USD, JPY flows: USD lower after PPI, claims

USD diops after weaker than xpected PPI and higher jobless claims, but scope for bigger decline

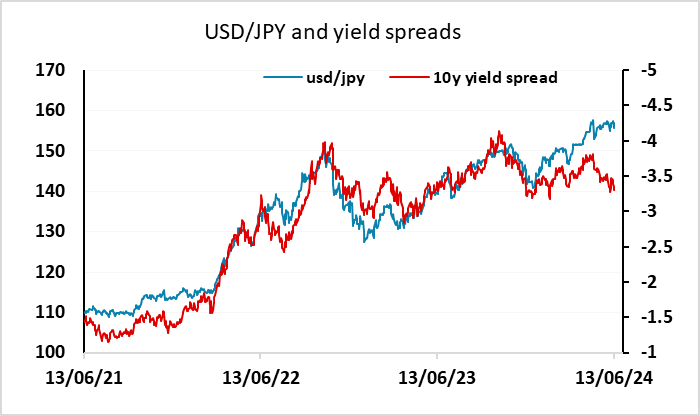

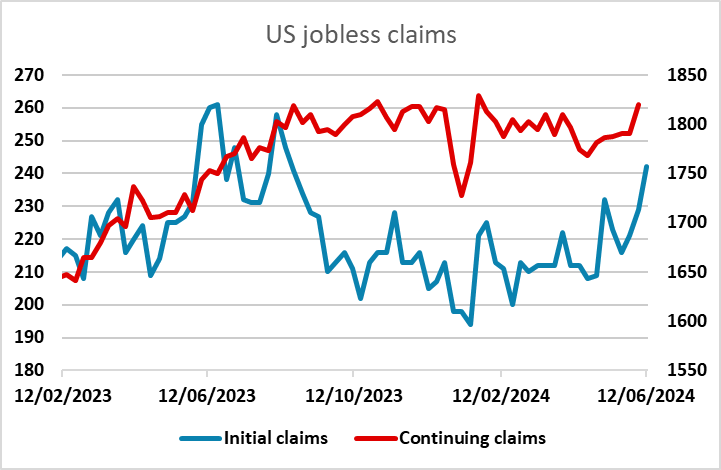

Softer than expected US PPI and higher than expected jobless claims both argue for a weaker USD, but the reaction has thus far been modest, with EUR/USD gaining around 10 pips and USD/JPY losing around 20 pips. Of course, the market isn’t going to adjust the Fed view too much so soon after yesterday’s FOMC. But US yields are significantly lower and there ought to be scope for a meaningful move in USD/JPY in particular, given that it has lagged behind other currencies against the USD in the last 24 hours, and 10y yield spreads are testing yesterday’s post-CPI lows – the lowest since February when USD/JPY was trading sub 150. The market may be wary of tomorrow’s BoJ meeting, but we suspect the risks there are that the BoJ do more rather than less than expected as well.