FX Daily Strategy: N America, April 9th

Imposition of reciprocal tariffs could trigger renewed equity market dip

JPY still good value, even if risk appetite stabilises

European currencies vulnerable on renewed risk decline

Imposition of reciprocal tariffs could trigger renewed equity market dip

JPY still good value, even if risk appetite stabilises

European currencies vulnerable on renewed risk decline

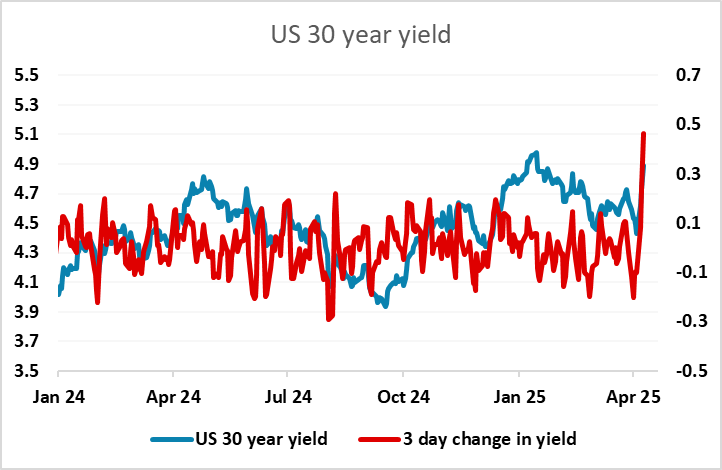

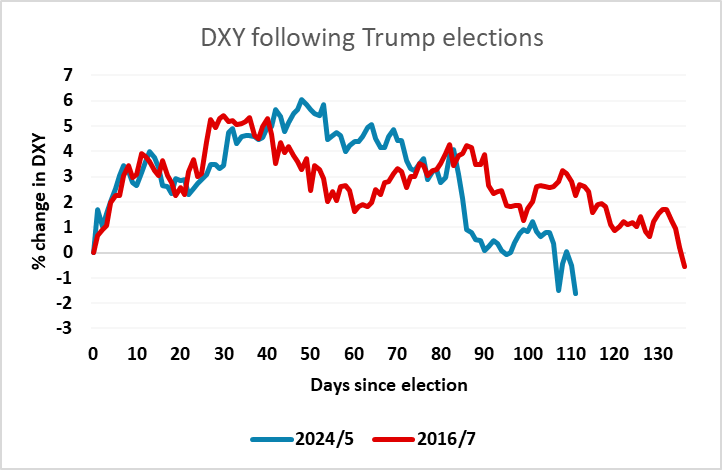

The reciprocal tariffs came into operation at 04:00 GMT, and the US also confirmed tariffs on China were rising to 104%. The USD has weakened in response, and at the same time, we have seen a cratering in the US bond market. While we have no direct knowledge of the flow, it is certainly easy to speculate that the simultaneous USD decline and sharp rise in US yields represents some central bank and/or sovereign wealth fund selling of US treasuries, with China a major suspect. Of course, the rise in US yields could also reflect a change of market view of US policy, with the higher inflation that is likely to result from the tariffs leading to tighter policy, but the fact that the US curve has steepened significantly at the same time suggests there is more going on.

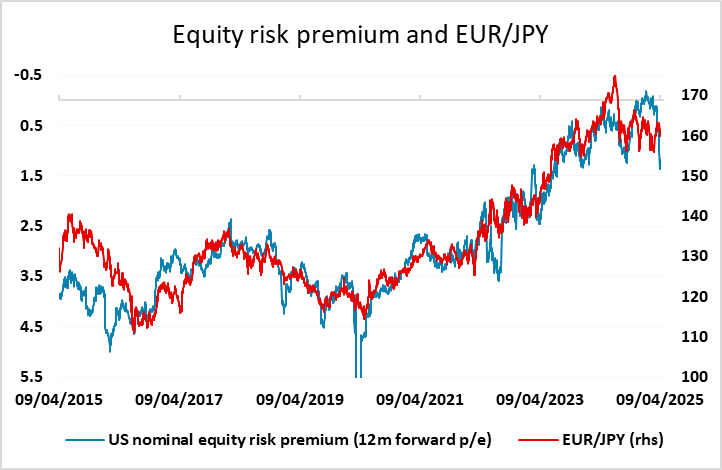

The rise in US 30 year yields in the last 3 days is one of the largest in history – the largest since 1987 as far as we can tell – and creates a danger of further sharp equity market declines. Equities are generally lower, but at the moment Europe is leading the way. Normally this might suggest weakness for European currencies this morning, but the USD is under general pressure, so if there is weakness it is only likely to be seen against the safe havens. We may well see some violent moves in bonds and equities from here. Unless there is some change in tariff policy, it’s hard to see any improvement in equities, while bond markets look extremely uncertain. For FX this suggests safe havens will remain in favour. The CHF and the JPY were the best performers overnight, and should continue to be the go to currencies. Otherwise, moves could be driven by positioning more than anything.

Even if markets remain sanguine about tariffs coming into effect, perhaps in the belief that there will be a reduction in the future, the JPY still looks good value at current levels. But if we see a stabilisation in risk sentiment it would also favour the riskier currencies against the USD.