FX Daily Strategy: Europe, January 31st

EUR sould remain well supported, German retail sales of interest

CAD awaiting tariff news more than GDP

JPY strength can extend further

EUR sould remain well supported, German retail sales of interest

CAD awaiting tariff news more than GDP

JPY strength can extend further

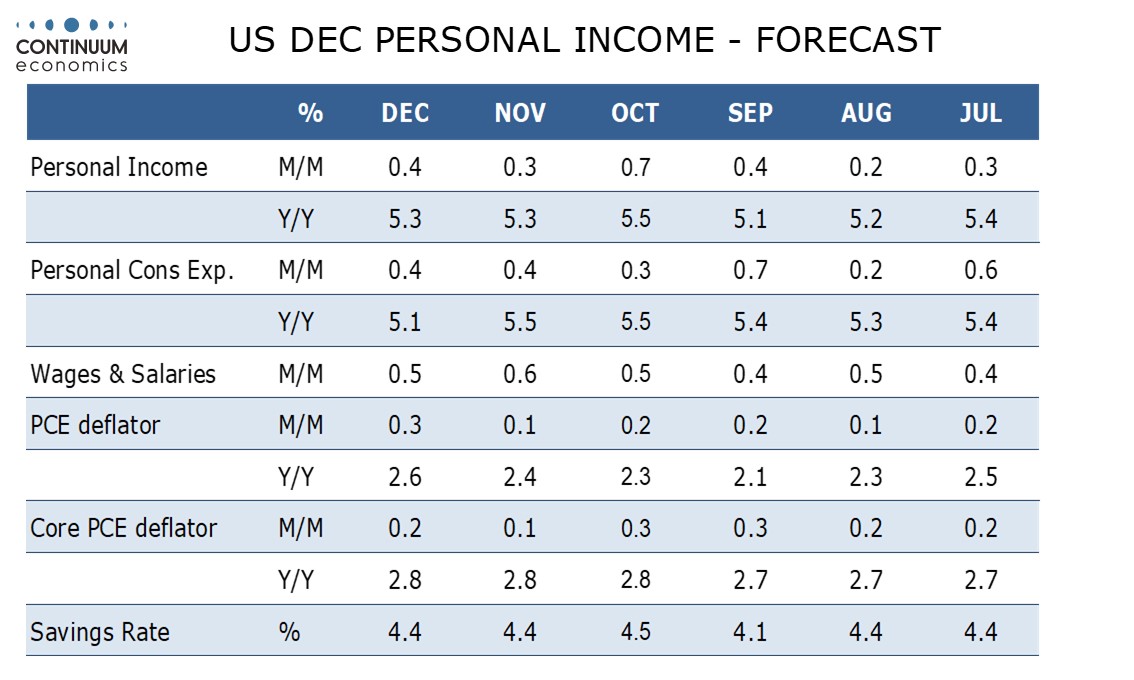

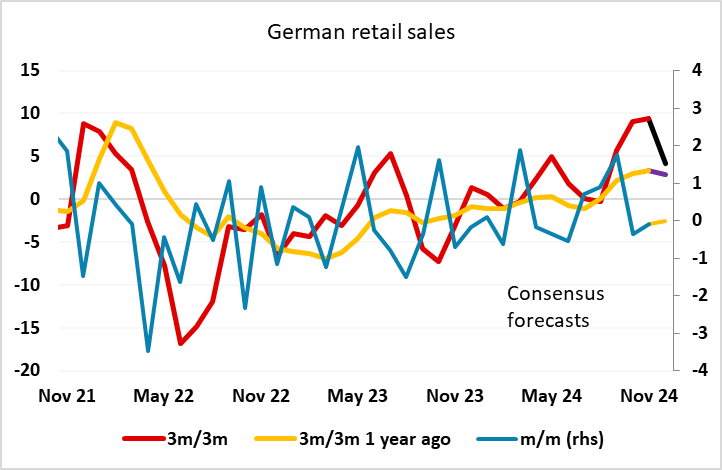

Friday sees French and German preliminary January CPI data and the US PCE price index for December, the employment cost index for Q4, as well as German December retail sales and Canadian November GDP.

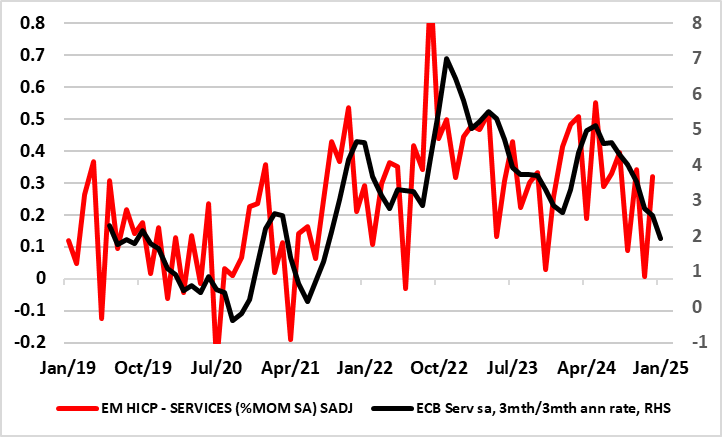

The Spanish CPI data released on Thursday was on the strong side of consensus, but we see some downside risks to the German numbers after the rise to an 11-mth high of 2.8% in December, and this should prevent any decline in ECB rate cut expectations. The EUR proved quite resilient on Thursday after the weakish Q4 Eurozone GDP numbers, even though the US data still showed the superior rate of growth of US demand, with EUR/USD finding demand below 1.04, and we doubt the CPI numbers will be weak enough to disturb this firmer tone.

Eurozone Services Inflation is Around Target in Shorter-Term Dynamics?

Source: Eurostat ECB, CE

German retail sales data doesn’t attract as much interest, and is very volatile on a month to month basis, but could be interesting in December as the recent trends have shown significant improvement. In spite of modest declines in the last couple of months, the strength of the September data means the 3m/3m growth rate in November was the strongest since July 2021. The consensus expectation of a flat month in December would bring this rate down to more normal levels, but the underlying trends suggests there are some risks of an upside surprise, and this may therefore mean upside risks for the EUR from the data.

December’s US personal income and spending report will be largely old news, with Q4 totals seen with the GDP report on January 30. Our pre-GDP forecasts for a 0.2% rise in core PCE prices and a 0.4% rise in personal income still look valid, though the GDP data is consistent with a 1.3% rise in personal spending, for which our original forecast was for a 0.4% increase. December is unlikely to rise so sharply, which suggests upward revisions in October and November. But impact should be modest given the Q4 data released on Thursday.

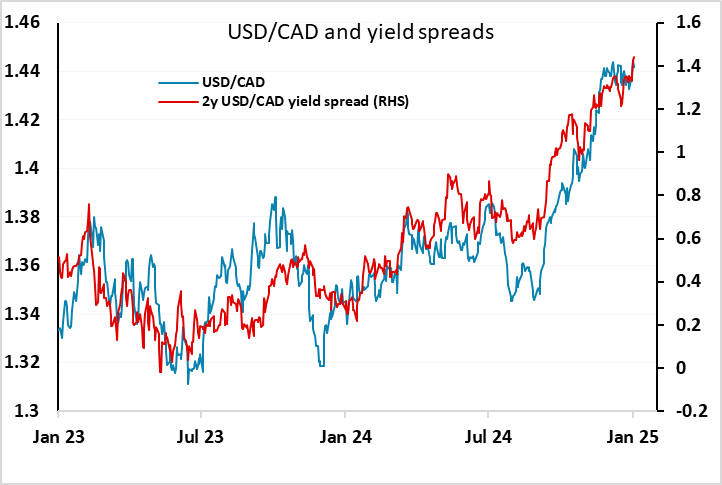

We expect Canadian GDP to see a 0.1% decline in November, in line with a preliminary estimate made with October’s 0.3% increase, and in line with consensus That would suggest a trend of around 0.1% per month. A 0.1% increase in December would leave Q4 marginally below 2.0% annualized, up from 1.0% in Q3. The Bank of Canada expects a 1.8% annualized gain in Q4. However, the data will probably be less important for USD/CAD than any news on whether Trump will be true to his word and impose a 25% tariff on Canada from February 1. The market is assuming here will be a last minute reprieve, but the longer we go with no news, the more nervous the CAD is likely to get. As it stands, USD/CAD has moved fairly closely with yield spreads, so there isn’t much risk priced in, suggesting most of the risk is on the USD/CAD upside.

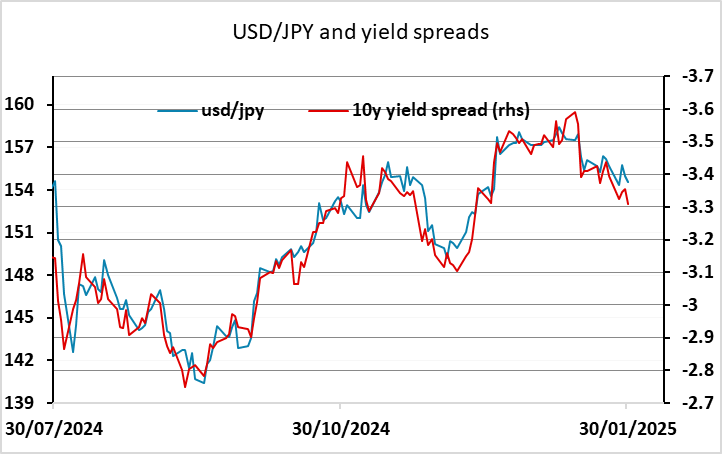

Otherwise, the JPY was the best performer on Thursday, with yields in the US and Europe generally a little lower, supporting JPY strength. As it stands, the US/Japan spread still suggests some downside risk for USD/JPY to 133, so JPY strength is hard to oppose, especially given the tariff risks which represent a significant risk to global equities.