FX Daily Strategy: APAC, Sep 16th

US retail sales unlikely to move market

BoC set to cut even without CPI decline

GBP risks on the downside from labour market data

US retail sales unlikely to move market

BoC set to cut even without CPI decline

GBP risks on the downside from labour market data

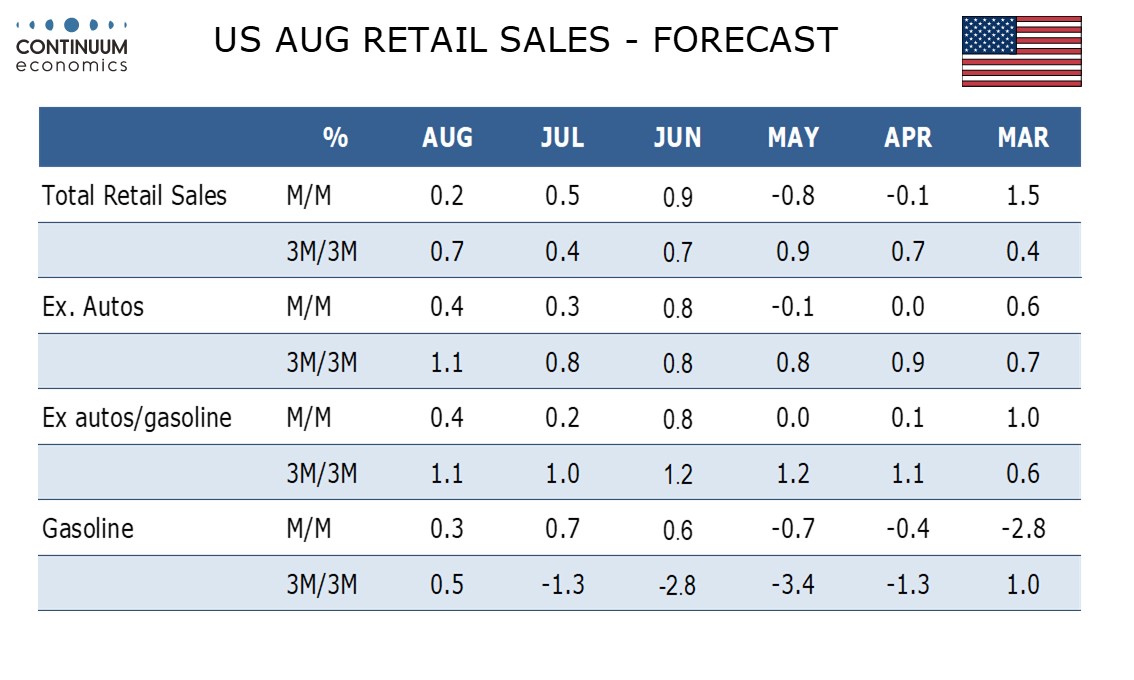

Tuesday sees US retail sales, UK labour market data and Canadian CPI. The US data is unlikely to change the market expectation of a 25bp cut from the Fed this week, but could affect expectations of future actions. We expect a modest 0.2% increase in August retail sales restrained by a correction lower in auto sales. However we expect the core rates ex autos and ex autos and gasoline to maintain trend with gains of 0.4%. Our forecasts are in line with consensus, so shouldn’t have a significant market impact. The underlying trend has been fairly steady, and is unlikely to change significantly even if we see a fairly large miss, so any reaction is likely to be knee jerk and shouldn’t be sustained.

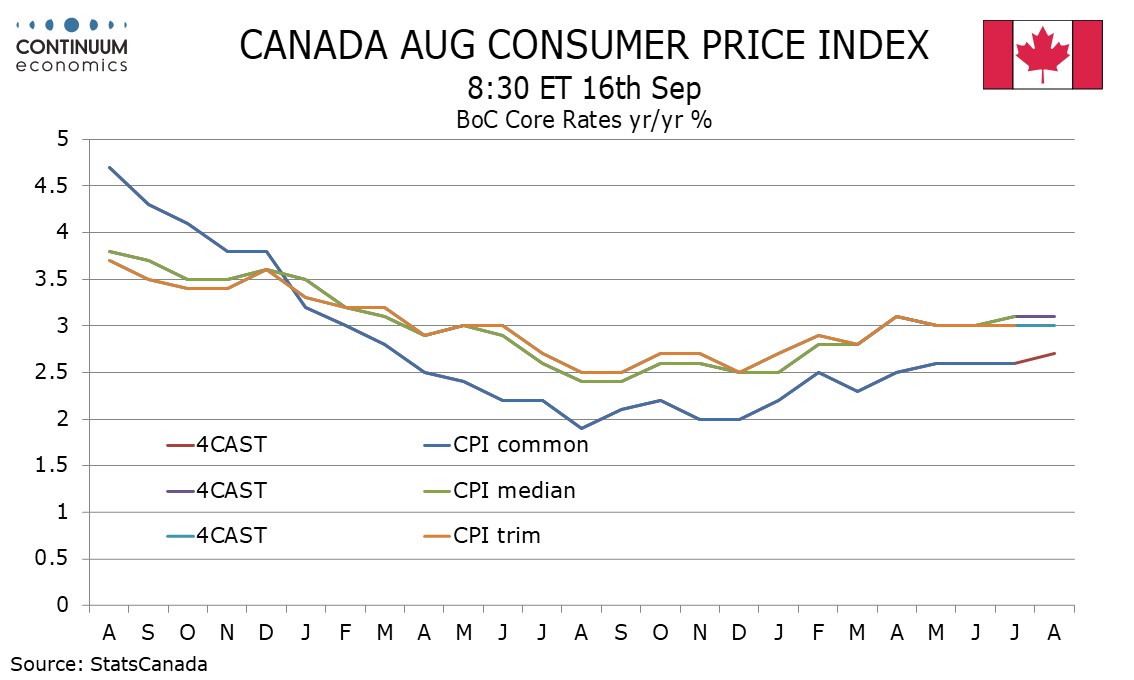

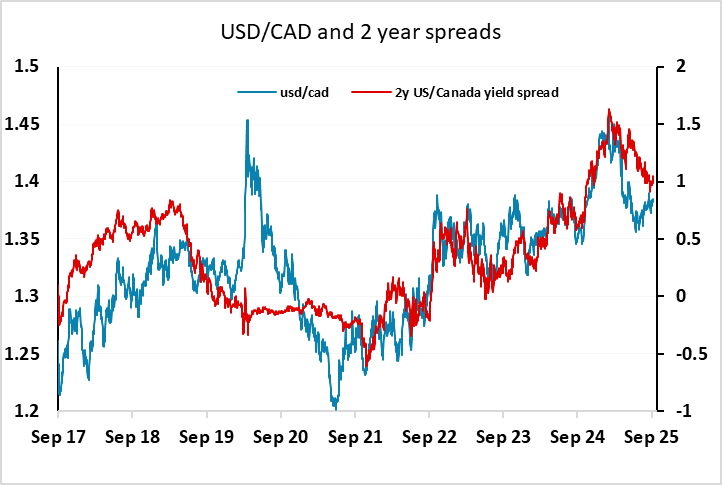

Canadian CPI is potentially significant, although after the latest weak employment data the market has now fully priced in a BoC rate cut. Weakness a year ago is likely to see August Canadian CPI picking up on a yr/yr basis, we expect to 2.0% from 1.7%. The Bank of Canada’s core rates are likely to remain fairly stable, and above the 2.0% target, but won’t prevent the BoC from responding to labour market weakness. USD/CAD continues to have potential to move higher if the USD shows any general recovery, but the CAD should in any case be soft on the crosses with the Canadian economy underperforming.

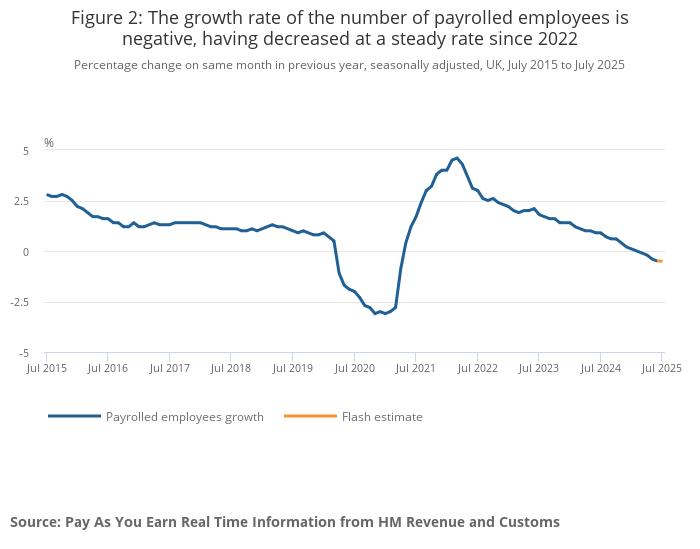

UK labour market data is always important for the BoE. As usual both the ONS data and the more up to date HMRC data will be of interest. The HMRC data are showing a much clearer weakness in employment than is evident from the ONS data, and are now being emphasised as the more significant numbers by the ONS themselves. Further evidence of weakness in employment, especially if accompanied by any weakening in earnings growth, would potentially increase market expectations of BoE easing over the coming year. As it stands, this is still very modest, with another cut in rates not fully priced until next April, so we see most of the risk to GBP as being on the downside.