Preview: Due January 21 - Canada December CPI - To fall on GST tax holiday

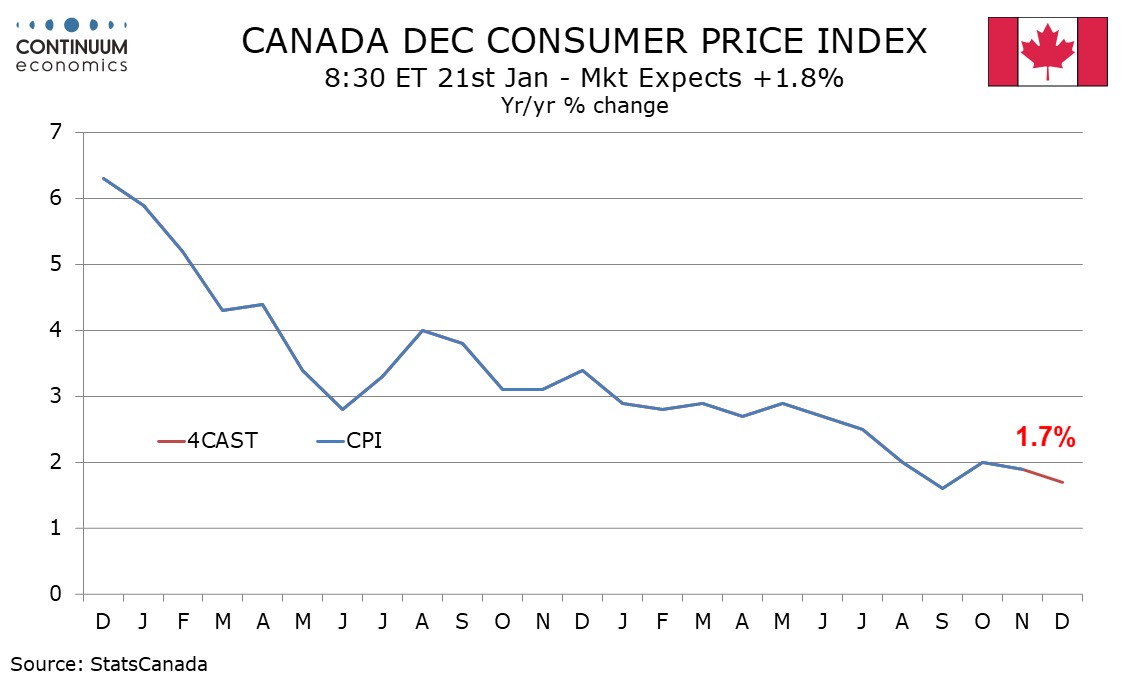

We expect Canadian CPI to slip to 1.7% yr/yr from 1.9%, the fall largely due to a temporary supse4cuion of the Goods and Services Tax that will run from Mid-December through Mid-February. Bank of Canada Governor Tiff Macklem has stated that the tax suspension is expected to move inflation down to a low of around 1.5% in January.

The full impact of the tax suspension will be felt in January with December and February data seeing around half of the impact. The BoC will look through these temporary effects. Generally inflationary pressures are subdued but with the economy showing tentative signs of responding to BoC easing and the CAD weak we doubt that the underlying picture will see any further softening in December.

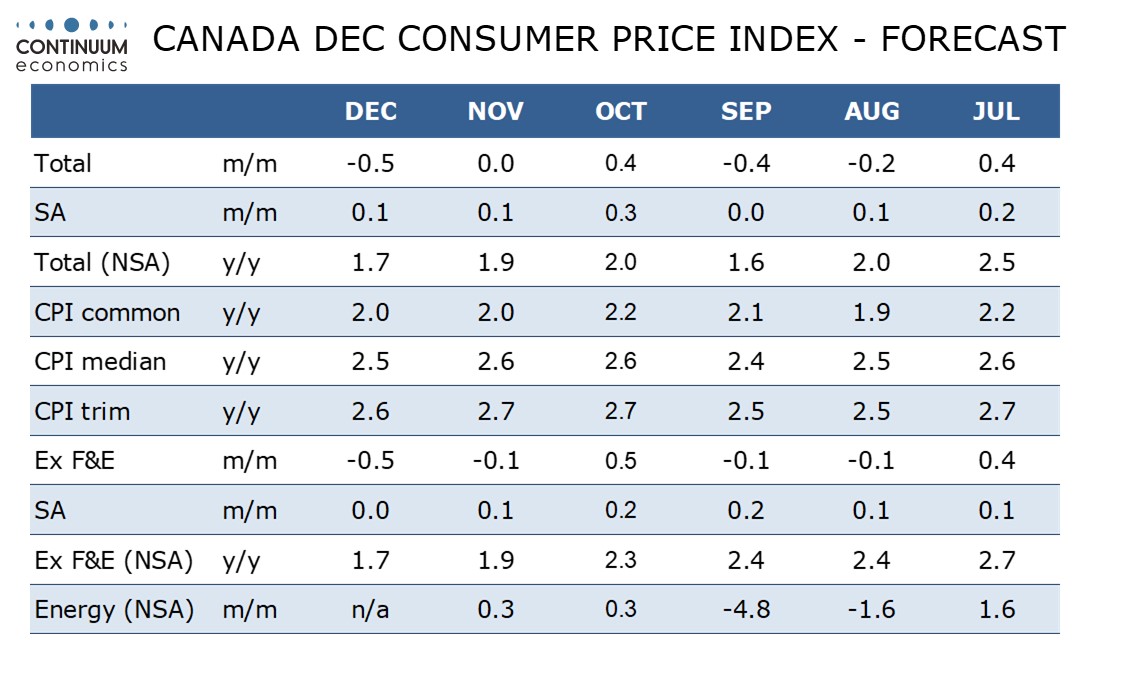

On the month we expect seasonally adjusted data to show a rise of 0.1% overall with the ex food and energy rate unchanged. Unadjusted the data is likely to show seasonal weakness, with both overall and ex food and energy CPI falling by 0.5% on the month.

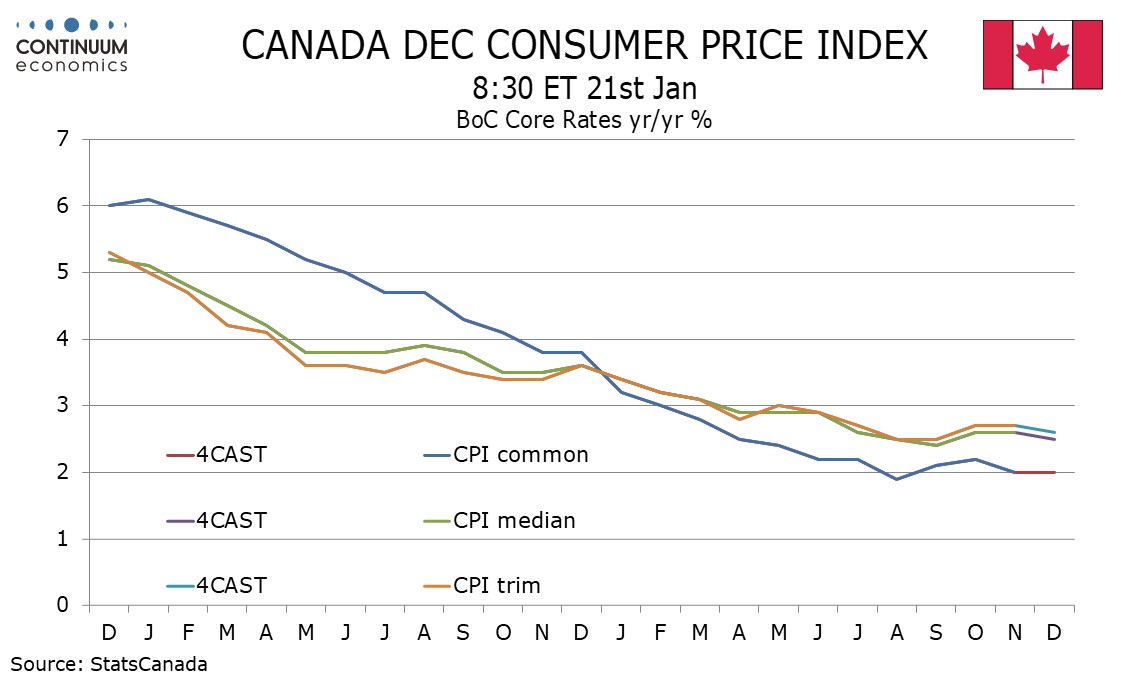

The ex food and energy rate is not one of the BoC’s core rates, which will be less impacted by the tax suspension, though we expect slippage in CPI-Median to 2.5% after two straight months at 2.6% and CPI-Trim to 2.6% after two straight months at 2.7%. We expect CPI-Common to be unchanged at 2.0%, all measured on a yr/yr basis.