FX Weekly Strategy: Asia, February 19th-23rd

EUR/USD rangebound but risks on the downside

Scope for US yields to rise further…

…and for equities to start to suffer from the less dovish policy outlook

JPY to stay weak until equities turn

Strategy for the week ahead

EUR/USD rangebound but risks on the downside

Scope for US yields to rise further…

…and for equities to start to suffer from the less dovish policy outlook

JPY to stay weak until equities turn

It’s a relatively quiet week for data, so the market is likely to focus on the impact of the data we had last week and any central bank reaction to it. The US inflation numbers were certainly on the strong side of expectations, and this has lopped 25bps off the expected Fed rate cuts this year in the last week. The impact on yield spreads with European currencies has, however, been modest, as European yields have come close to matching the rise in US yields. While there has been some negative impact from higher yields on equities, and this has had some periodic negative impact on the EUR and the riskier currencies, equities finished the week little changed, so for now EUR/USD is also little changed in the 1.07-1.08 range that has persisted since the employment report.

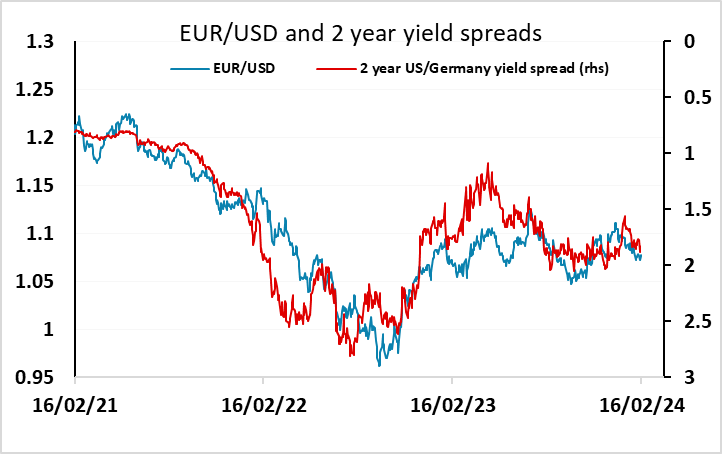

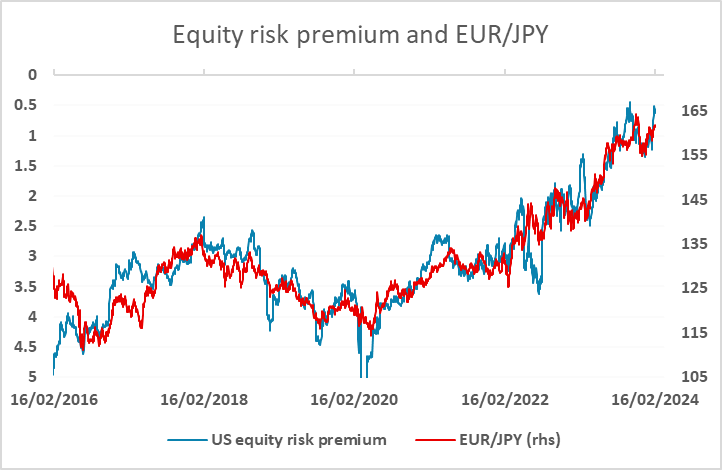

However, we do see the risks for EUR/USD as being to the downside of this range. Firstly, the rise in EUR yields that has accompanied the rise in US yields is clearly less justified by the European data, and may be reversed. Secondly, there is still scope for a further rise in US yields. The market has repriced the curve to price in a little more than three 25bp rate cuts this year from the Fed. But the Fed dots at the December meeting indicated three cuts was the median view. So if the inflation data is turning out to be stronger and more persistent than expected, there is scope for US yields to rise further. Thirdly, we are concerned that the equity market may have more downside, as the new highs we are seeing on the S&P 500 imply new lows in equity risk premia - below the levels seen in 2007 before the GFC. This is hard to justify with the US economy close to full employment – there is simply little scope for above trend growth. There is therefore a risk of a major correction lower in equities which could be expected to undermine all the riskier currencies if it happened.

For the EUR, the PMIs will be a focus this week and may be a factor that creates a disconnect between European and US yields, if the data continues to indicate relative weakness in the Eurozone economy. While the PMIs have been a poor indicator of UK growth, with strong UK numbers in recent months failing to pick up the 0.3% decline in GDP seen in Q4, they have been a reasonable guide to the Eurozone. Any weakness in these numbers could trigger a decline in EUR yields and a beak below 1.07 in EUR/USD. The reis also an account of the latest ECB council meeting that could have a negative EUR impact if it suggests that a more dovish stance is on its way.

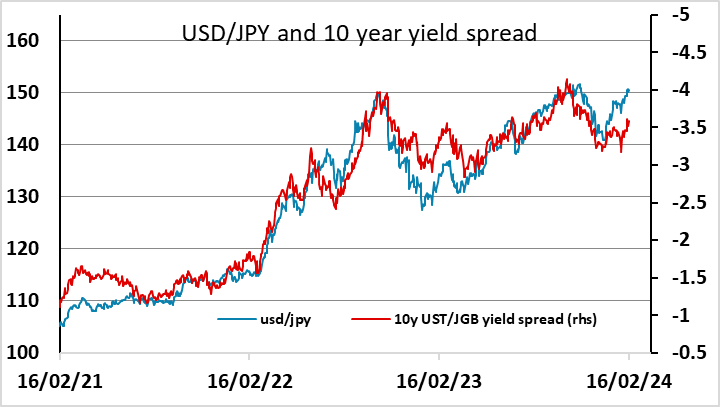

The risk of lower equities is a factor that should be a concern for those following the downtrend in the JPY. This downtrend has been highly correlated in recent years with the widening nominal yield spread with the USD, but this year’s move above 150 has run ahead of the move in yield spreads. The current JPY weakness appears to be being driven by the strength of equities, with their resilience to the rise in yields implying a decline in the equity risk premium. JPY crosses have been highly correlated with equity risk premia in recent years, and until we see a turn higher in risk premia, it is unlikely that we will see a JPY recovery on the crosses. For this to happen we either need to see equities start to suffer or US yields to fall. For the moment, the momentum behind the equity market is hard to oppose. Fed speakers this week will be important to indicate whether there is any concern at the latest data.

Data and event for the week ahead

USA

It is a quiet week for US data and Monday sees a holiday for Presidents Day. Tuesday’s sees January leading indicators. The most significant event of the week may be Wednesday’s minutes from the January 31 FOMC meeting. These are likely to show no hurry to cut rates, and any hawkish concerns in the minutes will take on added significance given strong employment and CPI data seen after the meeting.

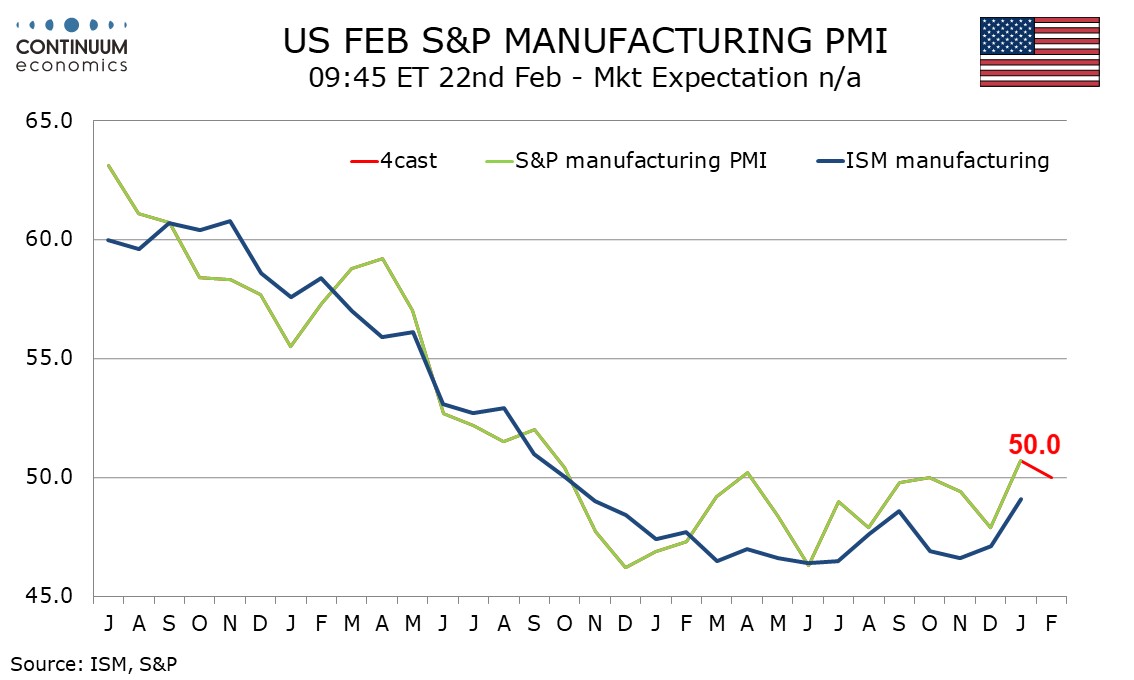

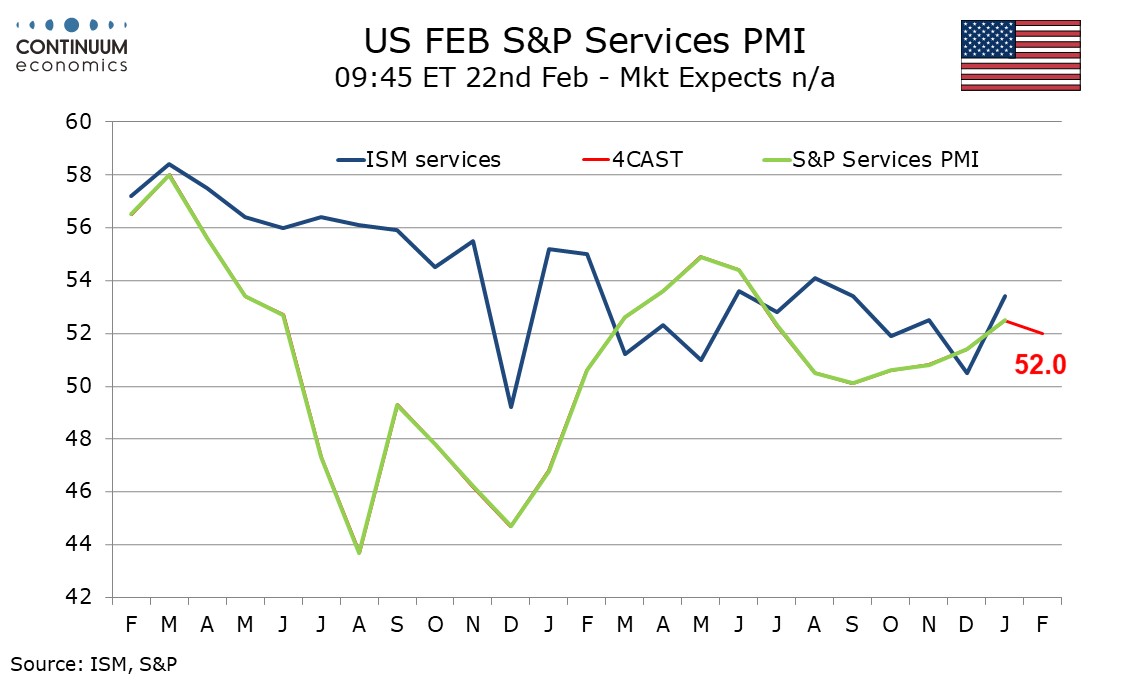

Thursday’s weekly initial claims data will cover the survey week for February’s non-farm payroll. February S and P PMIs follow, and we expect modest slippage in manufacturing to 50.0 from 50.7 and services to 52.0 from 52.5. We then expect a strong 6.2% rise in January existing home sales to 4.02m. Fed’s Jefferson, Harker, Cook and Kashkari all speak on Thursday. Friday’s calendar is quiet.

Canada

Canada releases January’s IPPI and RMPI on Monday and January’s CPI on Tuesday. We expect the latter to slip to 3.1% yr/yr, reversing December’s rise to 3.4%, though progress on the BoC’s core rates will be marginal. BoC’s Gravelle will speak on QT on Wednesday. December retail sales are due on Thursday. A preliminary estimate for a 0.8% increase was made with November’s data. Friday’s calendar is quiet.

UK

The data highlight this week is on Thursday in the form of flash PMI numbers. The January composite at 52.9 was up from 52.1 and above the 50 no-change level for the third month in a row and signalled a moderate rate of expansion. The latest reading was up from the earlier 'flash' reading (52.5) and the highest since May 2023 - NB; CBI survey data (Wed) will offer an alternative slant. Otherwise, public borrowing numbers (Tue) will perhaps provide more signs of an undershoot of the OBR budget deficit target; borrowing in the first nine months of FY 2023-24 totalled £119.1 billion, below OBR thinking primarily explained by debt interest payments, which were £5.7 billion below the forecast profile, reflecting lower than expected inflation. As for policy insights, led by Governor Bailey, the BoE hierarchy testify to parliament on Tuesday about the latest Monetary Policy Report.

Eurozone

Datawise, the main event are PMI flashes on Thursday. The downturn in the euro area economy extended into an eight month according to the January PMI. Even so, there were tentative signs of improvement as the Composite PMI, rose to a six-month high of 47.9 in January, from 47.6 in December, thereby it signalled the softest rate of decline since last July. A further small rise is expected, the main question whether February sees further signs if apparent cost pressures resuming. Other business surveys are due, including the INSEE numbers (Tue) and the German Ifo figure (Fri) where some small rise may be in the offing. That may also be the case for the EU consumer confidence numbers (Wed) too.

Elsewhere, the first concrete insight into Q4 wages comes with ECB-compiled negotiated wage data (Tue) and where some drop from the Q3 4.7% rate is envisaged. Otherwise, ECB-compiled consumer expectations data (Fri|) may show more signs of easing back on the inflation front while EZ construction (Tue) may show more softness

But the stand out event is the January ECB Council meeting account. These minutes should make it clearer that policy easing is very much on the radar screen. While President Lagarde may have said after the meeting that the Council regarded it to be premature to discuss easing, this was only by consensus, implying a minority wanted such a debate – the minutes may suggest how sizeable and persuasive this was. This is not surprising given the manner in which important data is both highlighting an ever clearer disinflation process and underscoring the manner in which policy tightening is still biting.

Rest of Western Europe

There are key figures in Sweden, with the January CPI update (Mon) where a clear ump is likely from just above the 2% target. We see CPIF inflation back up to 3.0% y/y and the ex-energy version slipping to 4.4%. This would be just a little below Riksbank projections.

Japan

Most important release for Japan next week is trade balance on Tuesday, Feb 20. Q4 2023 GDP has shown a soft Japan economy with private consumption the major drag. While it is expected to rebound in Q1 2024, the magnitude maybe limited with real wage remain negative. A stronger than expected trade balance is crucial for a better quarter for the Japanese economy and it is possible if export expands further and import continue to be restrained by domestic demand. There are also PMIs on Wednesday, Feb 21.

Australia

Following two dismal employment reports, we will have the Wage Price Index on Tuesday, Feb 20. Given those miss in employment, likely we will be seeing a soft wage report and that should reinforce our forecast of no hike from RBA in the next meeting. We also have RBA meeting minutes on Monday, Feb 19 and it could provide some clarity for the change in wordings for forward guidance and may see downside for the Aussie if it is clarified there is indeed no change to policy decision. There are also PMIs on Wednesday, Feb 21.

NZ

Trade balance on Wednesday, Feb 21 and Retail Sales on Thursday, Feb 22, neither should be market moving.