USD, CAD, JPY flows: Jobs data net strong

The January payroll number was a little lower than expected, but otherwise the US report was generally strong. The Canadian data was also stronger than expected

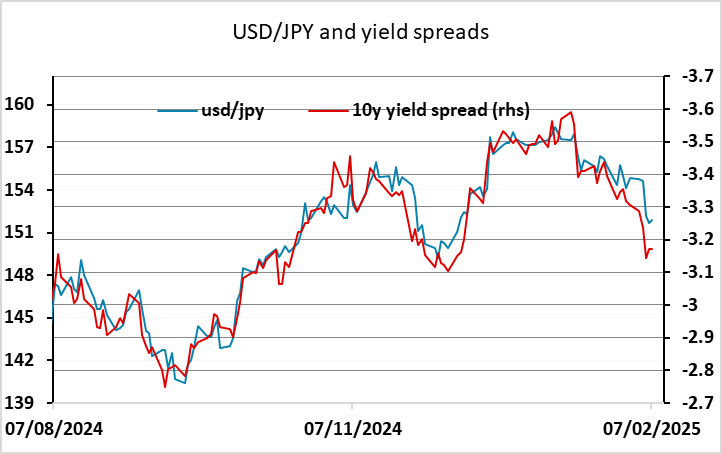

While non-farm payrolls were a little lower than expected, this may well have been due to bad weather, and other aspects of the report were strong, notably upward revisions to November and December, and hourly earnings at 0.5% and the unemployment rate at 4.0%. However, a lower workweek may have inflated hourly earnings, so all in all we wouldn’t see the data as notably different from trend, although for choice we would see it as slightly on the strong side. This has been the initial market reaction with short term US yields and the USD now a little higher after an initial brief blip lower on the lower payroll number, but the move is small and we wouldn’t expect any major action. We still see the JPY as attractive as yield spreads point to a lower USD/JPY, but we wouldn’t expect much traction today after this slightly strong report.

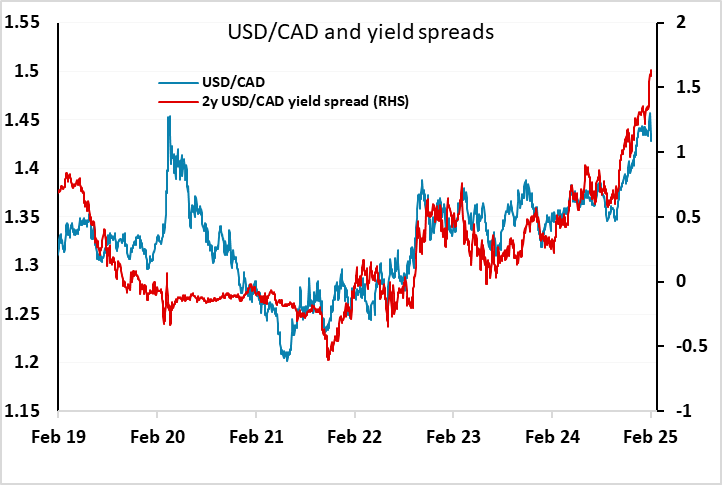

The Canadian employment report was more clearly on the strong side of consensus, with a 76k gains in employment and a drop in the unemployment rate to 6.6%. This has been enough to pull USD/CAD lower, but a strong number was likely needed to prevent CAD losses, as USD/CAD is still trading low relative to the yield spread correlation. We doubt there will be much progress sub-1.43.