USD flows: USD lower on Greenland

Greenland furore underminign equities and weakening the USD. EUR and CHF best performers so far but JPY preferred

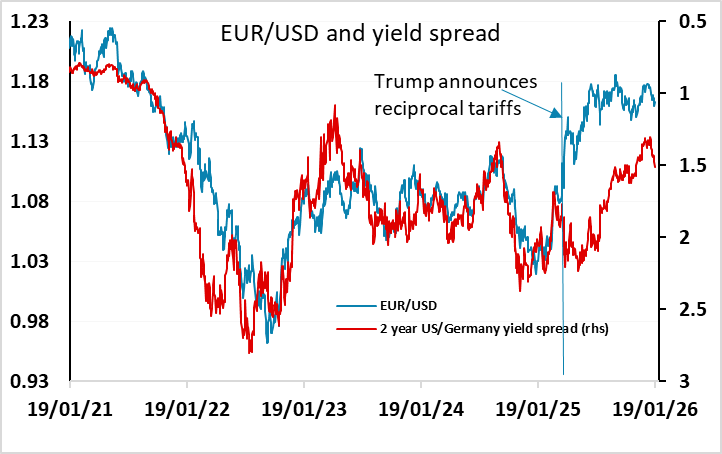

The US is on holiday for Martin Luther King day, but this is unlikely to prevent volatility as the row over Greenland continues to develop. The threat of tariffs on Europe has triggered a decline in equities across the board, but has thus far had only modest impact on currencies, with the USD generally a little lower. While the initial move lower was seen mostly against the JPY, the EUR has subsequently risen and is now, along with the CHF, the best performer since the Asian open. The EUR was the biggest beneficiary of the Trump announcement of reciprocal tariffs in April last year, so the market may be repeating that reaction.

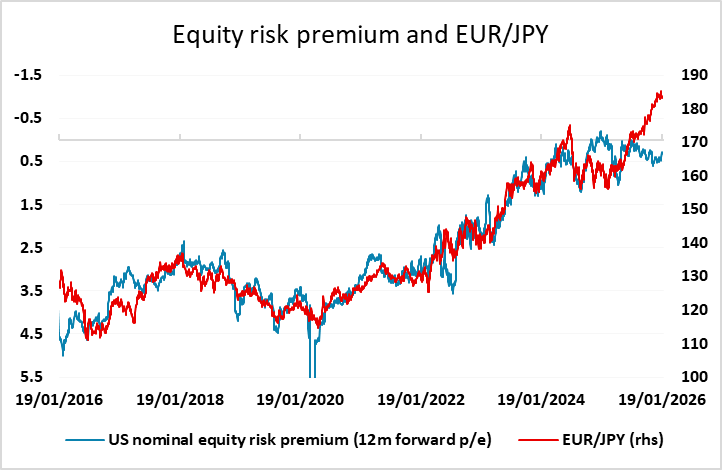

However, things may be a little different this time. Firstly, the tariff threat is now focused specifically on Europe. Second, the EUR only really started to benefit on the crosses last year when equities recovered, and at current levels there may be less scope for that. Also EUR/JPY is now trading at extreme levels close to all time highs. We would tend to favour the JPY more this time around.

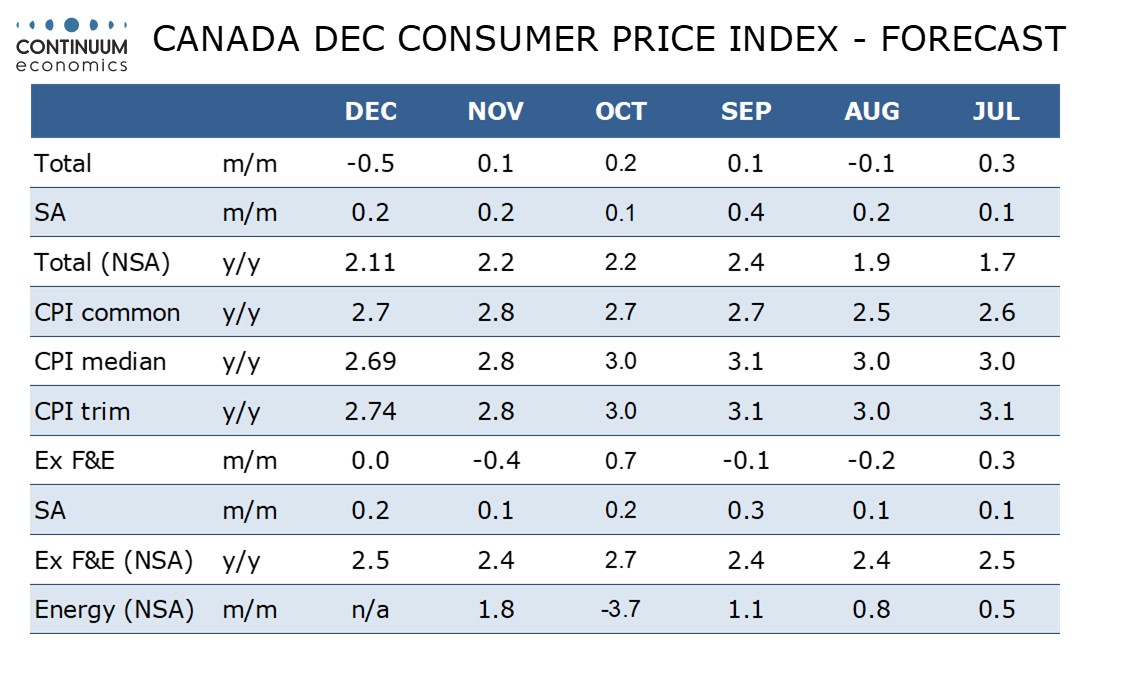

The developments on Greenland are likely to dominate, but there is Canadian CPI later on the data front. This probably won’t have too much impact, with the y/y rate expected to remain unchanged, although we see some downside risks. Canada is aligning with the EU over Greenland, and may come into the line of fire from Trump. As the country with the clearest geographical claim to Greenland, their position may be important.