FX Daily Strategy: APAC, December 18th

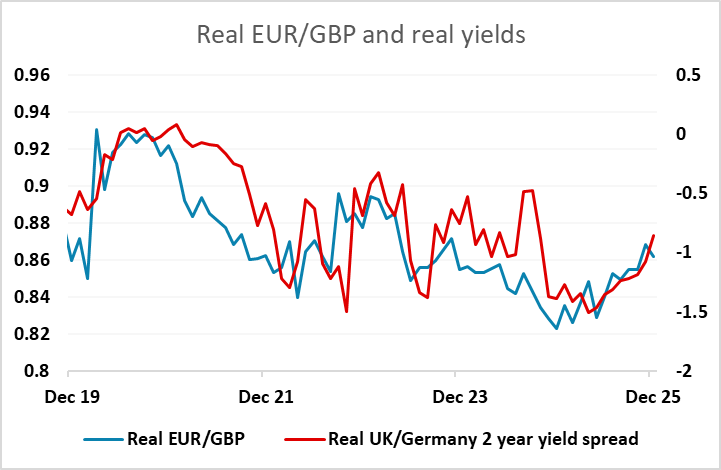

BoE likely to be more dovish than expected after latest data

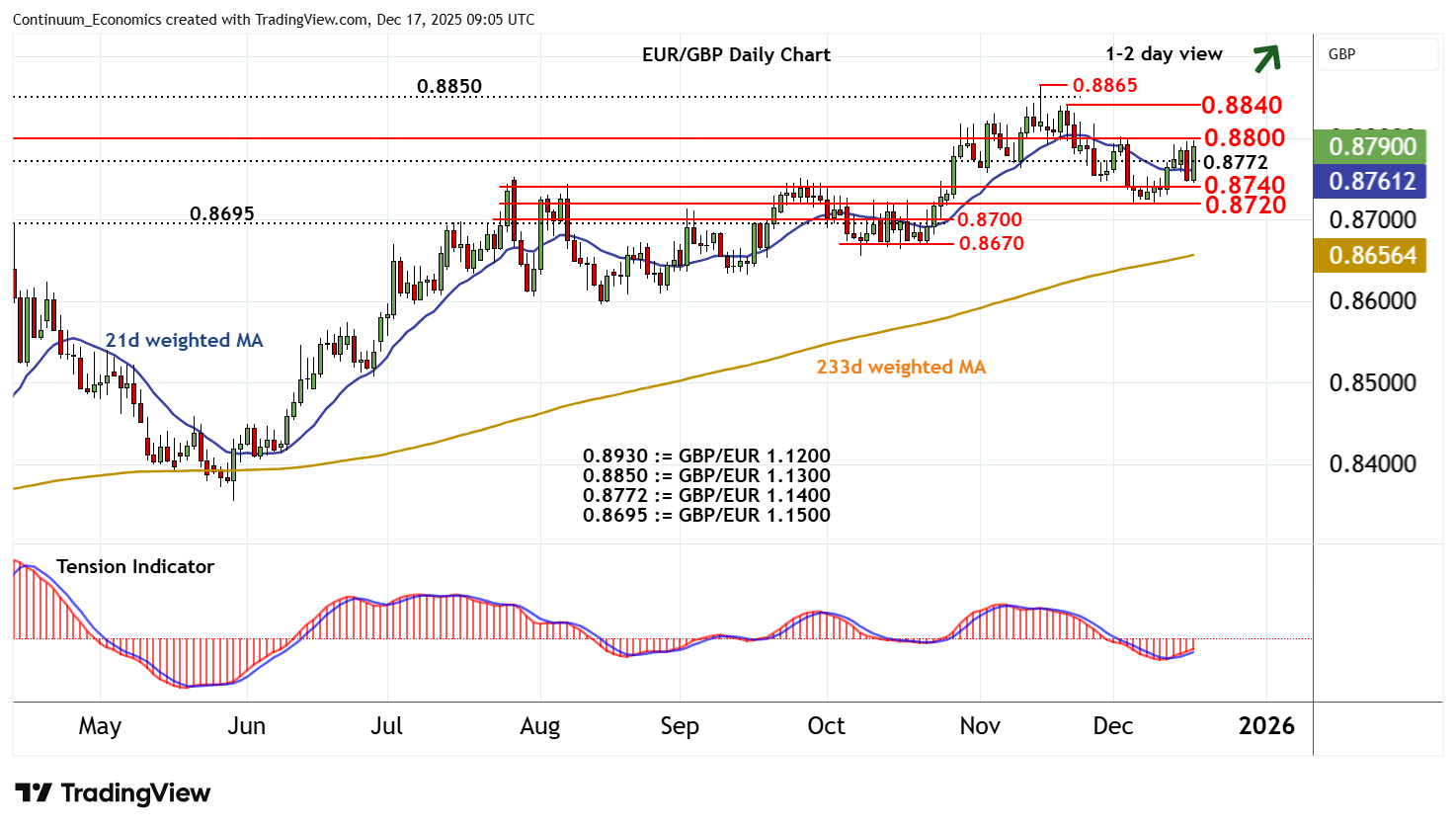

Scope for EUR/GBP to test above 0.88

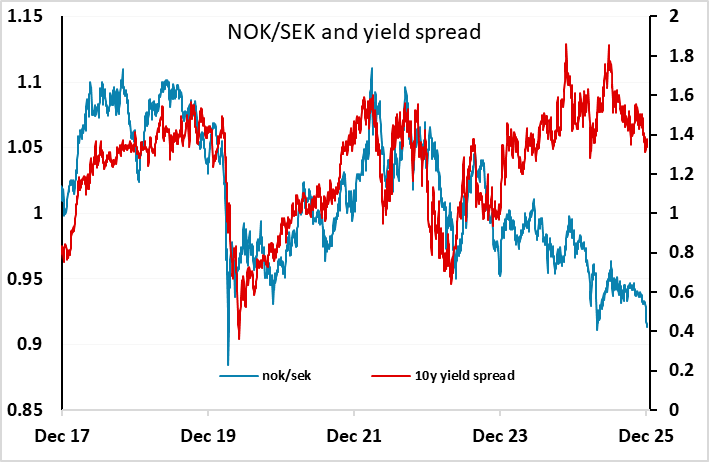

NOK looks too weak vs SEK and EUR

JPY may see a bounce ahead of BoJ

BoE likely to be more dovish than expected after latest data

Scope for EUR/GBP to test above 0.88

NOK looks too weak vs SEK and EUR

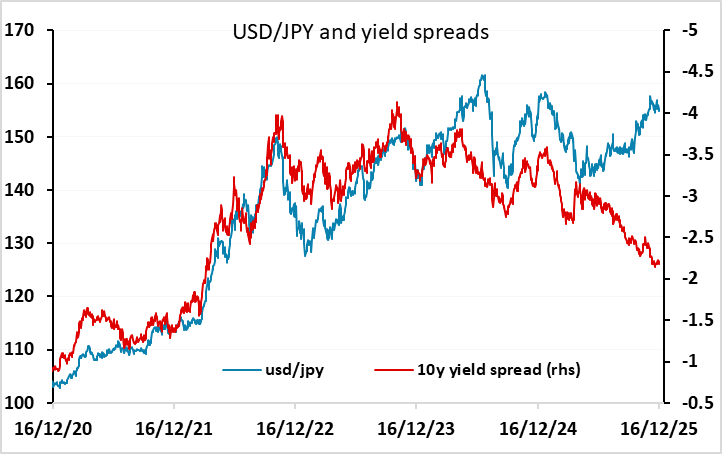

JPY may see a bounce ahead of BoJ

Thursday sees Monetary policy decisions from the Bank of England, ECB and the Riksbank, as well as CPI data for the US.

The biggest focus in the European morning will be n the Bank of England, as a rate cut is expected and there is potential for a change in tone after recent weak data. The question is whether the MPC vote will be as close as the 5:4 split seen last month but with Governor Bailey switching sides. However, we think dissents may be less than four this time around after the weak CPI data on Wednesday. Even hawk Chief Economist Pill may opt for an easing, and there may even be a vote for a 50bp cut from one of the doves. Certainly we see scope for more easing than the market is pricing in over the course of 2026. Thus we retain our below-consensus projection of Bank Rate falling to 3.0% by end-2026, against the market pricing of 3.25%.

GBP slipped back after the weaker than expected CPI data on Wednesday, with EUR/GBP reaching a high just below 0.88. But there should be scope for more GBP weakness if the MPC prove more dovish than expected. The 0.8865 high of the year reached in mid-November may come under pressure if the vote is more clear-cut than the 5-4 expected and there are indications of a more dovish stance going forward.

There is no expectation of any change in policy from the ECB or the Riksbank, so we wouldn’t expect any significant FX reaction. However, both the EUR and the SEK have been strong performers of late, both against the USD and notably against the NOK. Both NOK/SEK and EUR/NOK are closing in on key levels near 0.90 and 12 respectively. We struggle to find a good rationale for this NOK weakness, and would expect to see some NOK bounce from current levels.

For US CPI it is the two monthly change that will be published, with the government shutdown having scuppered the October release. We expect 0.49% for overall CPI, assuming October at 0.16% and November at 0.33%, and the core rate up by 0.53% over the two months. With the Fed out of the way, we doubt the numbers will have significant impact, although there may be some confusion because the two month change. USD/JPY continues to look overstretched up here, with JPY crosses similarly overextended, and with the BoJ likely to hike rates on Friday may be vulnerable to some significant profit-taking.