FX Daily Strategy: APAC, March 22nd

CHF weakness the main outcome of a week of central bank meetings…

…but CHF decline may not extend far except against the JPY

Low and declining risk premia to prevent significant JPY strength for now

Friday’s data unlikely to have much impact

USD strength should see some correction

CHF weakness the main outcome of a week of central bank meetings…

…but CHF decline may not extend far except against the JPY

Low and declining risk premia to prevent significant JPY strength for now

Friday’s data unlikely to have much impact

USD strength should see some correction

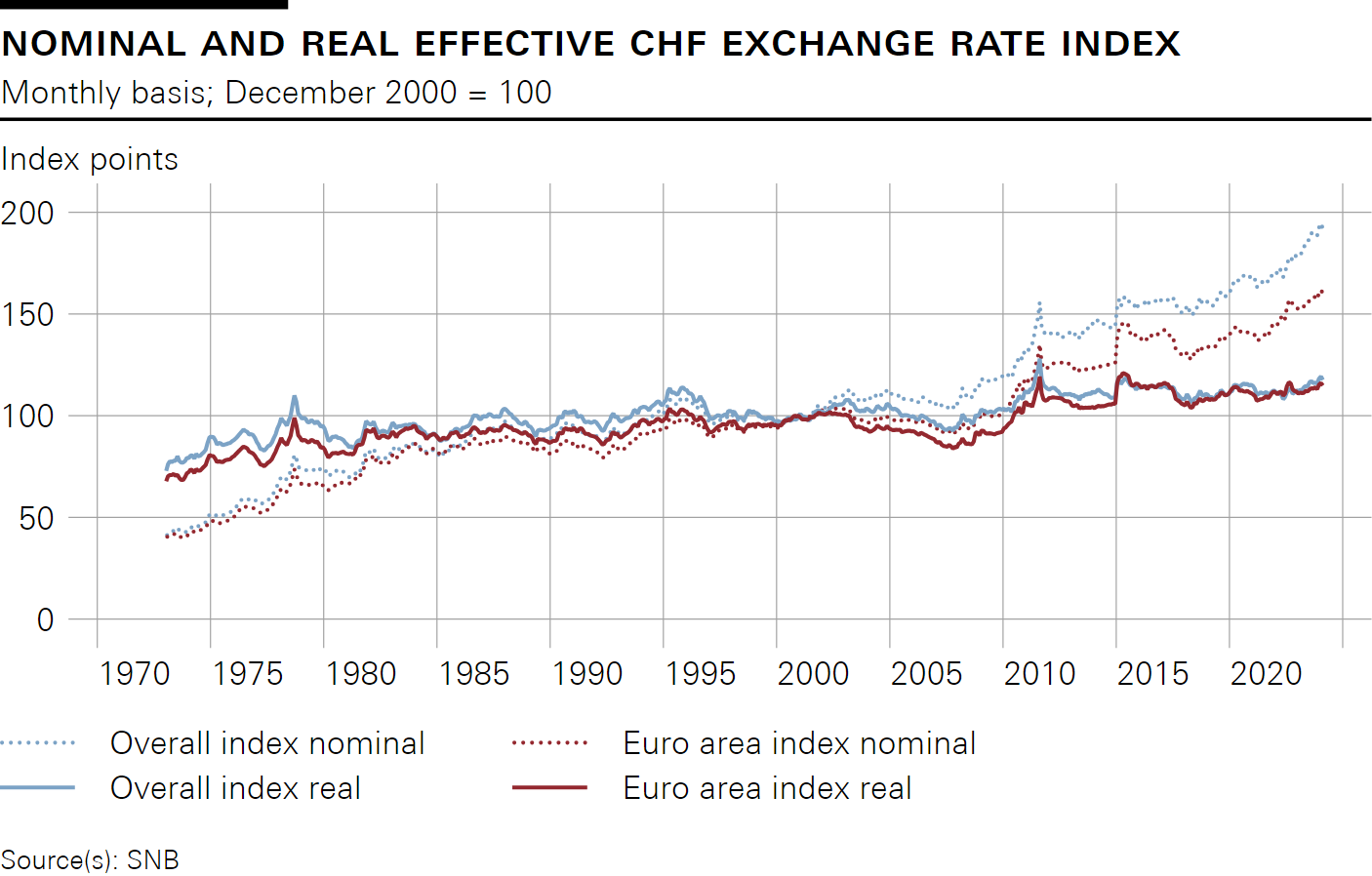

A week of central bank meetings ends with a relatively quiet Friday, with no central bank meetings and mostly second division data. The biggest impact of the week came from the SNB decision to cut the policy rate, becoming the first of the G10 central banks to start the easing cycle. The CHF unsurprisingly fell sharply on the news, although it wasn’t a complete surprise, being priced as a 38% chance before the meeting. However, in the longer run the CHF may not suffer from the easing cycle in Europe and the US, as the SNB is unlikely to ease as much as the Fed, BoE or ECB, simply because it is starting from a much lower base. Spreads are therefore likely to move in its favour when the easing cycle starts in earnest, suggesting fairly limited downside for the CHF, especially since the CHF hasn’t risen very much in real terms in recent years. Indeed, the real trade-weighted CHF is not far from the average seen since the sharp appreciation in 2015.

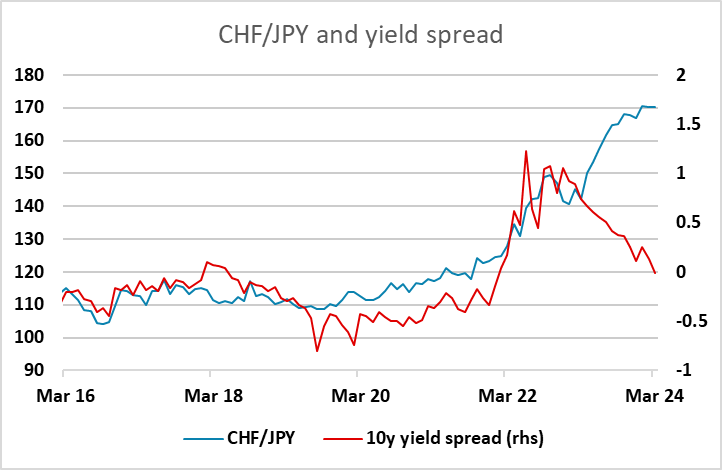

So there may not be a lot of followthrough strength in the CHF against the EUR from here, but there is still scope for the CHF to gain against the JPY. The JPY has been the weakest of the major currencies in recent years, and the weakness against the USD and many of the higher yielding currencies can be justified by the rise in nominal yield spreads. But this is no longer the case for CHF/JPY, with spreads close to being back to where they were before the 50% appreciation in the last 4 years. The real weakness of the JPY against the USD and EUR is partially disguised by the relatively high inflation in the US and Europe, but against the CHF the nominal move and the real move are similar. Unlike most of the other G10 currencies, the JPY will not be seeing an easing cycle in the next couple of years. In fact, the BoJ started the tightening cycle this week, and this should be a trigger for the start of a general JPY recovery.

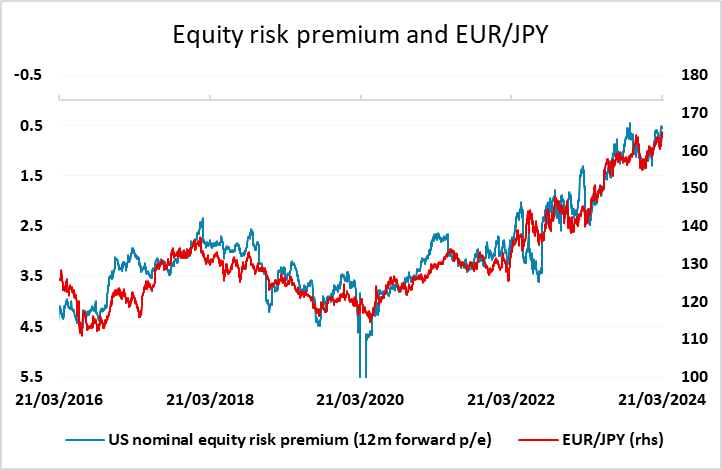

But while we have seen the JPY rise against the CHF in the last week, it has not risen against the USD or EUR. Indeed, EUR/JPY hit another 16 year high. This cannot be justified by the moves in yield spreads, which have been in the JPY’s favour. While some commentators are arguing that JPY weakness has been a result of the BoJ not indicating future tightening at the latest meeting, this argument doesn’t hold water when the rate hike itself was not generally expected and Japanese yields have not fallen over the week. Nor does the fact that yield spreads are still high mean the JPY should necessarily continue to weaken. If that were the case, the Argentinian peso would go up every year (rather than down). But unfavourable yield spreads are part of the reason for JPY weakness, as they encourage carry trades that tend to be favoured in risk positive markets. The JPY weakness against the EUR continues to be correlated with the declining US equity risk premium that has resulted from the strength of equities against the background of rising yields. This correlation has held well for some years, but we suspect it can’t last once the easing cycle in the US and Europe starts. For now, though, it may prevent the JPY benefiting from contracting yield spreads.

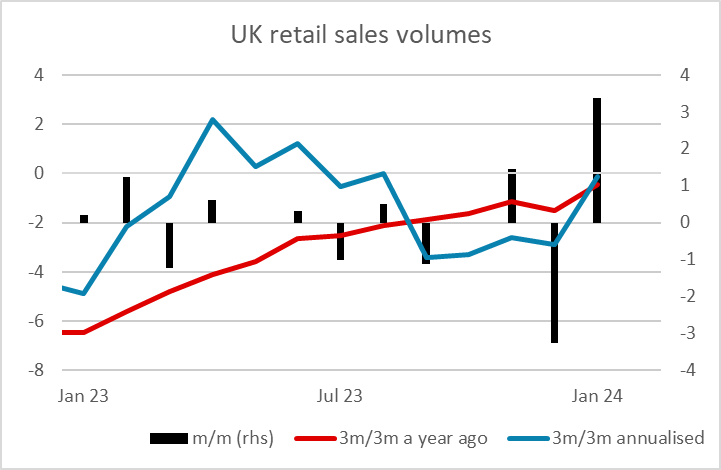

For Friday, the UK retail sales data and the German IFO survey are the main data, but seem unlikely to have much market impact. UK retail sales have been very volatile in the last couple of months, and the broadly flat outcome the market expects in February won’t provide much information about the underlying trend. The German IFO survey nowadays tends to be upstaged by the PMI survey that was released on Thursday, so is unlikely to trigger much reaction. But we do suspect there is some scope for the generally USD strength seen on Thursday to be reversed, given that the FOMC statement and dots were on the dovish side of consensus.