USD, JPY, CHF flows: Steady markets, JPY still has upside scope, CHF topping out

USD steady overnight, equities making new highs (again) but JPY favoured going forward. CHF looking toppy.

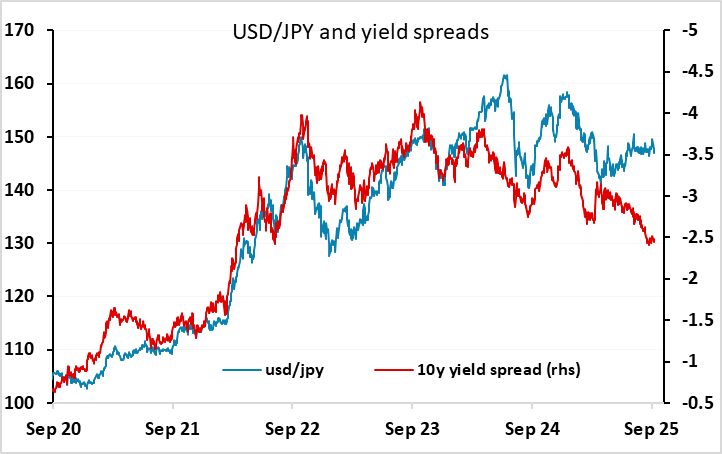

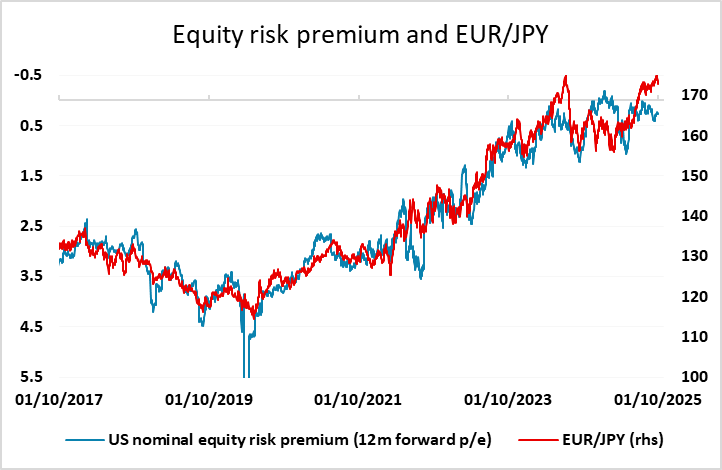

A fairly quiet overnight session in FX has seen another new all time high for the S&P 500, no doubt helped to some extent by the lower US yields seen after the weaker than expected ADP data yesterday. The equity market continues to take an optimistic view, seeing the government shutdown as having little or no economic impact and weaker employment as no barrier to continued growth. This looks a little complacent, and the latest new high in equities may not last too long. We still see upside risks for the JPY, both against the USD and on the crosses, based both on yield spreads and a likely rise in the US equity risk premium from extreme low levels.

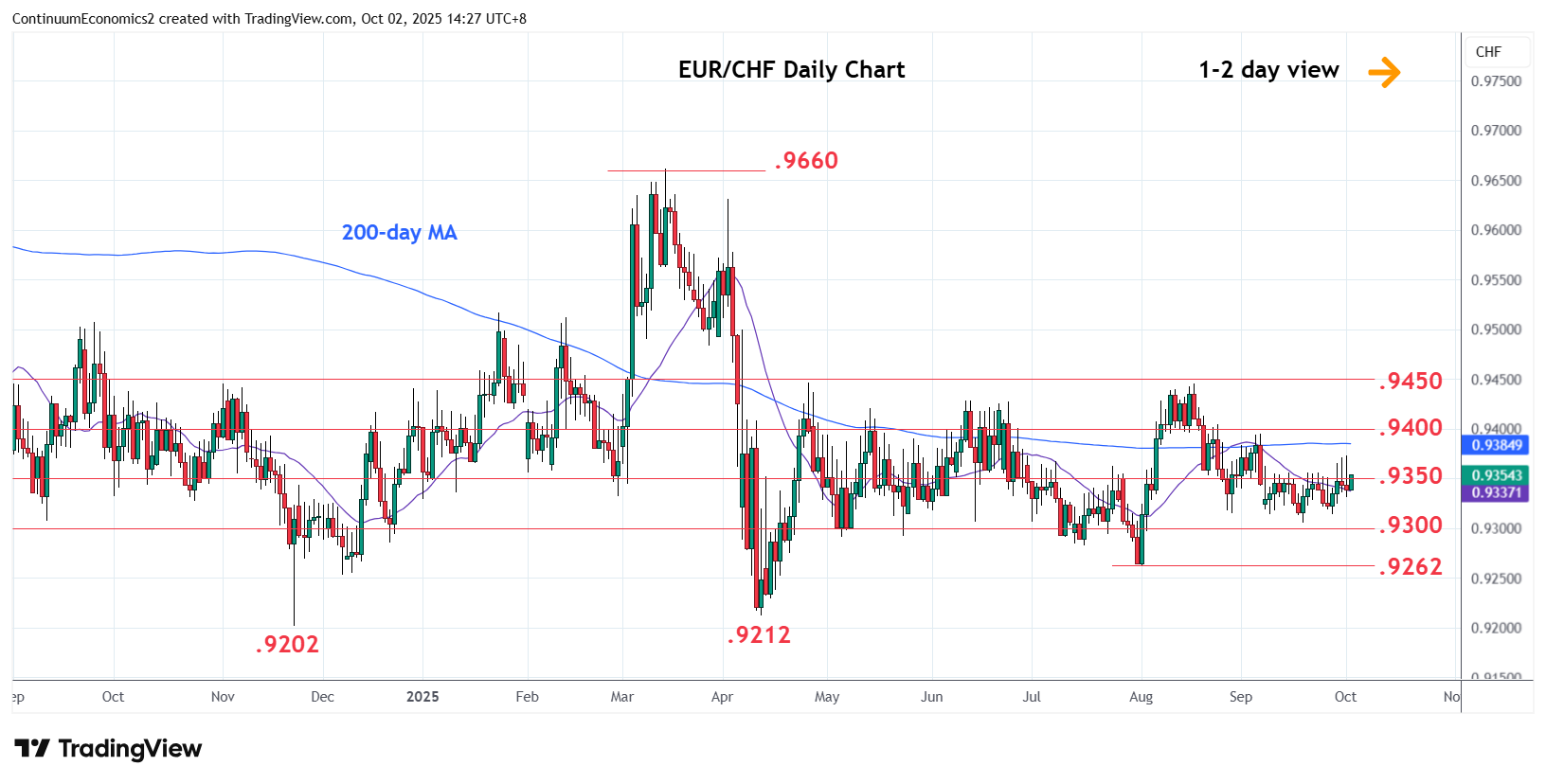

For today, it’s a quiet calendar due to the US government shutdown. The Swiss CPI data released this morning was in line with consensus on a m/m basis, but the y/y rate was a tad lower than expected, and this has helped EUR/CHF to move higher early in the session. We continue to see some upside risks for EUR/CHF, with 0.93 looking like a solid base. CHF valuation remains extremely high, and this should be challenged given very low yields and the likely negative economic impact of high US tariffs.