USD flows: USD mixed, focus on US data

Commodity currencies storng but USD makes gains against the JPY overnight. US retail sales and Empire Manufacturing survey in focus

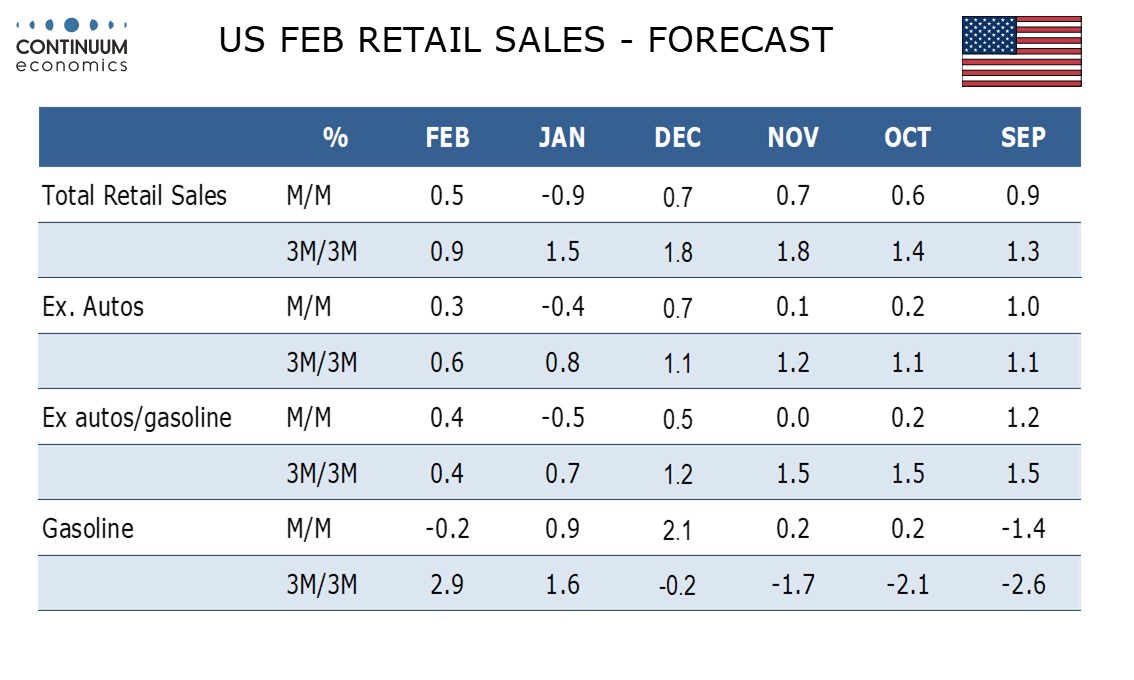

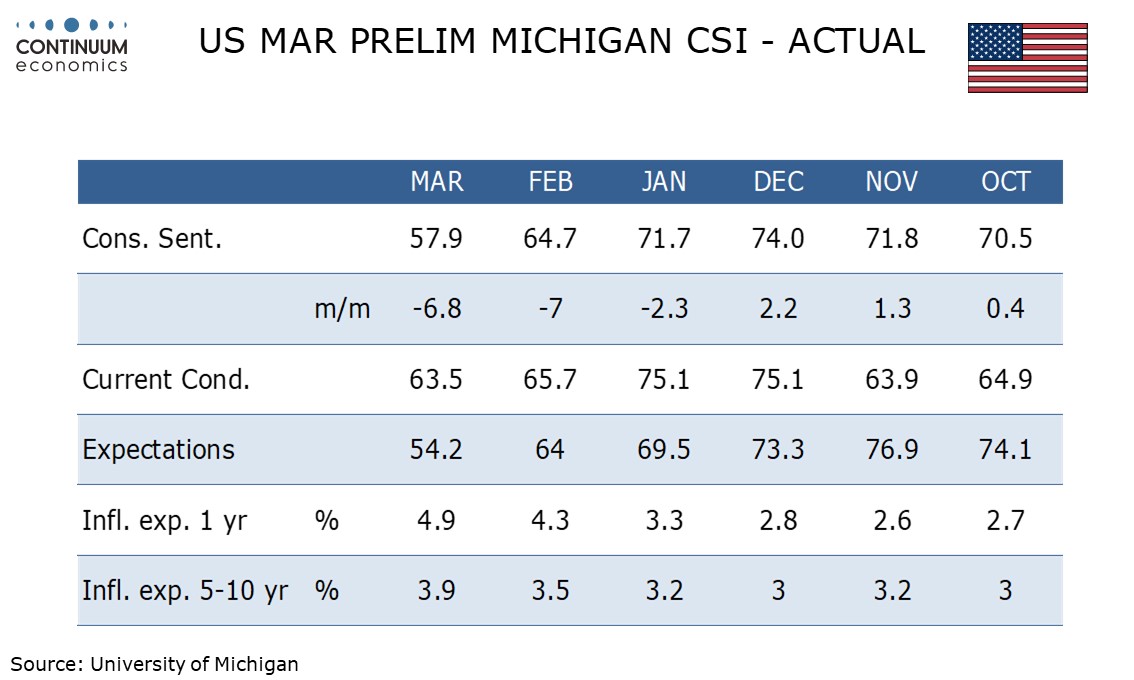

Focus is likely to be on today’s US data after Friday’s startling University of Michigan (UoM) confidence and inflation expectations data, and US Treasury Secretary Bessent’s weekend comments suggesting a US recession was possible and stock market declines were welcome. We expect US retail sales to rise by 0.5% in February in what would be only a partial reversal of a 0.9% decline in January. Ex autos we expect a 0.3% increase after a 0.4% January decline while ex autos and gasoline we expect a 0.4% increase after a 0.5% January decline. This would represent a deterioration in the 3m/3m trend, and might add to concerns about US slowdown, even though the market consensus is similar to our forecast. There will also be interest in the Empire State manufacturing survey. This showed an improving trend for much of last year, but has shown signs of topping out in recent months.

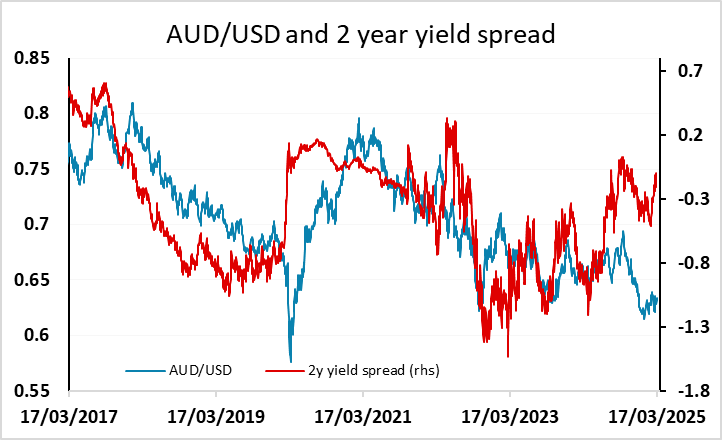

The USD was mixed in Asia, with the commodity currencies benefitting from strong Chinse retail sales and production data, but the USD making ground against the JPY and marginally against the EUR. But the market seems to have taken too little notice of the UoM survey and Bessent’s comments, and we see the USD as vulnerable here, particularly against the JPY. However, if equity markets hold up, the AUD still looks to have prospects to move up to test 0.64.