FX Daily Strategy: N America, February 27th

Japan National CPI Beats Estimate

JPY to stay weak on the crosses, but downside limited

EUR steady after confidence and money data

US data unlikely to have much impact

Japan National CPI Beats Estimate

JPY to stay weak on the crosses, but downside limited

EUR steady after confidence and money data

US data unlikely to have much impact

There isn’t a great deal of data on the calendar for Tuesday, but the initial market focus was the Japanese national CPI data. The core CPI (ex-fresh food) was expected to fall from 2.3% to 1.8%, after the Tokyo CPI numbers already released showed a fall in the core from 2.1% to 1.6%. However, the national CPI beat estimate. All three items stayed above 2% BoJ target. Headline y/y CPI came in at 2.2% from 2.6% in December , ex fresh food 2.0% from 2.3% and ex fresh food & energy at 3.5% from 3.7%. The Japan inflation picture continue to moderate and move closer to BoJ target. However, ex fresh food and energy CPI remains a tough nut to crack and may be on BoJ's mind for a while. Still, all eyes are on March wage negotiation as the result will have a higher impact than CPI currently.

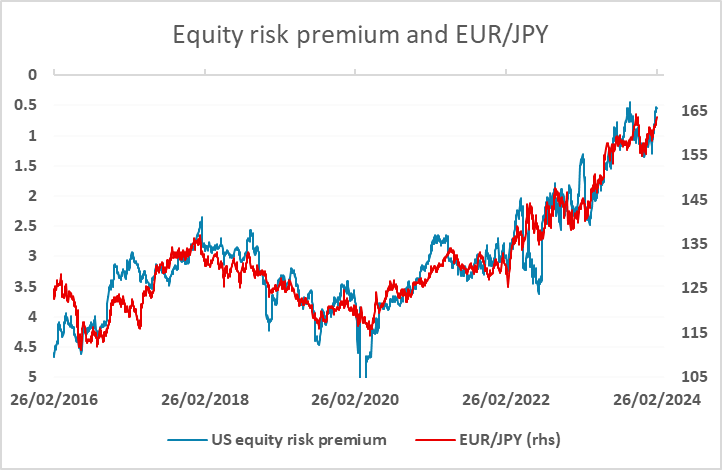

JPY weakness continued to be the theme on Monday, primarily against the European currencies, with GBP/JPY hitting a new post-2015 high and EUR/JPY hitting a new post-November high, the November high having been the highest seen since 2008. Of course, in real terms both pairs are even higher, with EUR/JPY at all time highs. The strogner Japanese CPI has, for the moment, halted the JPY decline, with the November EUR/JPY high of 164.30 still out of reach. But the driving force behind JPY weakness remains strong risk appetite, characterised by declining risk premia. JPY crosses continue to move in line with declining US equity risk premia, so unless we see equity weakness or a decline in yields that is not followed by equity gains, it will be hard for the JPY to recover. Even so, the levels here are very stretched form a valuation perspective, and Japanese inflation is expected to decline sharply, so even if EUR/JPY does trade to new post-2008 highs, we would expect the new highs to be marginal.

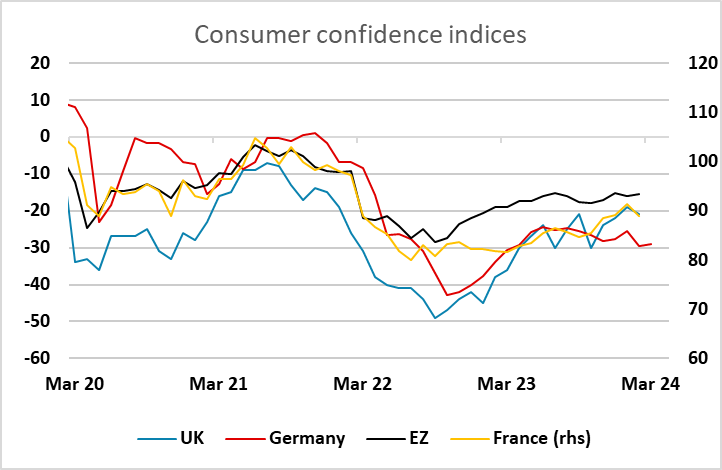

In Europe, we had consumer confidence data from France and Germany and Eurozone January money data. The German confidence data was nominally for March, while the French data was for February, but they likely reflect the same survey period. We have seen some recovery in French (and UK) confidence data in recent months, but the German data has been going in the other direction. The French data slipped back a little, and the German data held steady at low levels. Initial EUR strength faded after the French data, and the EUR slipped back to opening levels after the money data came in slightly on the soft side of expectations. But none of this is game changing for the ECB, and the inflation data later in the week remains the main focus.

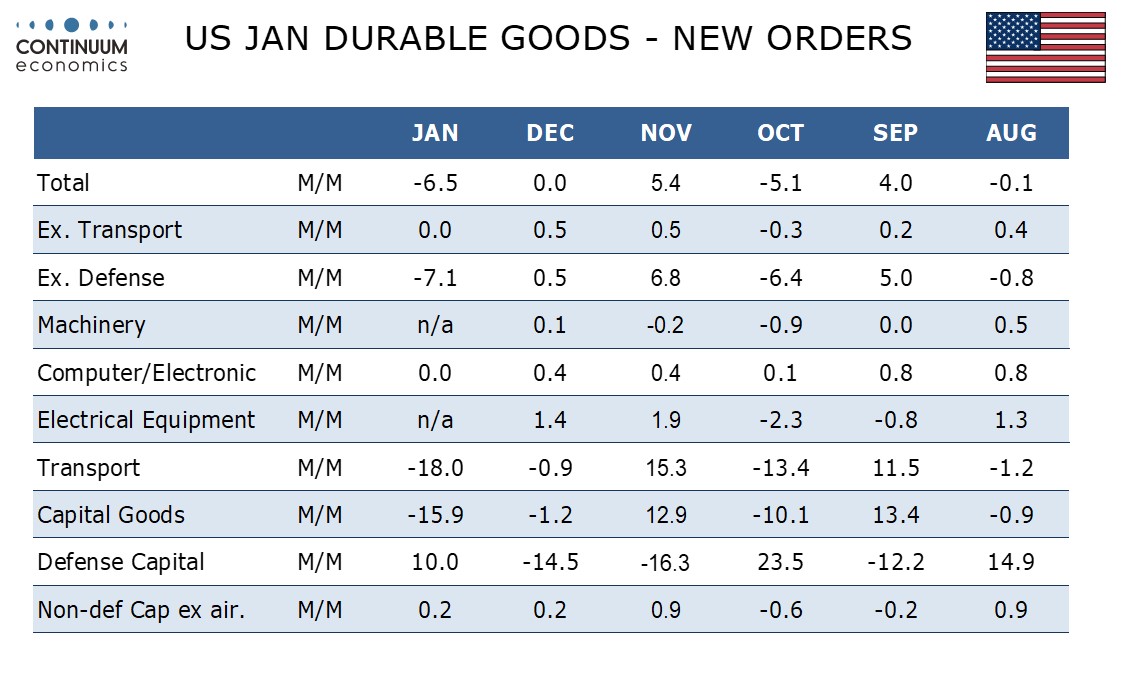

The second division US data on Tuesday also looks unlikely to significantly change market sentiment. While we expect January durable goods orders to see a plunge of 6.5%, this is largely due to aircraft slipping sharply from two straight strong months. Ex-transport we expect an unchanged outcome in a pause after two straight gains of 0.5%. These forecasts are broadly in line with market consensus, and we doubt the Conference Board consumer confidence index or the Richmond and Dallas Fed surveys will have a significant impact either. The market is now sensibly priced for three Fed cuts this year, with a slight risk of four, and we are unlikely to see this view change much ahead of the inflation data later in the week. The USD should consequently remain broadly range bound, with equity market sentiment probably the main cause of intraday movement.