FX Daily Strategy: N America, November 22nd

Geopolitical Risk Intensifies

European PMIs plunge

U.S. November S&P PMIs to show a marginal slippage

Japan CPI Moderates Less than Expected

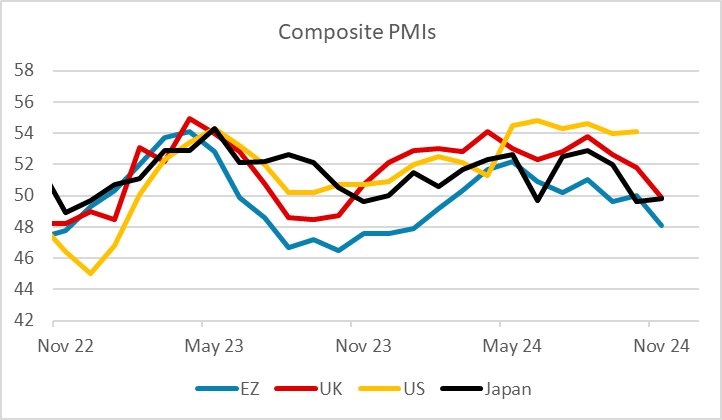

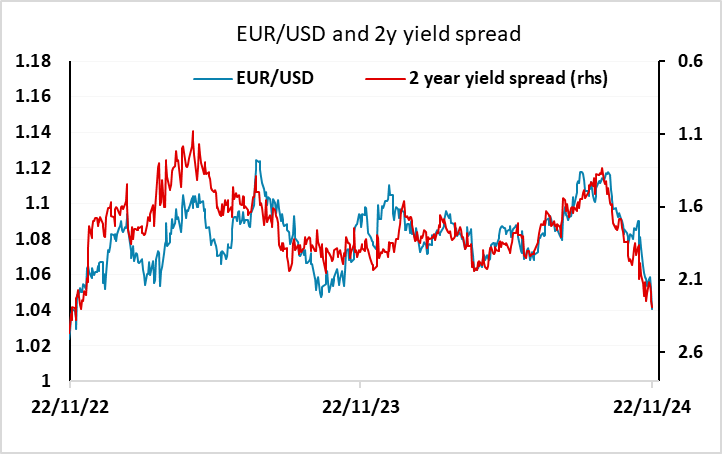

Much weaker than expected Eurozone PMI data has triggered a sharp decline in the EUR across the board. French PMIs were particularly weak, but German PMI also fell significantly. Eurozone PMIs are down to their lowest since January. The data doesn’t necessarily indicate recession, but does increase the chances of faster and/or larger ECB rate cuts. The market is now pricing the December 12 meeting as a 50-50 chance between a 25bp and a 50bp cut. As it stands, this has led to 2 year yields falling around 10bps, and on recent correlations this is consistent with the current EUR/USD level around 1.04. However, if the ECB were to cut 350bps, and/or the Fed were to leave rates on hold on December 18 (currently priced as a 60% chance of a 25bp cut), there is scope for further EUR/USD losses towards 1.02 or lower. For now, we may see EUR/USD hold near 1.04.

UK PMIs were also weak, albeit not quite as weak as the Eurozone numbers. The UK data also is a less reliable guide to UK GDP, so should be taken with a large pinch of salt. Indeed, the Eurozone numbers are also far from infallible. But for now the USD and JPY should remain very much on the front foot.

Geopolitical risk intensified again after the West authorized Ukraine to strike targets within Russia with long range misses. Russia has responded by nuclear threats and seems to have launched an intercontinental ballistic missile, targeting critical infrastructure in the central Ukrainian city of Dnipro. While the west has restrained from nuclear retailiation, it seems likely there will be further escalation in the Ukraine-Russia front unless a deal is brokered by Trump soon. The cheerful equity market does not seem to have priced in any possibility of a world war!

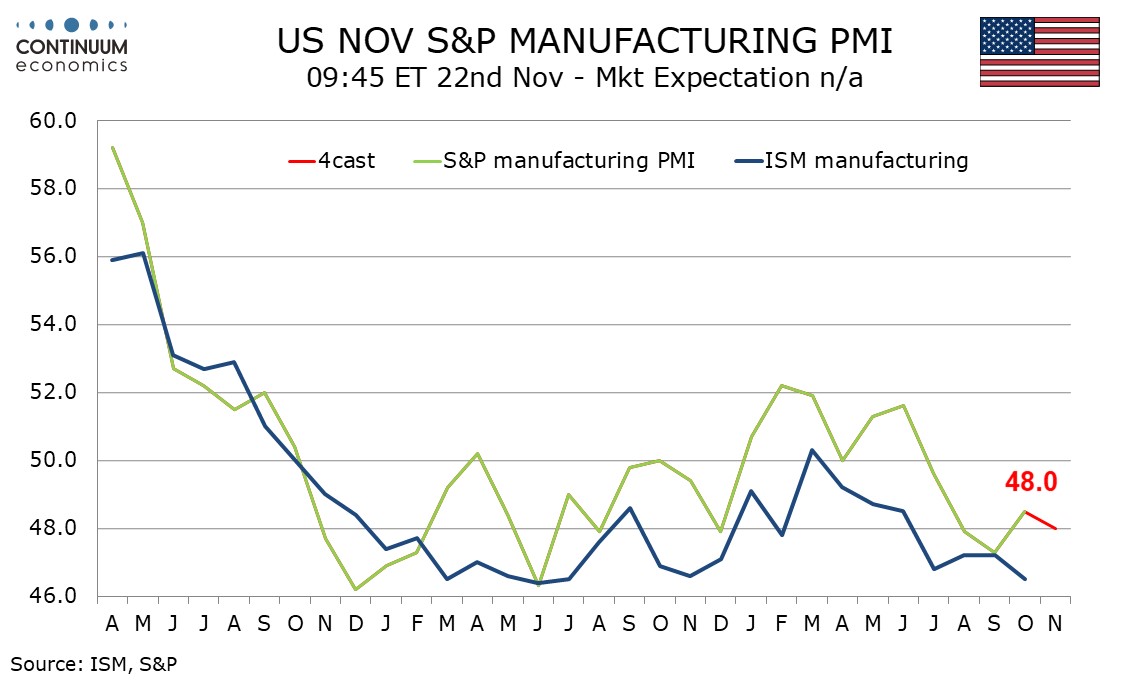

We expect November’s US S and P PMIs to show a marginal slippage in manufacturing to a still weak 48.0 from 48.5 but with services unchanged at a healthy 55.0. The manufacturing index would still be above the preliminary October reading of 47.8, but down from the final 48.5. While the improvement in the second half of October is supportive for further recovery in November a softer October ISM manufacturing index argues in the opposite direction.

The S and P service indices has now been stable around 55 for six straight months and we do not expect much change in October. ISM services data has recently been more volatile, moving above the S and P index in October, though this rise, led by a sharp bounce in delivery times, may prove difficult to sustain and is probably not a signal for November’s S and P services PMI.

Japan National October headline CPI came in stronger than expected at 2.3% y/y, moderating from 2.5% in September. Ex fresh food and energy rose to 2.3% from 2.1% y/y. It would be favorable for our call of a December BoJ hike. It continues to point towards stronger underlying inflation with headline inflation moderating but ex fresh food & energy rose.

On the chart, the consolidation beneath congestion resistance at 156.00 has given way to renewed selling interest, as overbought intraday studies unwind, with the break back below 155.00 adding weight to sentiment. Focus is turning to support at the 154.00 break level, but daily readings are turning down once again and overbought weekly stochastics are flat, suggesting potential for a later break. Focus will then turn to the 152.50 break level, where by-then oversold daily stochastics could prompt fresh consolidation. Meanwhile, a close back above congestion resistance at 155.00, if seen, will help to stabilise price action and prompt consolidation beneath 156.00.