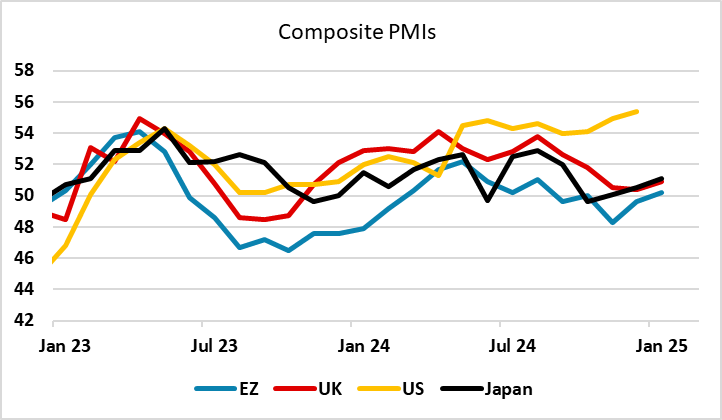

EUR, GBP flows: GBP rallies on PMIs, general risk positive tone

GBP recovers as UK PMIs match EUR rise. Global risk positive tone persists helped by PMIs and Trump's less pro-tariff comments overnight

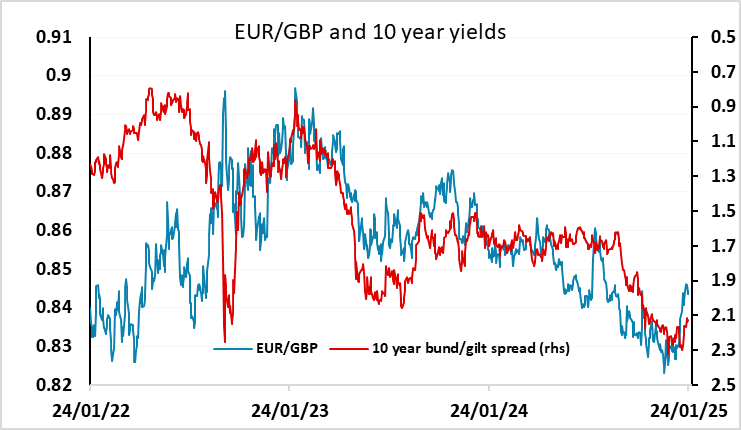

UK PMIs show similar strength to the Eurozone PMIs, but we are more wary of the UK data as the correlation with GDP data has been much weaker. Nevertheless, the market has taken the data at face value, and GBP has recovered slightly in response, and is back below the 0.8450 level. The stronger PMI data has helped a general risk positive tone that has meant European yields have edged a bit higher while equities are also continuing to make gains. This has put the JPY and CHF on the back foot, with EUR/CHF, like EUR/USD, reaching its highest since September, and USD/JPY reversing the decline seen earlier in the morning. While there is value in European equities if we see positive growth momentum developing, we would still be wary of the risk positive market tone inasmuch as it is based on a more positive view of Trump tariff policies, as we are likely to see plenty of volatility in Trump’s statements in the coming weeks. We also remain concerned that US equity valuation remains extremely high, limiting upside for global equities. But for now the USD looks likely to remain under pressure against the riskier currencies, at least until or unless Trump makes a statement favouring tariffs.