FX Daily Strategy: N America, July 15th

US CPI data they key focus

Neutral numbers would likely maintain risk positive tone

CHF strength looks out of line with positive risk tone

JPY weakness excessive but hard to see a trigger for reversal

CAD looks well supported unless data is weak

US CPI data they key focus

Neutral numbers would likely maintain risk positive tone

CHF strength looks out of line with positive risk tone

JPY weakness excessive but hard to see a trigger for reversal

CAD looks well supported unless data is weak

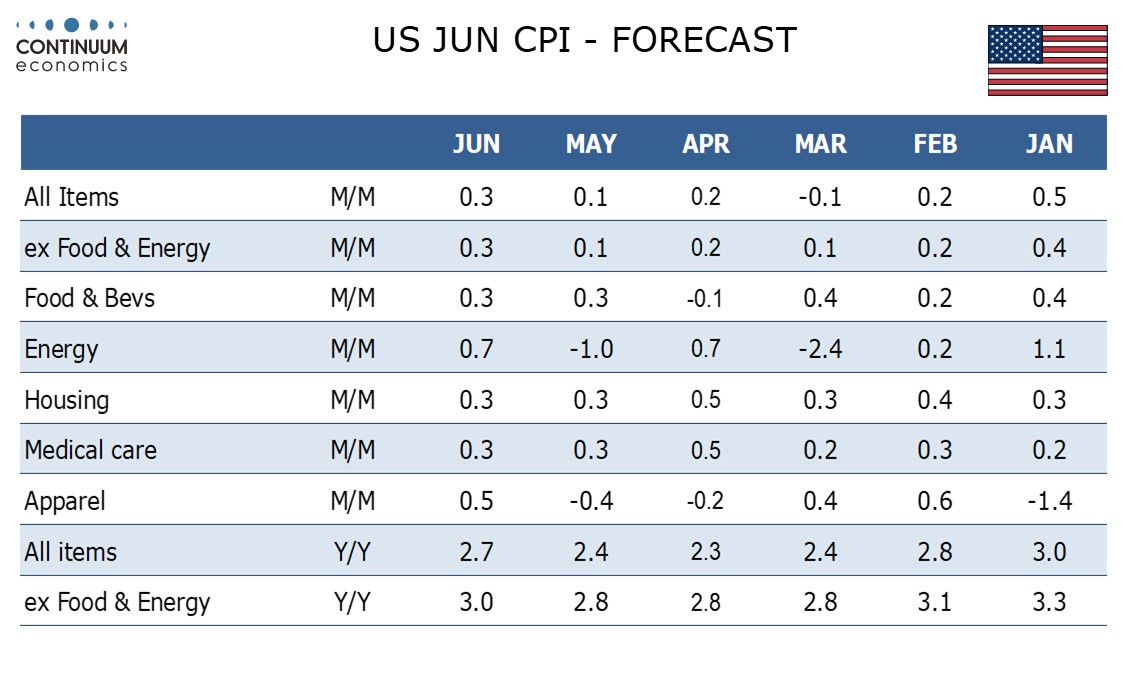

Tuesday sees US and Canadian CPI data, with the US numbers the main data of the week. We expect June CPI to increase by 0.3% overall and by 0.3% ex food and energy, with the overall pace close to 0.3% before rounding but the core rate rounded up from 0.27%. This would still be the strongest core rate since January and reflect tariffs starting to feed through, something expected by Fed Chairman Powell. But our forecast is in line with the consensus, and won’t be enough to undermine what has proved to be extremely resilient risk sentiment. 0.4% or above will be required to have any negative impact on bonds or equities.

Monday saw a surprising lack of reaction to the Trump announcement of 30% tariffs on the EU and Mexico at the weekend. This partly reflects a market belief that these will not be imposed for any length of time, as TACO (Trump always chickens out). But if the markets don’t react to the threats, there will be little incentive for Trump to back down. As we get closer to the August 1st deadline there is likely to be some market reaction if there is no progress on trade talks. Our best guess is that Trump will compromise a few days after August 1st, in part due to pressure from the markets, but for the moment, if we don’t see any impact from the US CPI data, we may see some further positive risk reaction.

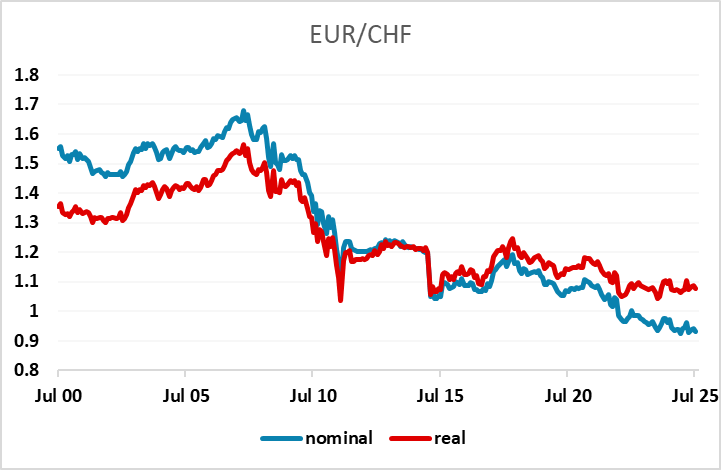

JPY weakness remains the main market feature, with another all time high in CHF/JPY seen at 1.8521 on Monday. The strength of the CHF continues to be the anomaly in this generally risk positive market. As the classic safe haven with zero rates, it’s hard to understand why EUR/CHF continues to press the downside when EUR/JPY continues to press higher. EUR/CHF is still not quite low enough to draw the SNB into a reaction, holding just above all time lows in real terms. But with tariffs likely to be as severe on Switzerland as the EU, and pharma tariffs potentially being more severe, the SNB may soon do something to oppose CHF strength.

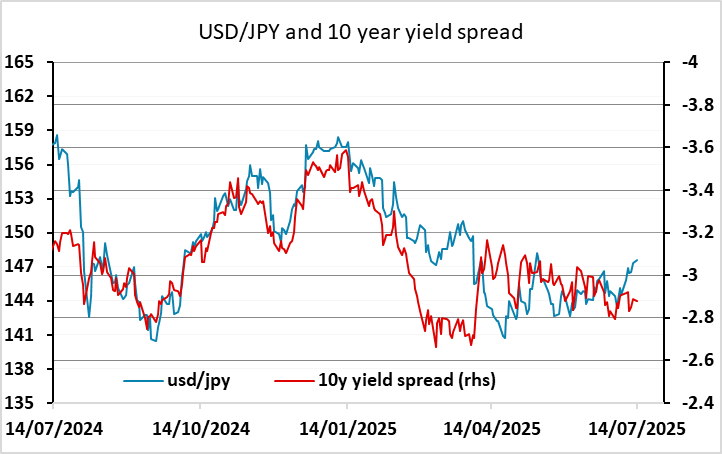

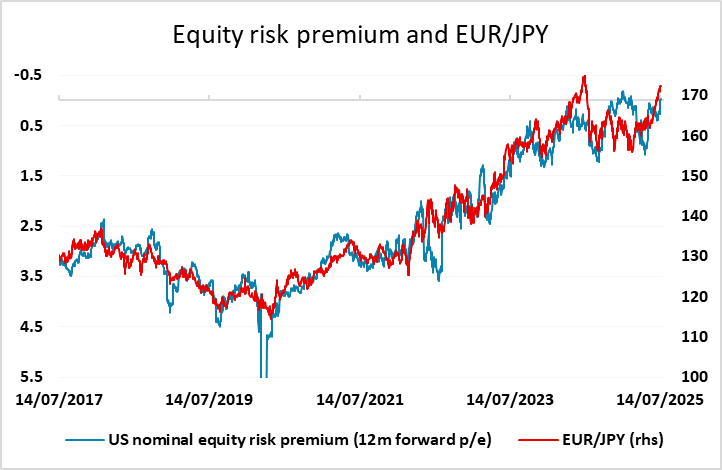

JPY weakness against the EUR looks overdone even given the extremely low level of risk premia, and having seen seven consecutive weeks of EUR/JPY gains we would expect a pause this week, especially since USD/JPY also looks expensive based on yield spreads as JGB yields have risen in recent days. But unless the US CPI data prove much stronger than expected, or there is some surprise risk negative development, it’s hard to see anything more than a very modest JPY recovery.

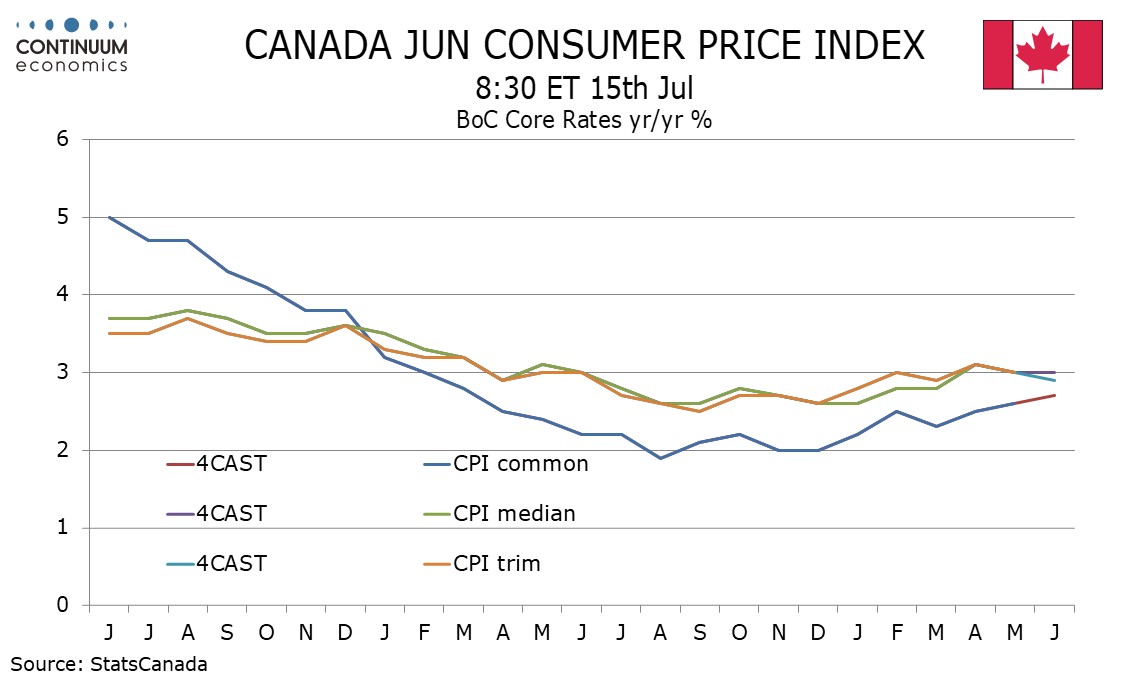

For Canadian CPI, we expect June Canadian CPI to rise to 1.9% yr/yr after two straight months at 1.7%, the fall to 1.7% from 2.3% in March having been fully due to the abolition of the consumer carbon tax. We expect the Bank of Canada’s core rates to be on balance stable in June, and still above the 2.0% target. USD/CAD did very little on Monday and the CAD looks better supported after the strong Canadian employment report last week. The market consensus is in line with our forecast, and unless the US data surprises, the bias should be towards the CAD upside.