FX Daily Strategy: APAC, March 21st

Some downside risks for GBP as hawks are expected to turn neutral

Significant risk that the SNB decide to cut rates so main CHF risks to the downside

Norges Bank may avoid sounding too dovish in order to support the NOK

Some downside risks for GBP as hawks are expected to turn neutral

Significant risk that the SNB decide to cut rates so main CHF risks to the downside

Norges Bank may avoid sounding too dovish in order to support the NOK

We have the last three central bank meetings of the week on Thursday with the BoE, SNB and Norges Bank. None are expected to produce a change in policy, but as we have seen with the BoJ, the policy decision may be less relevant that the future guidance. (Actually, we don’t believe that the JPY weakness since the BoJ meeting has much to do with the BoJ decision or guidance, but the point nevertheless stands).

UK CPI Headline and Core Inflation Drop Resume in February

Source: ONS, Continuum Economics

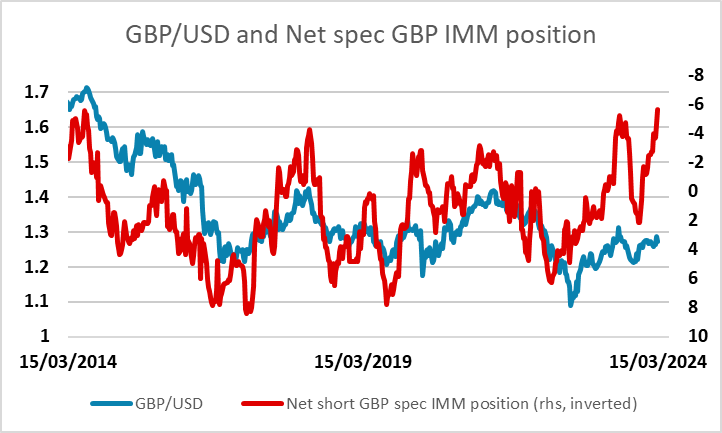

It would be a shock if the BoE was to vote to do anything but keep policy on hold. More likely than not there will be no further dissents in favour of a further hike, merely one again calling for a cut. This is both our view and the market consensus. In the wake of the slightly softer February CPI data, the implicit easing hints offered back at the February decision may be repeated, paving the way for a (25 bp) start to rate cutting at either the May 9 or Jun 20 meetings, especially as headline CPI may be below target by the latter date. This should pave the way for around 100 bp of cuts this year and almost as much in 2025! Given that the market currently only prices around a 10% chance of a May cut and a 65% chance of a cut in June, this suggests some downside risks for GBP. These risks look all the more significant given the current net speculative long in GBP/USD reported in the CFTC data.

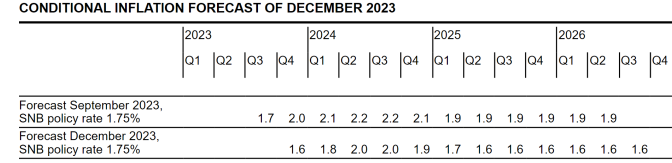

Before the BoE meeting we have the SNB and Norges Bank. The SNB is the one with the most genuine chance of delivering a rate cut today. This is priced at around a 38% chance (of a 25bp cut), with 30bps of cuts priced in by June. The market is slightly aggressively priced relative to the consensus, with 22% of forecasters looking for a cut. This all suggests there is some small upside risk for the CHF in the event of no change in policy, and the gains could be larger if the SNB leave the impression that they might not cut in June. But this looks very unlikely given the softness of inflation since the last SNB meeting. Indeed, the fact that inflation has undershot projections, and was already projected to be well below target by next year based on unchanged rates at the time of the December meeting, means a rate cut this time around is very possible. EUR/CHF therefore should have quite limited downside and substantial potential upside.

SNB CPI Inflation Projections Clearly Below Target

Source: SNB

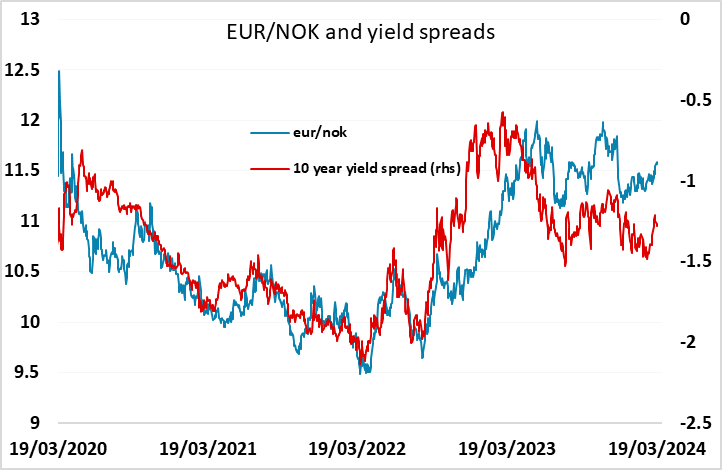

All 32 of the surveyed forecasters expect Norges Bank to leave rates on hold for a second successive meeting. They may even retain the thinking first aired at the December meeting, namely the ‘policy to stay on hold for some time ahead’ rhetoric. However, the updated Monetary Policy Report (MPR), which will incorporate a much lower than expected underlying inflation backdrop, alongside less weak activity, may leave more scope for a cut in rates in Q2, rather than in the autumn as existing Norges Board projections suggest. Given the weakness of the NOK, the Bank may feel it can/should defer rate cuts into H2, or at least suggest as much to the market, so their statement may be geared to producing a stronger NOK. This may not be 100% successful, but we would slightly favour the NOK upside.