FX Daily Strategy: N America, December 12th

ECB likely to cut 25bps, mild EUR upside risks

SNB cut 50bps, suggesting CHF to decline, but maybe only short term

AUD recovers on strong employment report

ECB likely to cut 25bps, mild EUR upside risks

SNB cut 50bps, suggesting CHF to decline, but maybe only short term

AUD recovers on strong employment report

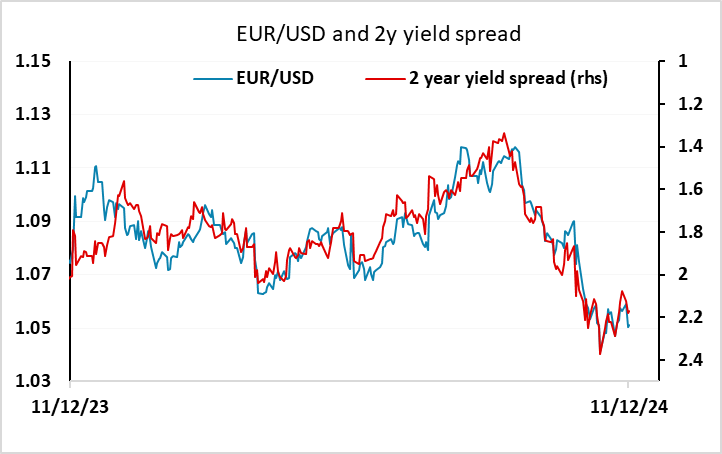

The highlights of a busy Thursday are the SNB and ECB meetings. The market is pricing a 25bp ECB cut as an 85% chance with a 50bp cut just a 15% chance, so there is only modest scope for EUR gains if the ECB act as expected. But if they only cut 25bps but sound more dovish than expected, the EUR could still decline, although the starting point for EUR/USD looks slightly low relative to 2 year yields spreads, so risks are modestly on the upside. This meeting may be as important for what may be a change in forward guidance in which the ECB accepts that on-target inflation is likely to be durable enough to end policy restriction in due course. In this regard, the first glimpse of 2027 economic projections may support this as they may point to a second successive year of around-target inflation. But with the growth outlook for 2025 also likely to be pared back, we think this transition will involve four 25 bp cuts in H1 next year, with an ensuing around-neutral 2% policy rate. However, the current market pricing already has a policy rate of 1.8% by June, so there doesn’t look to be much downside risks to rates or the EUR.

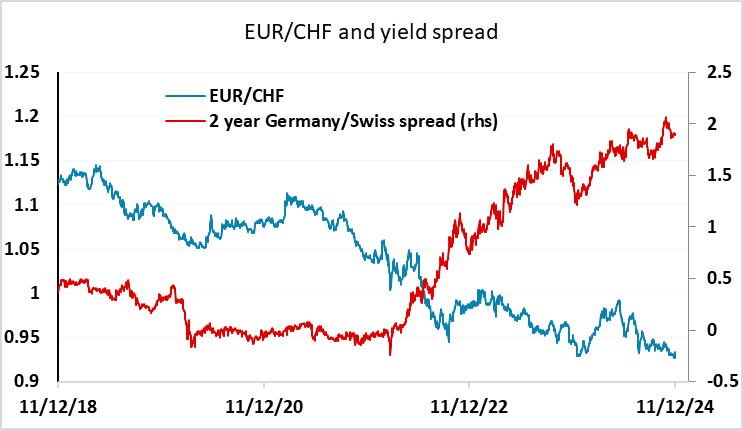

The SNB cut rates by 50bps, more than expected by most forecasters (85% expected a 25bp cut) but the market had priced a 50bp cut as the most likely outcome ahead of the meeting (65% probability). EUR/CHF has jumped half a figure in response. The SNB also said they are prepared to intervene in the FX market as necessary, and implied further rate cuts are on the way by lowering their inflation forecast for 2025 to 0.3% from 0.6%. Although the 2026 forecast was raised marginally to 0.8% from 0.7%, this is still below target.

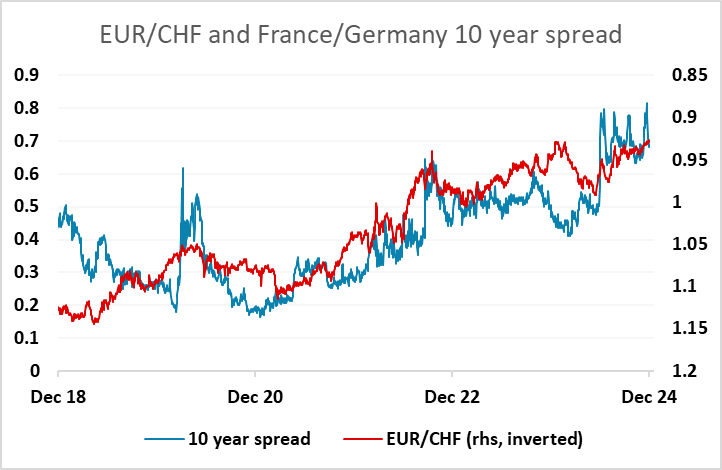

The CHF decline may extend a little today, but the problem for the SNB is that EUR/CHF has very limited responsiveness to interest rate spreads, and rather tends to be driven by geopolitical factors, and particularly by perceptions of the stability of the Eurozone. Intra-Eurozone spreads continue to be significantly correlated with EUR/CHF, and until or unless we see some narrowing in the France-Germany spread, which has widened out significantly in recent months, it will be hard for EUR/CHF to extend gains back to 0.95 and beyond. But the strength of the CHF in real terms is an issue for the SNB, and they will likely oppose any further strength with intervention.

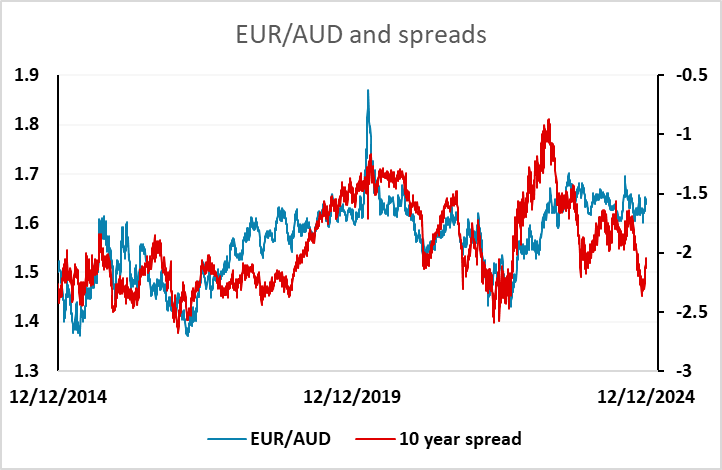

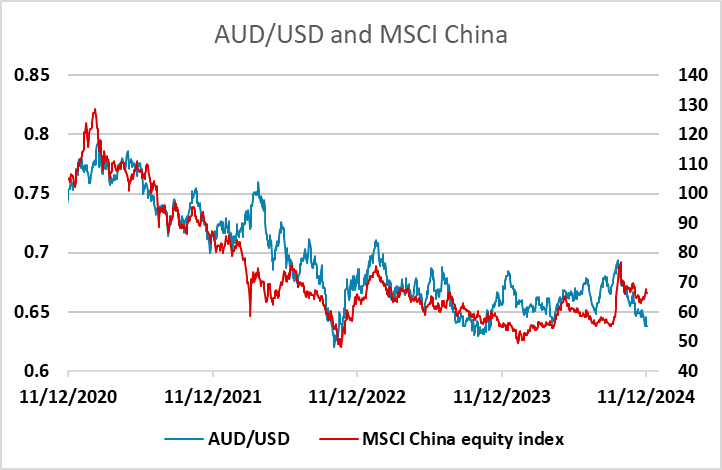

AUD strength was the main feature overnight, with the AUD rising sharply on the back of a much stronger than expected employment report. A larger than expected rise of 36k in employment was stronger than it looked because there was a 53k rise in full time employment, while the unemployment rate fell sharply to 3.9% from 4.2%. AUD yields rose strongly on the news, and the AUD gained more than 1% after hitting new lows for the year on Wednesday.

We continue to see much more substantial upside scope for the AUD, as it has underperformed the usual yield spread relationships this year, and has also lagged behind the usual correlation with equity market performance, both globally and locally.