JPY, AUD flows: JPY soft AUD strong as risk tone improves

USD/JPY correcting towards 150, AUD/USD threatening 0.64 resistance area

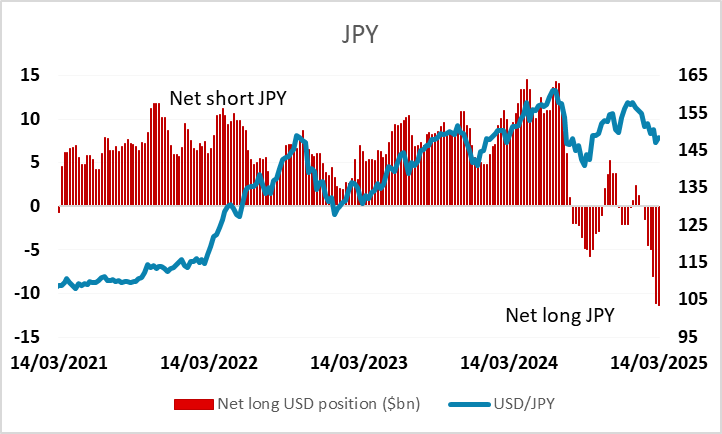

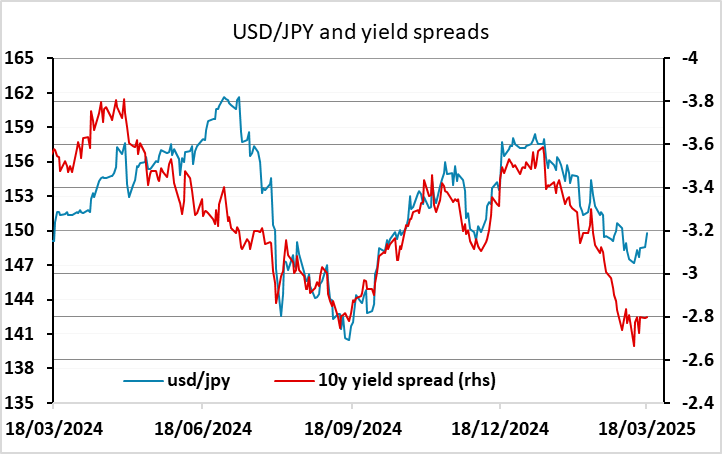

JPY weakness has been the main feature overnight, with a generally risk positive FX tone. USD/JPY is approaching the 150 resistance area, and EUR/JPY is approaching the highs of the year above 164. The moves look corrective and technical rather than fundamentally based, with little news of note overnight, although regional equities continues to perform well. The CFTC data showed large speculative long JPY positions last week, and these may be being pared back ahead of the BoJ meeting tomorrow, even though there isn't much risk of a rate hike priced in. Yield spreads continue to suggest USD/JPY downside risks dominate, but this increasingly looks likely to depend on another turn lower in equity markets.

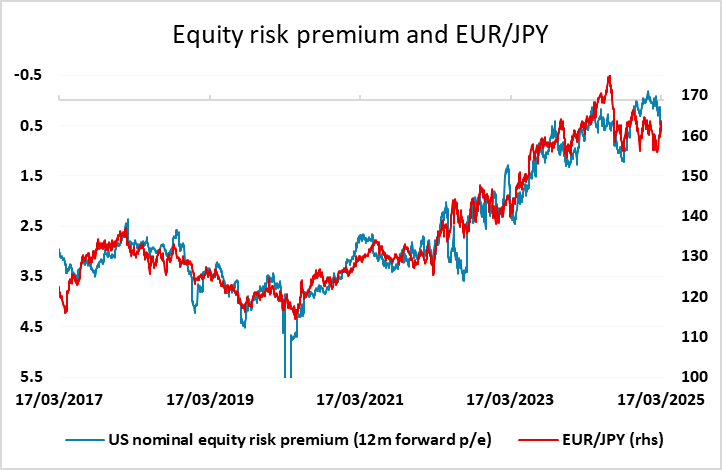

EUR/JPY has recovered back to the levels consistent with the correlation with the US equity risk premium that has held for much of the last decade, but we continue to think this premium is much too low given the risks the US and world economy currently face, so we still favour JPY gains over the medium term.

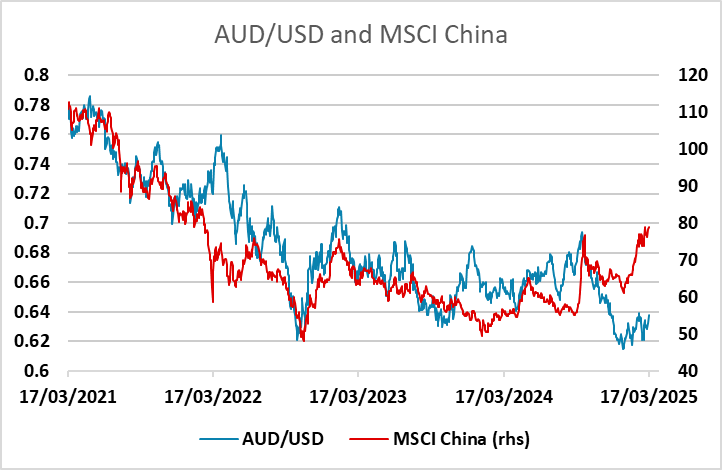

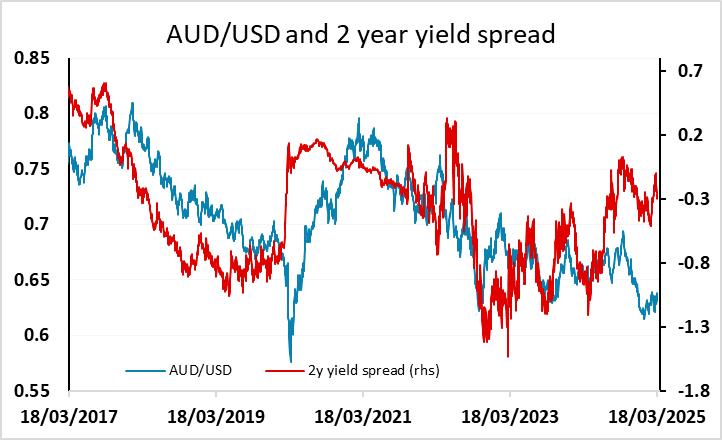

On the other side of the coin, the AUD has performed well overnight and AUD/USD is threatening the year’s highs above 0.64. This looks well justified by the combination of strong regional equities and attractive yield spreads relative to the current level.

While we are sceptical about the risk positive tone currently being seen in the FX market, there isn’t much on today’s calendar that looks likely to turn things around, so there may be scope for AUD strength to extend.