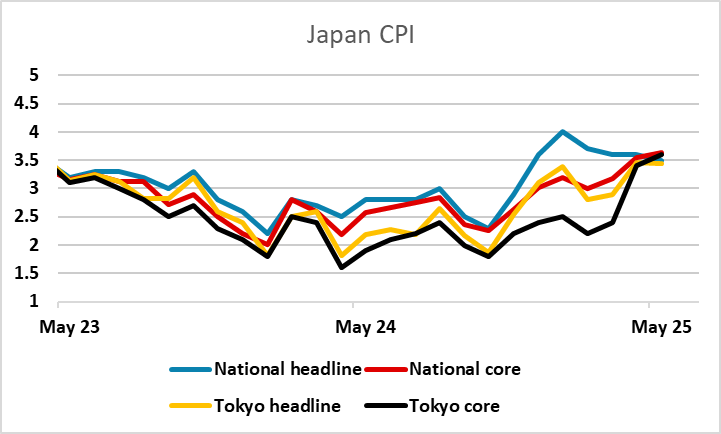

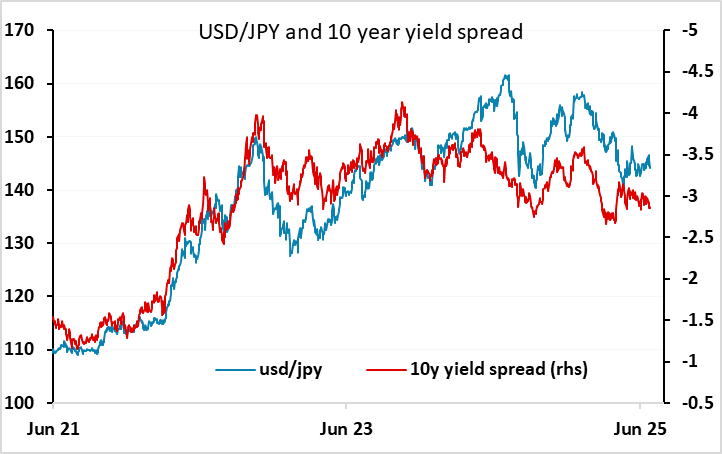

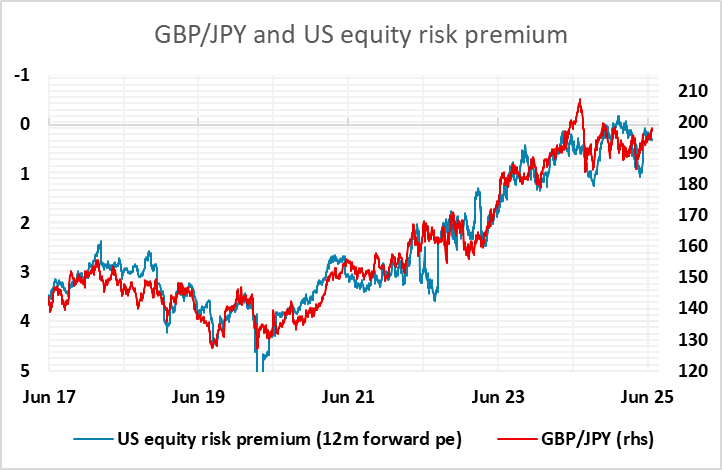

Technically, the Japanese data is the Tokyo CPI data, but this effectively acts as the preliminary CPI data in Japan, as the Tokyo CPI data precedes but typically closely matches the national data. The consensus expectation is for a decline in the core CPI to 3.3% y/y in June from 3.6% in May. A number along these lines might slightly reduce pressure for BoJ tightening, although this has largely evaporated in recent weeks as concerns about the impact of tariffs has turned the BoJ more cautious. The JPY continues to struggle on the crosses in the current USD negative environment, with the European currencies all outperforming it significantly in recent weeks. CHF/JPY made an all time high on Monday while EUR/JPY made a one year high on the same day and GBP/JPY hit its highest this year on Thursday. This weakness on the crosses has mostly been about the resilience of equity markets, but the JPY has also suffered more on geopolitically related safe haven flows into the USD than others. Nevertheless, whether you look at yield spreads or risk premia, JPY weakness looks overdone, and there should be scope for medium term recovery. But weaker Tokyo CPI is unlikely to trigger such a recovery, and we may yet see some more weakness short term.

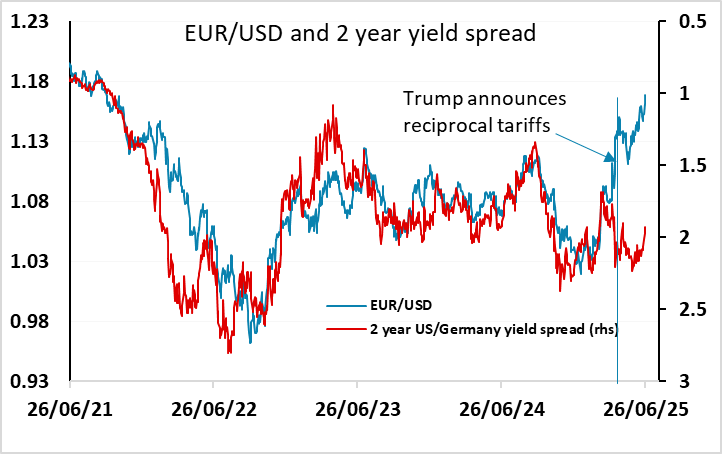

The French and Spanish CPI numbers are expected to show little change in y/y inflation rates in June from May, so probably won’t impact the EUR significantly. It would take a lot for the market to move away from the view that the ECB is planning one more cut this year, probably in October or December, but in any case EUR/USD doesn’t look to be being driven by policy expectations, but rather by a more structural shift away from the USD even since Trump announced reciprocal tariffs. Even though a lot of the original announcement is no longer in place, the uncertainty around policy coupled with the already high share of USD assets in global portfolios has triggered some strategic unwinding of USD exposure. It is hard to say whether this is complete. Based on the first Trump presidency it may yet have further to run, but this is an argument for selling the USD on rallies rather than indiscriminately, as at current levels the EUR does look stretched.

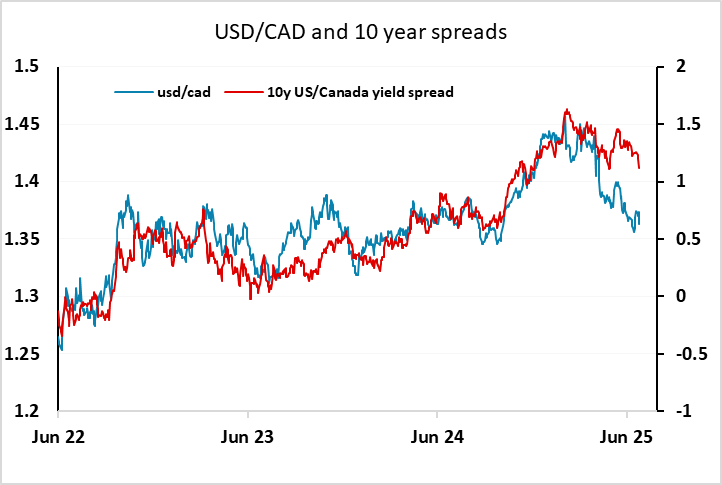

For Canada, we expect Canadian GDP to be unchanged in April, slightly below a preliminary estimate for a 0.1% increase made with March’s report. Tariffs are likely to be a restraint on the economy through Q2 and beyond. USD/CAD has started to show some signs of recovering after the dip following the tariff announcements, and evidence of weakening in the Canadian economy due to tariffs could extend the recovery. The CAD may prove to be something of a canary in the coalmine for the USD’s performance against the European currencies, and if so we may see some USD recovery against Europe as well into the end of the month.