FX Daily Strategy: APAC, May 30th

Some downside risks for the USD on US data

USD/JPY remains the most obviously out of line with spreads

EUR/USD to hold steady

Some downside risks for the USD on US data

USD/JPY remains the most obviously out of line with spreads

EUR/USD to hold steady

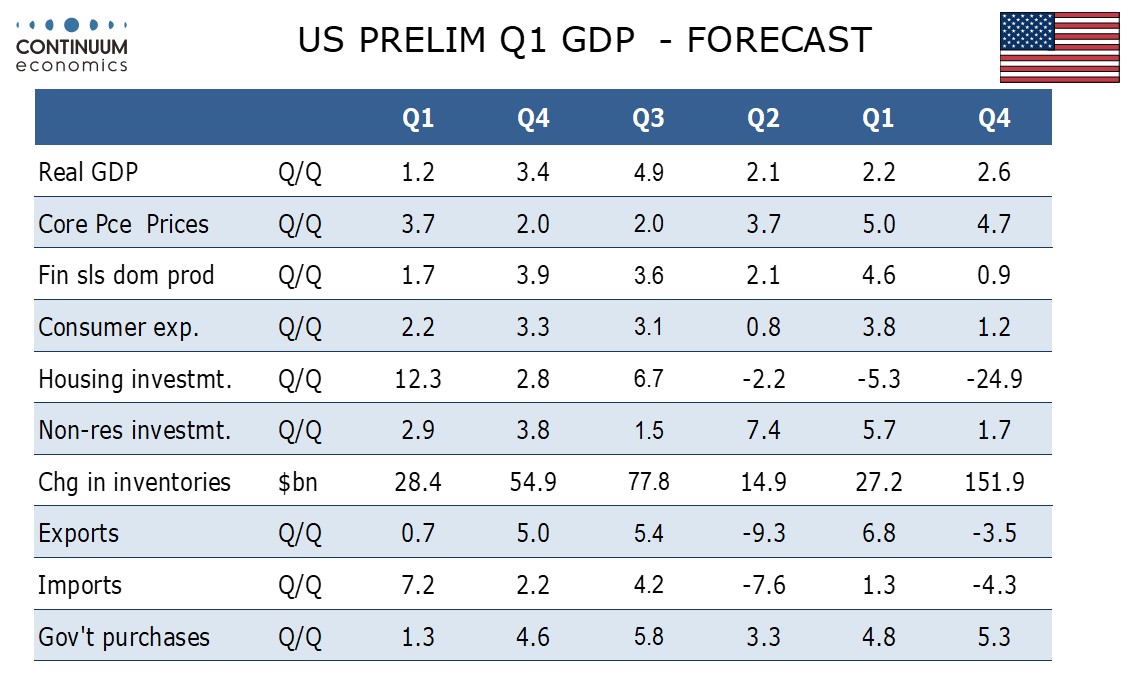

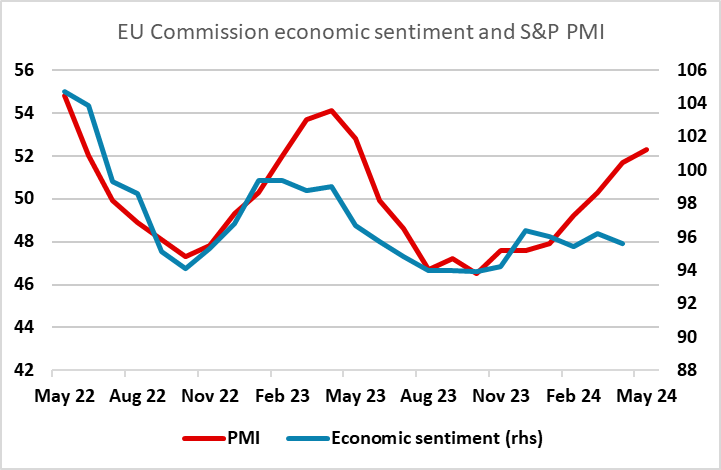

Thursday sees a revision to US Q1 GDP data as well as the usual US weekly jobless claims numbers. There is also the European Commission survey, which is of more significance than usual as recent readings have been weaker than the PMI data which have encouraged the more optimistic market expectations of Eurozone growth. We also have GDP and confidence data from Sweden, Swiss Q1 GDP and Spanish CPI, so in general a fuller calendar than we have had in the first part of the week.

The US GDP data is expected to be revised lower to 1.3% annualised from the advance estimate of 1.6%. Our own forecast is slightly lower at 1.2% annualized. This will remain the slowest quarter since a decline in Q2 2022. Our current estimate for Q2 is for a rise of 2.0%. The main source of the revision will be retail sales, where February and March data were revised down with April data. We also expect a downward revision to inventories. We expect final sales (GDP less inventories) to be revised down to 1.7% from 2.0%. We do not expect any revisions to the price indices with 3.7% for core PCE remaining an unwelcome acceleration from two straight quarters that at 2.0% annualized were consistent with target.

Although a lot of the weakness in Q1 GDP was due to net exports, some of this corrects for strong net exports in Q4, and there is evidence of a general underlying slowdown. While the rise in the PCE deflator is disappointing, and the higher rate of inflation in Q1 has reduced market expectations of Fed easing, the evidence of a slowing economy should sustain expectations of Fed easing down the road. As it stands, the market is fully pricing only one Fed rate cut this year, after pricing 6 rate cuts at the beginning of the year, so from here we see the risks as being towards lower yields if the data comes in in line with our forecast. The reaction will also depend to some extent on the jobless claims data, which have shown a small uptick in the last couple of weeks. Further evidence of a softening labour market would support a view that the Fed will find room to cut more aggressively than the market is currently pricing in. The USD has been strong this week, largely on the back of rising yields, and the consequent softening in equities, but the softer GDP data should be a reminder that there isn’t much more upside for US yields, and we see some downside risks for the USD on the data.

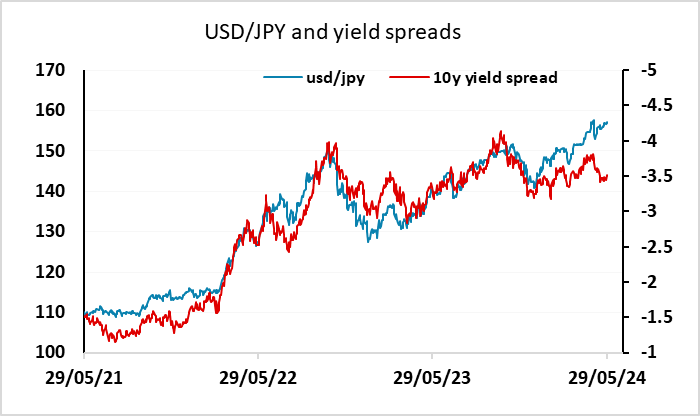

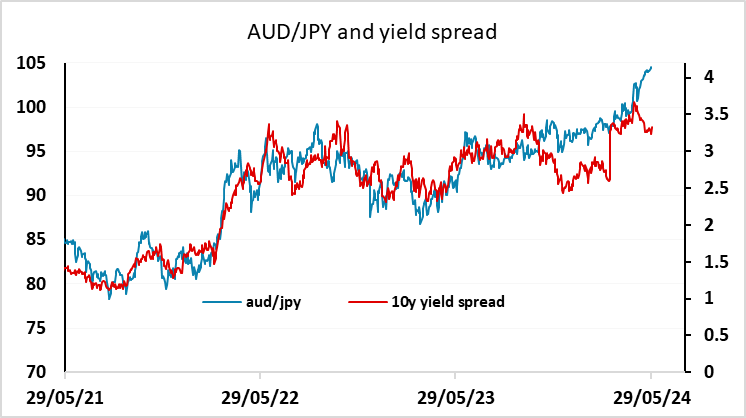

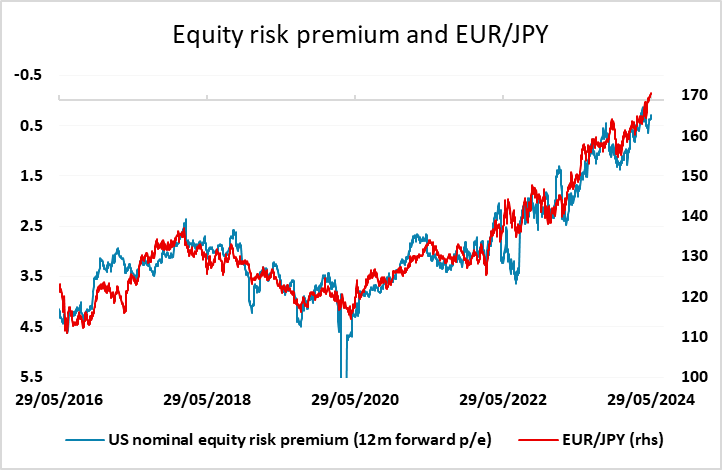

USD/JPY remains the most obviously anomalous pair, trading well above the level consistent with the recent relationship with US/Japan yield spreads, and crosses like AUD/JPY and CAD/JPY have also soared well above the levels suggested by the (very strong) yield spread correlation seen in the last few years. While US yields have risen this week, JGB yields have risen in tandem, so the spread hasn’t supported USD/JPY gains. The rise in yields in the US and elsewhere has undermined equities, but not enough to push implied equity risk premia higher, as the decline in bond yields tends to dominate the moves in equity yields. Nevertheless, the JPY also looks overly weak on the crosses relative to the historic relationship with equity risk premia. Having said all this, it seem likely we will need more action from the Japanese authorities to trigger a JPY recovery, as at the moment the carry traders remain comfortable.

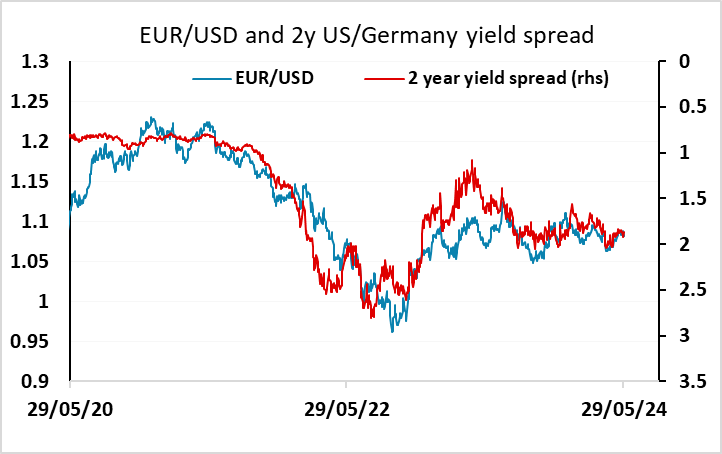

EUR yields have matched the rise in US yields this week, so EUR/USD has held relatively steady. There is certainly some optimism building on the Eurozone economy helped by the recent PMI data, but the European Commission survey has thus far not matched the PMI optimism, so the May data will be significant. However, even if the economic data improve, we still see scope for more ECB easing than is priced into the market as the inflation picture looks to be heading back to target, and this view is supported by the comments from the ECB this week. So we would expect EUR/USD to hold fairy steady for now, although longer term we still see upside scope as US yields adjust lower and optimism about the Eurozone economy builds.