FX Daily Strategy: N America, November 12th

UK labour market data important for BoE outlook

GBP remains biased higher against the EUR on neutral numbers

EUR/USD remains under pressure on tariff fears

2016 Trump victory suggests more USD gains to come

GBP edges a little lower after labour market data...

...but GBP remains biased higher against the EUR

EUR/USD remains under pressure on tariff fears

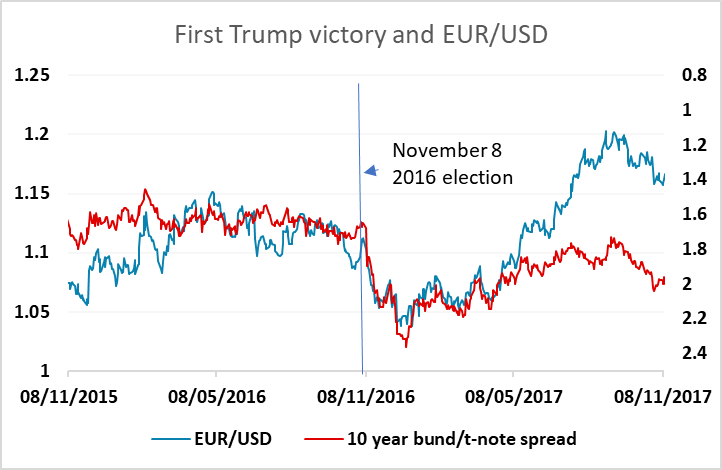

2016 Trump victory suggests more USD gains to come

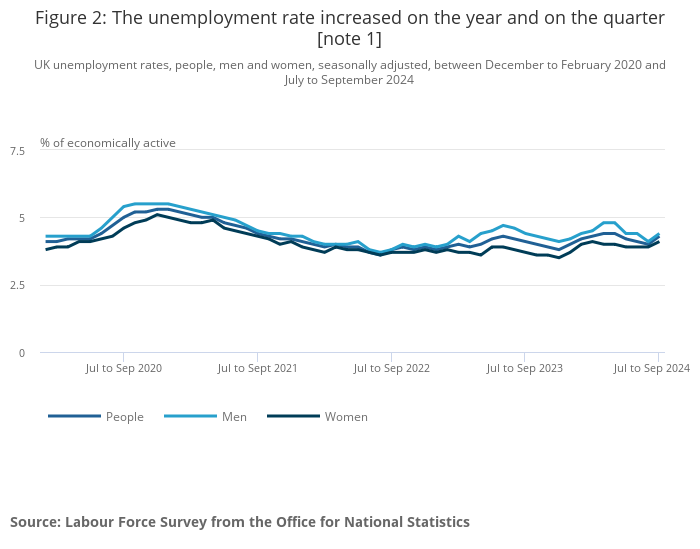

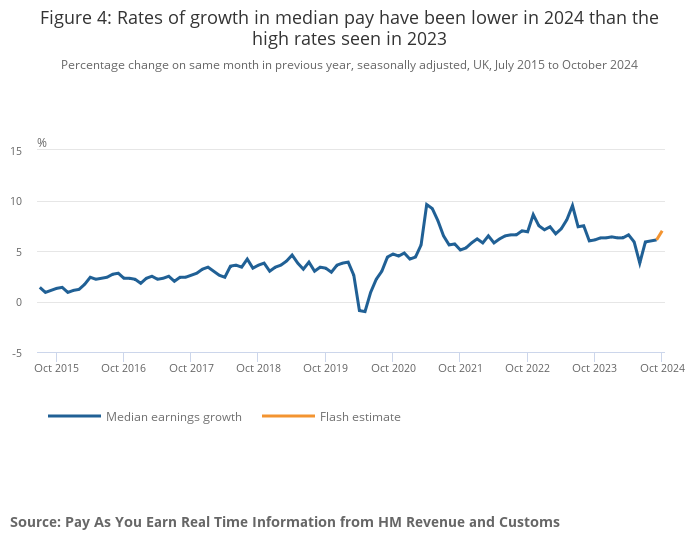

GBP has edged a little lower after the mixed UK labour market data, even though the data was on balance slightly on the strong side of expectations. The official ONS data is less up to date than the HMRC data, but shows stronger than expected average earnings growth in the 3 months to September at 4.3% including bonuses and 4.8% excluding bonuses (medians 3.9% and 4.7%). However, the unemployment rate rose to 4.3% from 4.1% (4.1% expected), and employment growth was slightly weaker than expected at 219k (290k expected). The provisional HMRC data for October showed a 5k decline in payrolled employment, which remains broadly steady on the year, but showed stronger than expected earnings growth at 7.0% y/y.

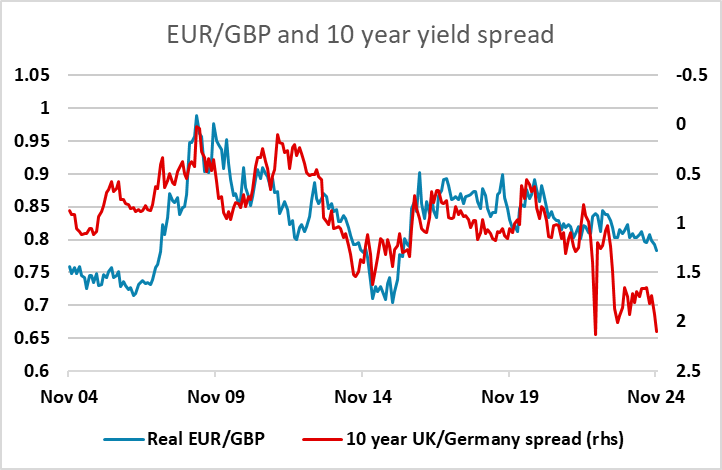

The (modest) decline in GBP after the data suggests the market is focusing on the rise in the unemployment rate, but this has been choppy in recent months and it looks fair to describe it as basically stable. The stronger than expected earnings data looks more likely to attract the BoE’s attention and should prevent a BoE rate cut in December. EUR/GBP should consequently hold below 0.83 and may edge lower if we see some sort of recovery in risk sentiment over the day. Early softness in equity markets is also tending to weigh on GBP and the other higher yielders.

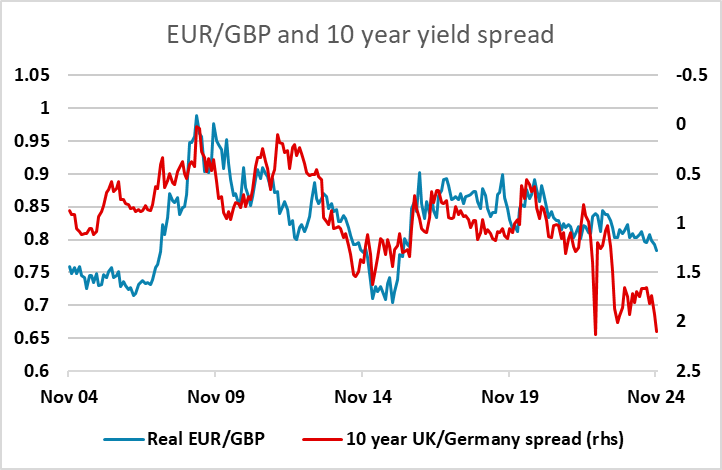

EUR/GBP hit its lowest level since April 2022 on Monday, due partly to the more hawkish BoE tone but mostly to the weakness of the EUR due to concerns about the likelihood of Trump putting significant tariffs on Eurozone exports to the US. The UK is expected to be less seriously affected than the Eurozone by the imposition of tariffs, and this is weighing on the EUR, but GBP is in any case at levels that look a little low relative to the longer term correlation with yield spreads, so it is hard to oppose GBP gains as long as market expectations of relatively tight UK monetary policy persist. The low of 0.82 from March 2002 is now a target unless we have data that indicates more rapid BoE easing is likely.

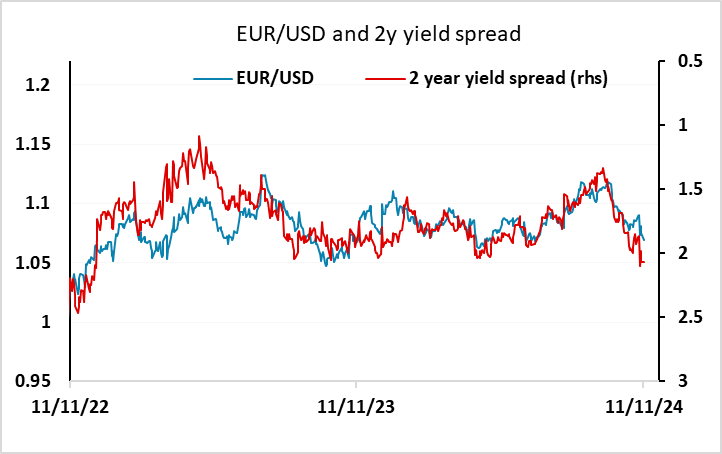

There isn’t a lot on the calendar other than the UK labour market data. The German ZEW survey may have some impact, but is not typically a big market mover of late. EUR/USD continues to look under pressure, and yield spreads suggest there is scope to 1.05, but the initial target will be the year’s low of 1.06 which was hit in April.

The USD remains well bid on a broad front, and if the Trump victory in 2016 is anything to go by, we may be in for a further month of USD gains. In 2016 DXY rose 5% from the election of Trump on November 8, peaking on December 20. The USD’s rise was driven by rising US yields, as it has been this time around. If anything, the USD rose less than the rise in yields suggested. Back then, EUR/USD tended to move more with 10 year yields, while currently it tends to move more with 2 year yields. Spreads have moved in the USD’s favour, and may have scope to move a little further. But at this stage we doubt the Fed will be changing their policy outlook. Trump’s tax cut promises have yet to be enacted, so it isn’t clear that monetary policy will be significantly affected. So while we can see the USD extend gains a little further, we wouldn’t at this stage be looking for a large move.