Reserve Bank of India Preview: No Rate Cut In Near Term

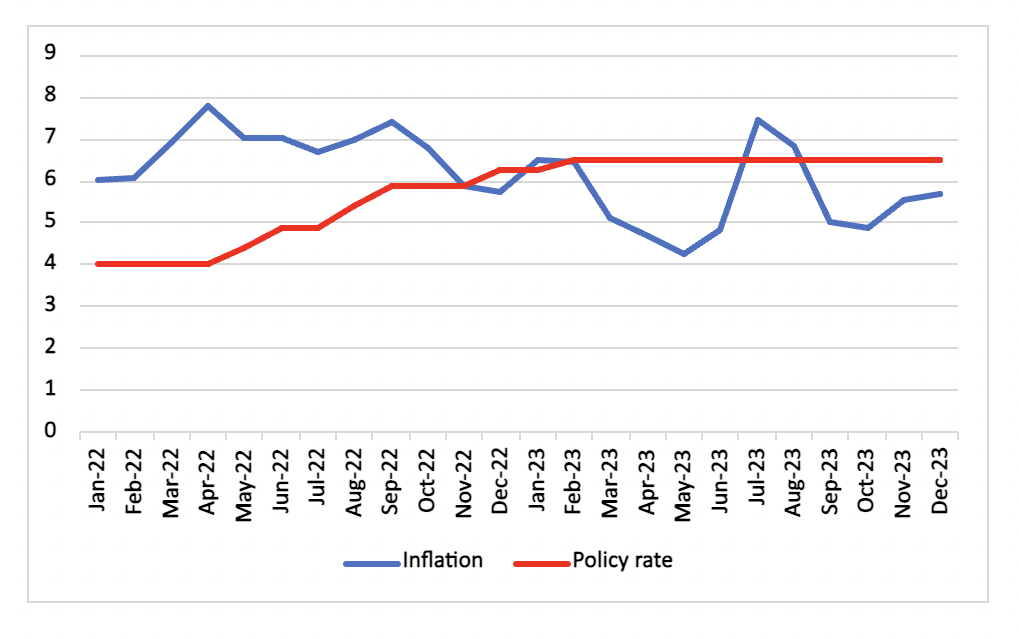

The RBI will keep the repo rate unchanged at 6.5% during the upcoming monetary policy committee meeting on February 8th. The current tight stance is expected to persist until at least mid-2024, as the central bank foresees inflation averaging 5.4% year-on-year in FY24, ending on March 31, 2024, before decreasing to below 5% in the following fiscal year. Favourable macroeconomic indicators and sustained demand will allow the RBI to continue with its liquidity withdrawal stance over the near term.

The Reserve Bank of India is unlikely to change its main policy rate, the repo rate of 6.5% in the upcoming meeting on February 8, despite recent upward surprises in India's inflation. The inflation surge is largely attributed to unpredictable food price fluctuations. While inflation hasn’t breached the 6% upper target limit of the RBI, it has trended close to the limit, coming in at 5.7% y/y in December. The year-on-year acceleration is driven by higher prices in cereals, fruits, vegetables, pulses, and spices, partially balanced by decreasing oil and fats prices due to government measures. Food and beverage inflation rose by 8.7%, the highest since August, while inflation in other categories like clothing, footwear, household goods, and services eased to multi-month or multi-year lows in December, indicating a relief in underlying inflation pressures.

Figure 1: India Consumer Price Inflation and Main Policy Rate

Source: Reserve Bank of India, MOSPI, Continuum Economics

Meanwhile, India’s current account deficit remains manageable, and therefore the pressure on the INR too remains modest. India’s merchandise deficit declined 14.4% y/y in December 2023, and on a cumulative level stood at USD 188bn in the first three quarters of FY24(Apr-Dec), down from US$ 212.3bn in FY23. However, there exists some pressure on the currency ahead of the upcoming budget later today (February 1) and with the chances of a March rate cut by the Federal Reserve diminishing. Nonetheless, we expect the INR to remain range bound USD/INR 82.9-83.3 in the near term.

Consequently, the RBI has sufficient room to maintain the policy rate for now, and continue with withdrawal of liquidity. We remind that bank credit to private sector grew 15.8% y/y in December 2023 (personal loan growth stood at 17.7% y/y), despite the sustained high interest rate environment, suggesting consistent private sector demand. With elections looming in India (April 2024), government spending on on projects and cash handouts are likely to support demand in the near term. Therefore, the RBI has little need to cut interest rates ahead of the elections. The earliest rate cut is likely in June 2024, of 25 bps.