FX Daily Strategy: N America, July 9th

EUR strength hard to justify

EUR/JPY showing signs of a turn

GBP strength extends but upside limited

EUR strength hard to justify

EUR/JPY showing signs of a turn

GBP strength extends but upside limited

Tuesday should be a relatively quiet day in FX with very little of note on the calendar. The USD has shown a mildly softer tone since the employment report, and that may continue into the CPI data later this week. The EUR quickly got over the victory for the Left Alliance in the French election once it was clear that they would not have any real impact on policy, and EUR/USD has continued to edge higher. But we don’t see a lot of scope for further gains. While there is some belief that there is a recovery underway in the Eurozone, based on the pick-up we have seen in the PMIs, a lot of the data remains very weak, and it is notable that domestic demand growth is showing little sign of recovery, with most of the growth seen of late being due to weak imports. German production and orders data are at the lowest levels since 2012 (excluding the pandemic), so we see little reason for significant EUR optimism.

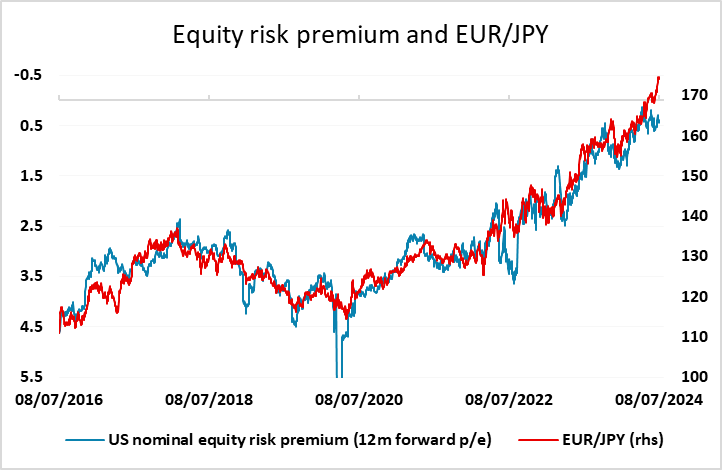

The most notable FX move on Monday was the rise in EUR/JPY to new 32 year highs, but this was reversed by the end of the session. While the weak Japanese cash earnings data on Monday didn’t provide much reason for optimism on the Japanese economy, or for any July tightening from the BoJ, the JPY is already at weak enough levels to justify a recovery if there is weakness elsewhere, particularly if there is some sign of rising risk premia. EUR/JPY gains were highly correlated with declining equity risk premia in recent years, but have continued in the last month even though risk premia have stabilised, and there may now be scope for some correction.

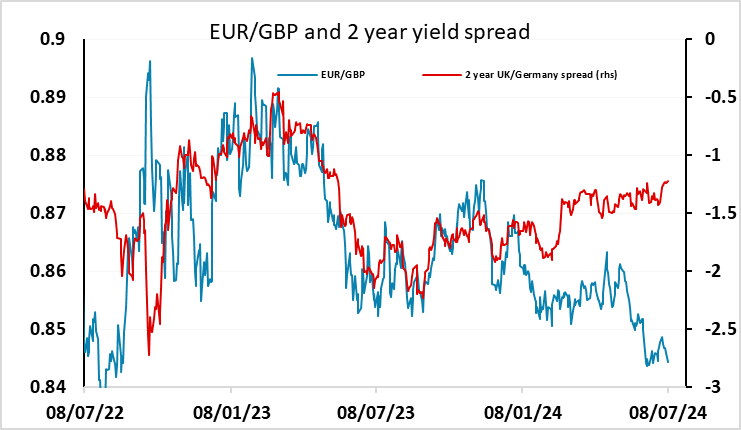

The EUR also fell back against GBP through Monday’s trading, and there is some optimism in the UK markets about the prospects for improved growth under the new Labour government. There were also some comments from BoE MPC member Haskel on Monday suggesting that more declines in inflation were needed to justify a rate cut. However, he is established as being on the hawkish side of the argument, so a UK August rate cut remains possible. EUR/GBP still looks a little stretched approaching the lows of the year neat 0.84 in the absence of clearer evidence of BoE hawkishness, dovishness form the ECB, or relatively stronger UK data.