FX Daily Strategy: Asia, February 18th

RBNZ To Be On Hold

Australian Wage Growth Could Support the Aussie

Slate of U.S. Data

UK CPI Fresh and Marked Fall to Resume

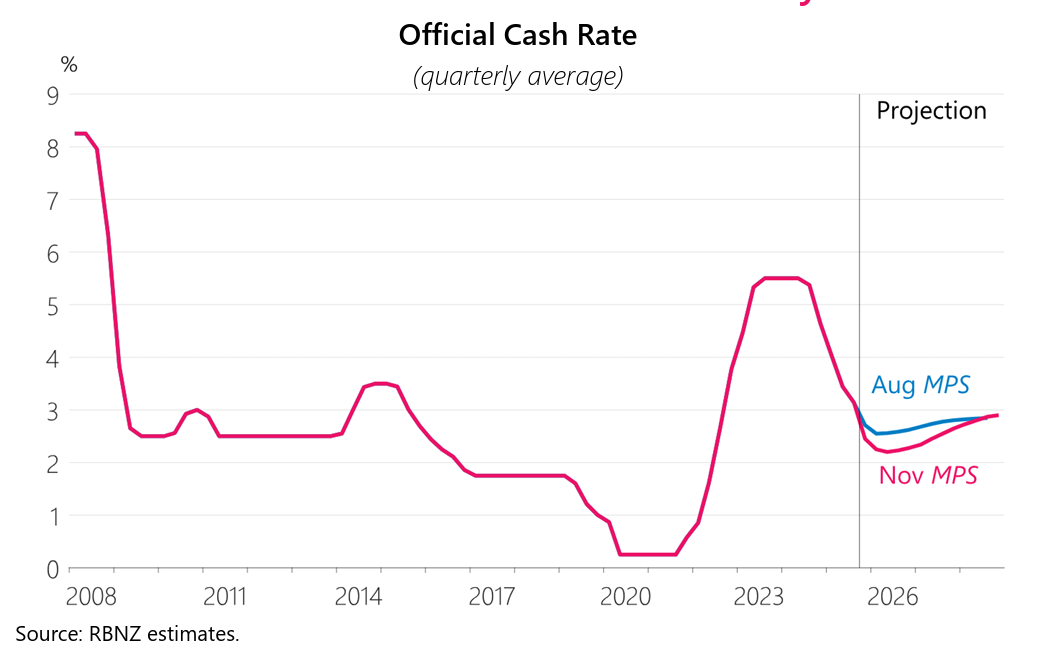

The RBNZ rate decision will be announced on late Tuesday and we expect the OCR to be on hold at 2.25%. The November OCR forecast shows the RBNZ will likely keep rates unchanged at current levels at least till 2027. We do not believe the RBNZ will either hike/cut due to current inflation above target range. The overshoot has been addressed by the RBNZ to be transitory. It will be a hawkish surprise if they change their wordings or revise their OCR forecast.

On the chart, NZD/USD is in the neighbor hood of annual high. With a hawkish push, we could easily see a jump above the 0.61 figure. Yet our base scenario see no change to rates, forward guidance or forecast and suggest little last impact towards the Kiwi.

The RBA has tilted hawkish and is forecasting two more hike in 2026. Thus, economic releases are going to be more dynamic going forward, especially wage data. The Australian Wage is expected to continual its growth and may accelerate on the release from preliminary data points like job ads. A strong wage growth may trigger market participants'' anticipation of an earlier hike from the RBA and support the Aussie.

On the chart, anticipated losses have tested below 0.7065 to reach 0.7045~, before bouncing back into consolidation around 0.7075. Daily stochastics have turned down and the flat daily Tension Indicator is also coming under pressure, highlighting a deterioration in sentiment and room for deeper losses in the coming sessions. A close below the 0.7065 lows from 10-11 February will add weight to sentiment and open up congestion around 0.7000. Meanwhile, a close back above 0.7100 would help to stabilise price action. But a further close above the 0.7147 current year high of 12 February and the 0.7155~ year high of February 2023 is needed to turn sentiment positive and open up strong resistance at the 0.7200 Fibonacci retracement.

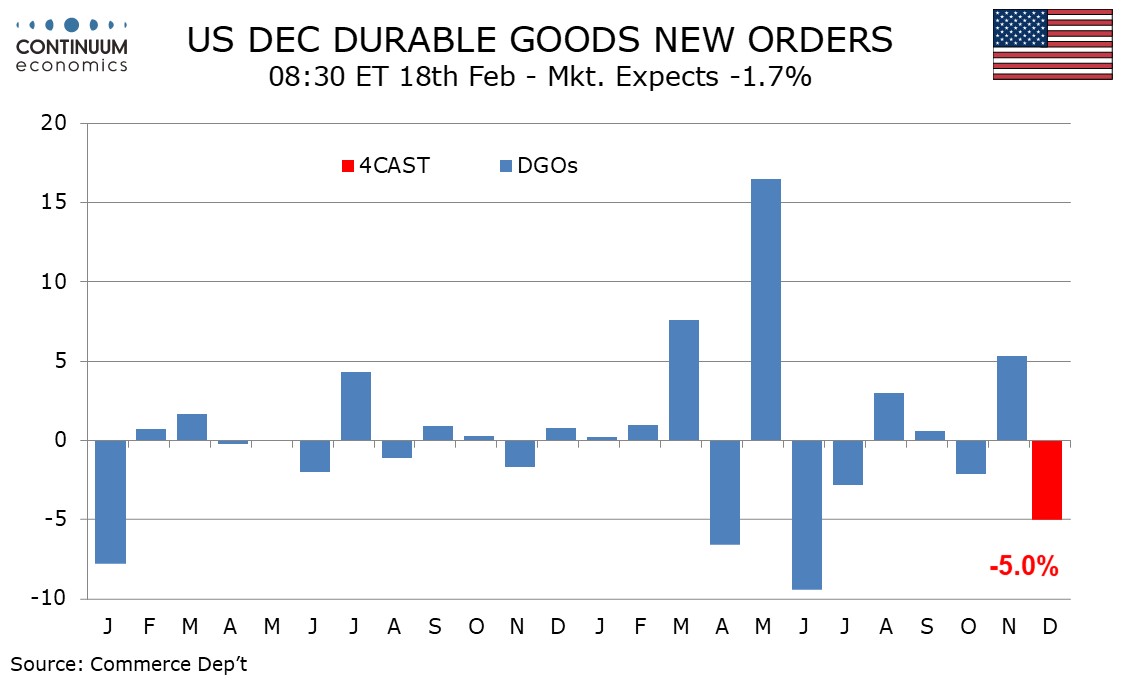

We expect December durable goods orders to fall by 5.0% after a 5.3% increase in November, the reversal led by aircraft after a strong November increase. Ex transport we expect a 0.4% increase, matching the gain in November. Boeing orders were only slightly lower in November after a sharp rise in November but seasonally adjusted a full reversal of November’s aircraft increase in the durable goods orders data should be seen. Autos are likely to see little change but we expect a bounce in defense, which has a large overlap with transport, after two straight declines. Ex defense expect a fall of 5.7% after a 6.3% increase in November.

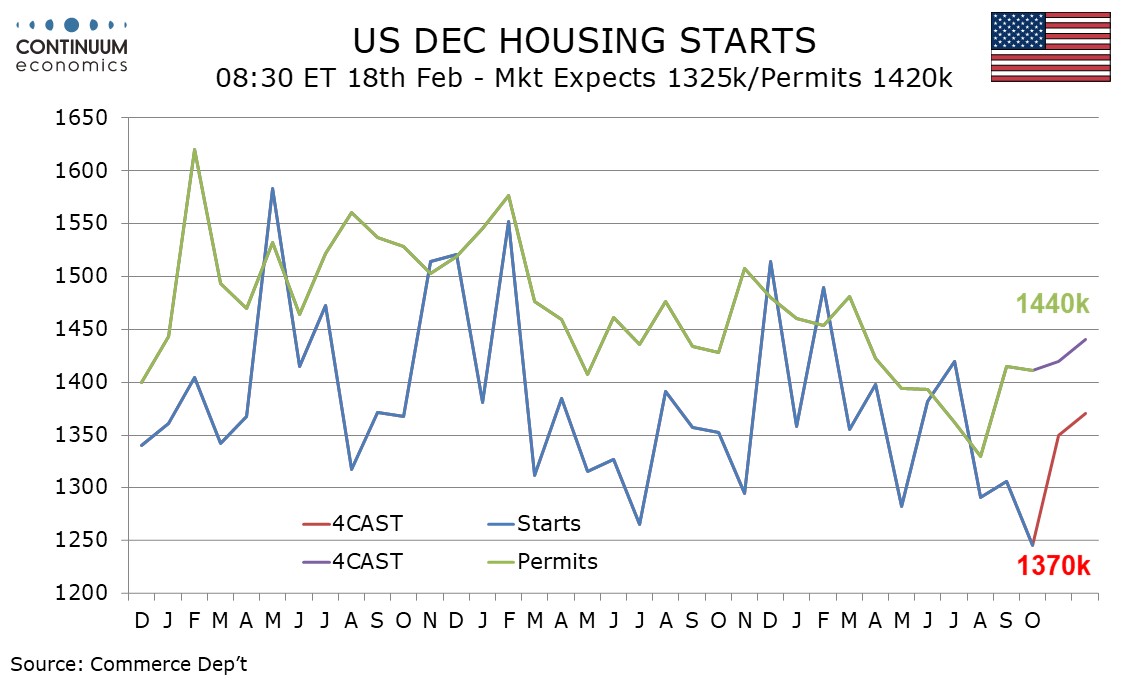

Housing starts and permits data for both November and December are due on February 18. For starts we expect a rise of 8.3% in November to 1350k to follow a decline of 4.6% in October, with a more moderate 1.5% increase to 1370k in December. For permits we expect moderate gains of 0.6% in November, to 1420k, and 1.4% in December, to 1440k. The housing sector picture generally picked up moderately in Q4, assisted by Fed easing, though non-farm payroll details were more constructive for construction in November than December. New home sales data is available only through October, with November and December data due on February 20.

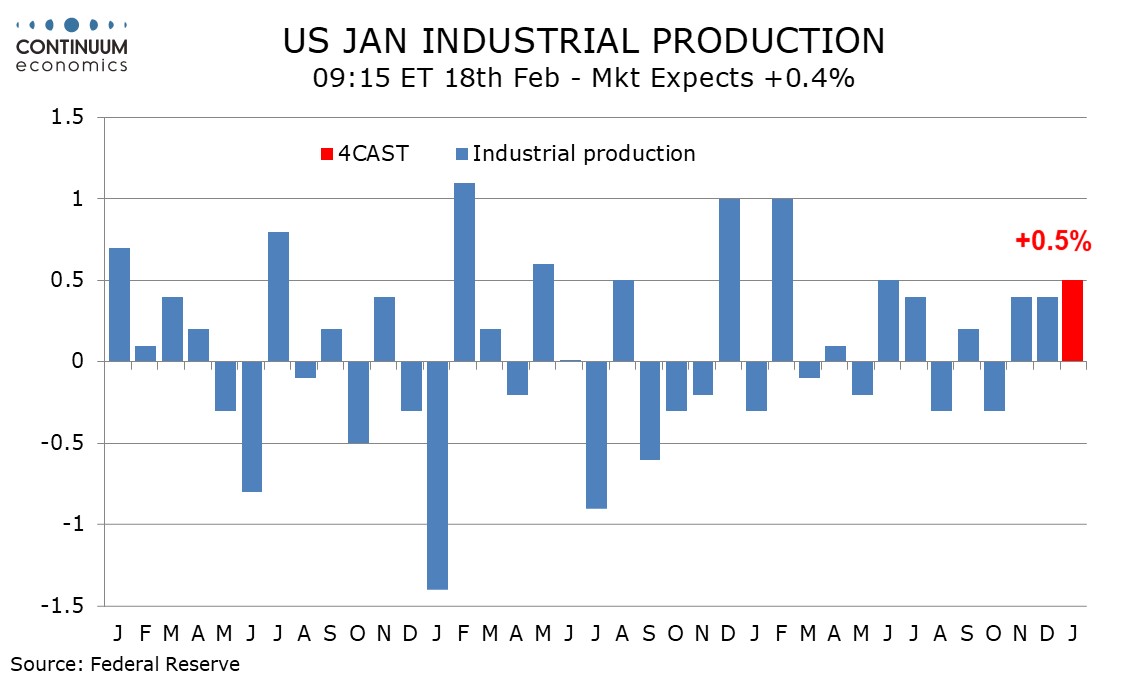

We expect a 0.5% increase in January industrial production, with ISM manufacturing and manufacturing payrolls suggesting stronger data, though there is some downside risk from bad weather late in the month. January’s non-farm payroll showed aggregate manufacturing hours worked up by 0.3% with a 0.6% rise for production and non-supervisory workers, making our forecast for a 0.5% rise in manufacturing output not an aggressive one, though the payroll was surveyed before the bad weather hit. ISM manufacturing data saw a sharp bounce in January.

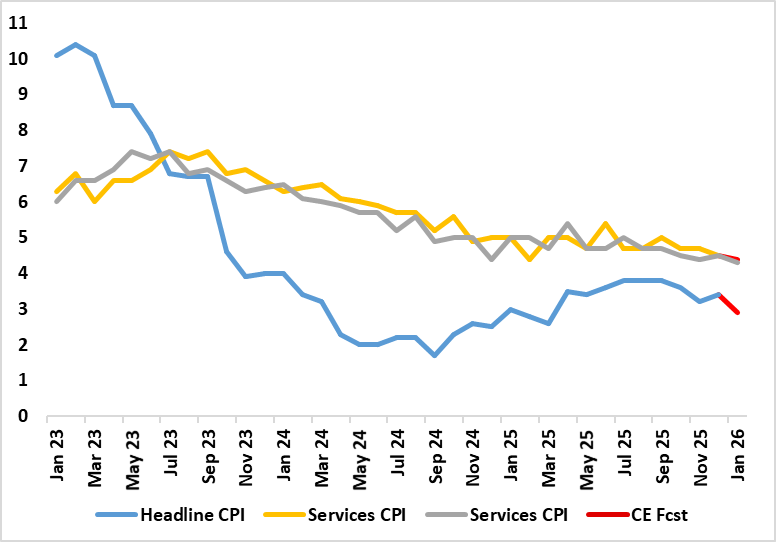

Figure: Headline and Core Further To Fall Clearly

UK policy makers may not be able to say they have won the war against inflation, but a clear victory may be seen in the batter likely in the next few months with a likely return to the 2% target by April These projected falls are likely to commence with the looming January numbers (Figure) where airfare distortions which pushed up the December outcome should unwind, and where base effects may reduce food inflation. As a result, we see the headline CPI rate falling from December’s 3.4% to 2.9% (as does the BoE) and also where services and the core should fall by around 0.3 ppt to 4.2% ad a new cycle low of 2.9% for the latter. Notably such declines have been signalled for some time by adjusted m/m data, with already-soft wage figures likely to result in lower underlying inflation ahead. Such data should encourage further speculation that the BoE will ease afresh next month.

Although we have been flagging a fall in CPI headline inflation rate down to the 2% target sometime in the spring, this line of thinking is becoming more widespread, helped by some recent Budget measures. Notably the BoE is now suggesting that inflation will fall to 2.1% by April, partly reflecting base effects and largely stay there through Q2. We see a similar drop but (unlikely the BoE’s anticipated more modest drop) also that this will be accompanied by a fall in the core rate to just over 2% by mid-year.

For some time and for a variety of reasons, UK CPI inflation has been higher than other parts of Europe and often higher than expected. At the current juncture, that in part reflects unusually large increases in administered prices such as Vehicle Excise Duty and higher water bills last April, thereby creating favourable base effects for later this year as they are contributing around 0.5 percentage points to current inflation. Moreover, food, and tobacco inflation is estimated to be contributing a further 0.5 percentage points to current inflation and this should unwind although PPI data do not yet suggest this is likely to occur imminently.

Other factors are also likely to weigh on inflation, and only partly due to the weak demand backdrop that we think is currently evident. Indeed, partly reflecting the energy bills package announced in last November’s Budget, which, alongside a fall in wholesale gas prices, is expected to result in a decline in the Ofgem price cap by up to 8% in April, enough to knock some 0.3 ppt off the headline rate.