FX Weekly Strategy: Asia, April 7th-11th

Focus on equities and tariffs rather than data

Hard to oppose equity weakness

FX moves to be mainly determined by risk characteristics

JPY remains the safest haven

AUD and NOK will struggle if equities continue to weaken

Normally, the focus this week would be on the US March CPI data, but the Trump tariffs and Chinese retaliation have made the current data largely irrelevant. The question is now whether the sharp decline in equity markets that has been seen in the wake of the announcement will continue, and what the consequences of the tariffs and the market reaction will be for the world economy and for the FX markets.

It seems clear that a continuing decline in equity markets would lead to further USD declines against the JPY and CHF, which continue to act as the main safe haven currencies. The EUR has also made gains against the USD in response to the recent events, but the riskier currencies have shown mixed reactions. The AUD has been the worst performer. Despite initially making gains against the USD on Wednesday and Thursday after the tariff announcement, the AUD fell back on Friday to hit new lows for the year near 0.60 – its lowest since the pandemic. But the CAD has been much more resilient, holding onto modest gains against the USD after the announcement. GBP and SEK are not much changed, but the NOK was hit hard on Friday, losing more than 3% against the EUR, almost matching the declines in the AUD.

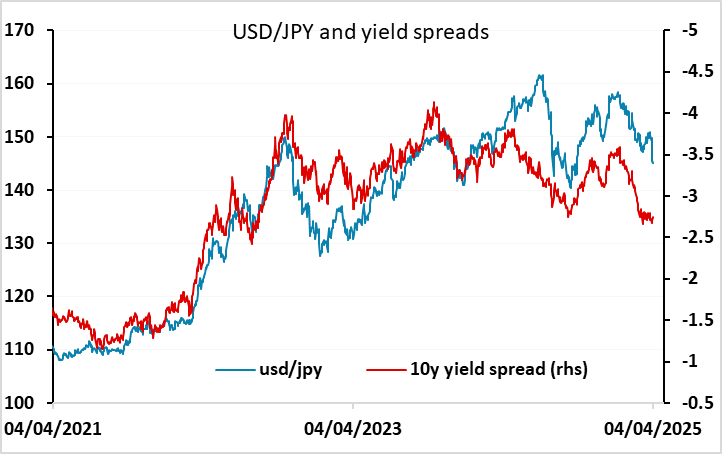

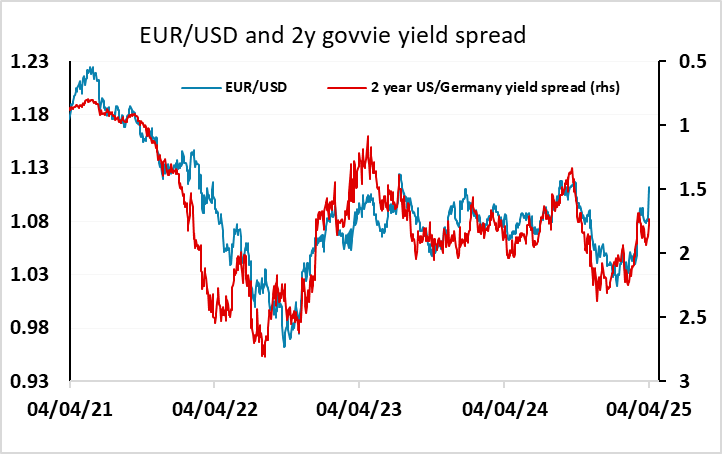

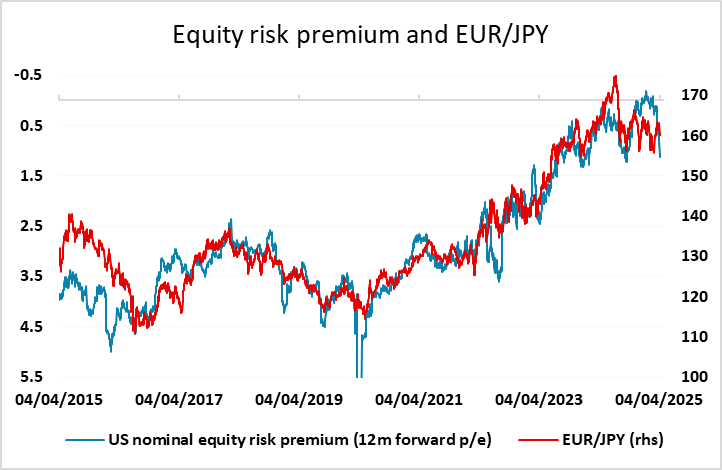

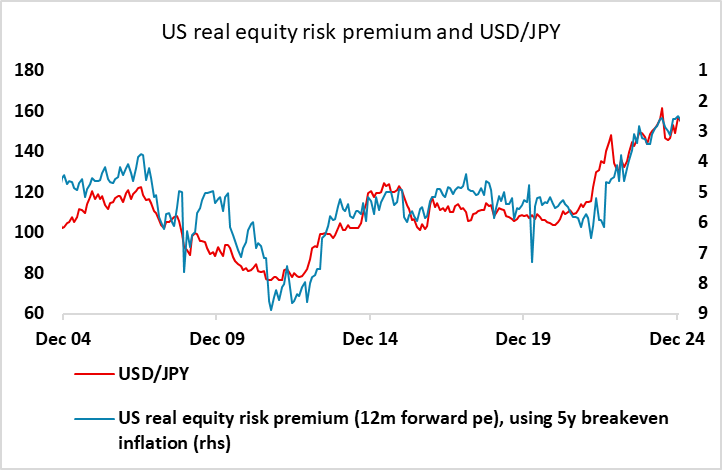

As far as the majors are concerned, yield spreads are likely to continue to be a reasonable guide. We see short term scope to 140 in USD/JPY if equities stay soft, but EUR/USD will struggle to sustain a move much beyond 1.12 unless we see some evidence of resilience in the European economy. The clearest correlation with equities is typically in JPY crosses. EUR/JPY and GBP/JPY both show a tight correlation with the nominal US equity risk premium, which suggests both have further to fall.

We would be wary of assuming that all recent reactions will be sustained, but history does suggest that if equities continue to weaken the AUD is likely to fall further. The NOK picture is less clear, with the sharp decline on Friday reflecting poor liquidity as much as anything, as seen in the pandemic when we saw a big spike higher in EUR/NOK, which rise 30% in a month (a move from which it has never fully recovered).

So will equity markets continue to weaken? It’s hard to see why the US market would not weaken further unless Trump reverses or reduces the tariff increases. The market remains expensive on all measures, and we have been saying for some time that it’s hard to see how the level can be justified when the economy is close to full employment so that growth is unlikely to exceed trend. When growth is now looking likely to be well below trend, it’s even harder to see how current levels can be justified. The Q1 US GDP data may well be negative, and although this is likely to be mainly due to the timing of imports due to concerns about tariff increases, Q2 also looks likely to be weak as a result of declining confidence and spending. Recent events are likely to damage confidence further. While some of the growth weakness will be moderated by central bank easing, this may prove difficult in the US when prices are being hikes due to tariff increases. So we look for more USD weakness to come, and more weakness in the riskier currencies, although the riskier currencies may hold up better against the USD than usual in these circumstances because of the high USD starting point, the expensive US equity market and the US being the epicentre of the current problems.

Data and events for the week ahead

USA

Monday sees February consumer credit, while Tuesday sees March’s NFIB small business survey. February wholesale trade is due on Wednesday, while FOMC minutes from March 19 are likely to show caution over future easing given trade policy uncertainty. Fed’s Barkin will also speak on Wednesday.

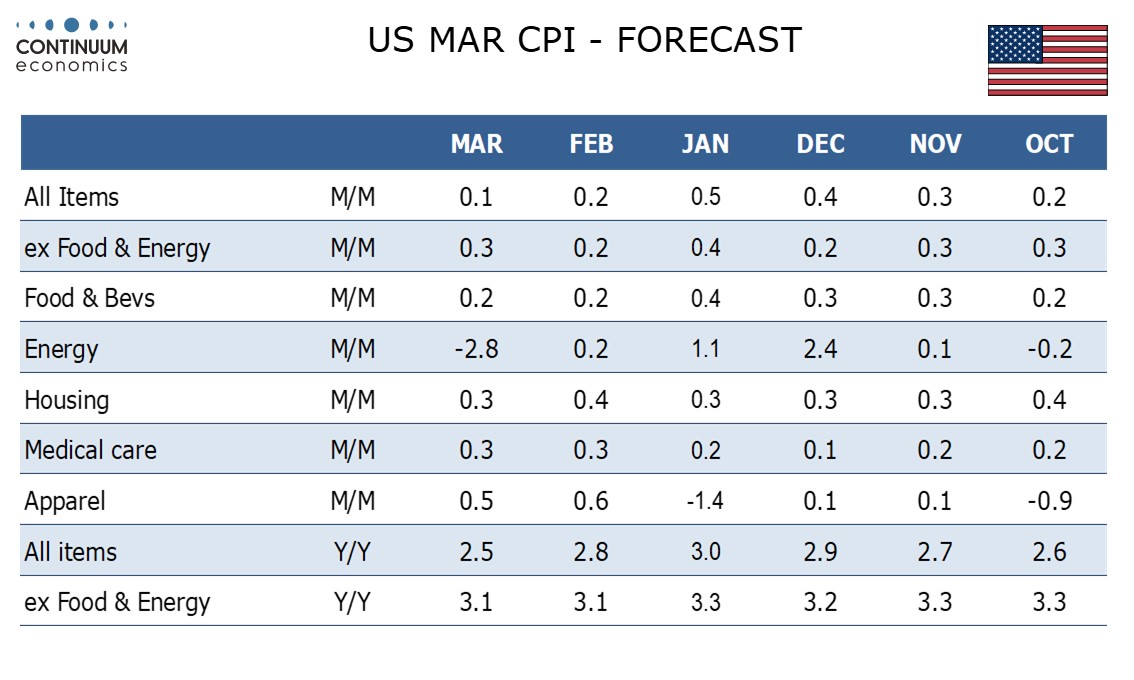

Thursday sees March CPI, where we expect a subdued 0.1% rise overall but a 0.3% increase ex food and energy. Weekly initial claims are also due while Fed’s Logan, Goolsbee and Harker will speak. On Friday we expect March PPI to rise by 0.2% overall with a 0.4% increase ex food and energy. The preliminary April Michigan CSI will be closely watched, particularly for inflation expectations. Fed’s Musalem and Williams are also due to speak.

Canada

Canada’s most significant event may be Monday’s Q1 Bank of Canada survey of business expectations. Also due are March’s Ivey PMI on Tuesday and February building permits on Thursday.

UK

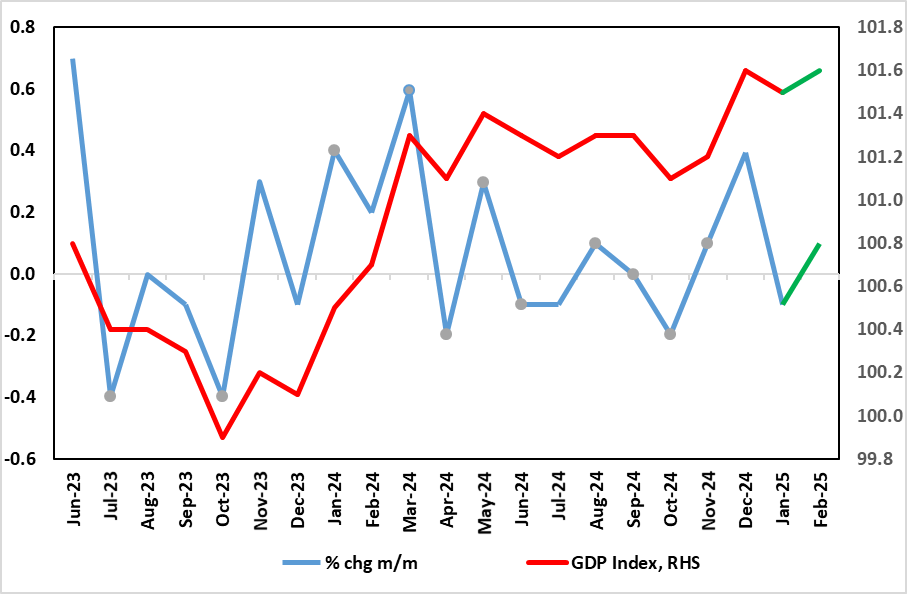

More BoE insight may come after some key speeches (Lombardelli on Tue and Breeden on Thu) as well as the Financial Committee Report on Wednesday. RICS housing survey data (Thu) will tell how much a reversal may be occurring given that stamp duty increases have taken place. The key data arrives Friday in the form of monthly GDP. Despite a fresh downside surprise for January numbers, the odds are increasing that current quarter GDP will be decidedly positive as opposed to the weak(ish) picture we perceive. This is all the more likely given the 0.1% m/m ‘recovery’ we have pencilled in for February and where upside risks arise from higher property transaction (ahead of those stamp duty rises), solid retail sales but where warm weather may hamper utility output.

Actual GDP Looking Better into Early 2025

Source: ONS, green denotes CE forecast

Eurozone

A middling week with a few second-order ECB comments. There is February German industrial production (Mon) which may show a small correction but possibly not enough for the EZ counterpart having have an even softer undertone (Thu).

Rest of Western Europe

There are few key events in Sweden, but Thursday sees the monthly industrial production and orders data and monthly GDP indicator, the question being whether the latter’s much more solid tone of late persists or not having fallen back in the last (ie January) figure. Details to the CPI data appear Thursday. Norway has low-profile industrial production numbers (Mon).

Japan

The critical labor cash earning will be released on Monday. We forecast wage continue to grow above 2%, likely staying close to 3%. Any upside surprise would likely tilt market expectation of a earlier hike from the BoJ, though latest tariff complication may limit any gains in JPY. There is also PPI on Thursday and likely points towards more cost pressure to be piled into inflationary pressure.

Australia

Mostly tier two data for Australia next week, starting with ANZ job ads on Monday and Business outlook & confidence on Tuesday. RBA governor Bullock will be speaking on Thursday but unlikely to provide useful information.

NZ

RBNZ Rate decision will be on Wednesday and should be cutting along their OCR forecast. We do not currently see any major revision in their OCR or inflation forecast.