U.S. March Durable Goods Orders - Underlying trend still near flat

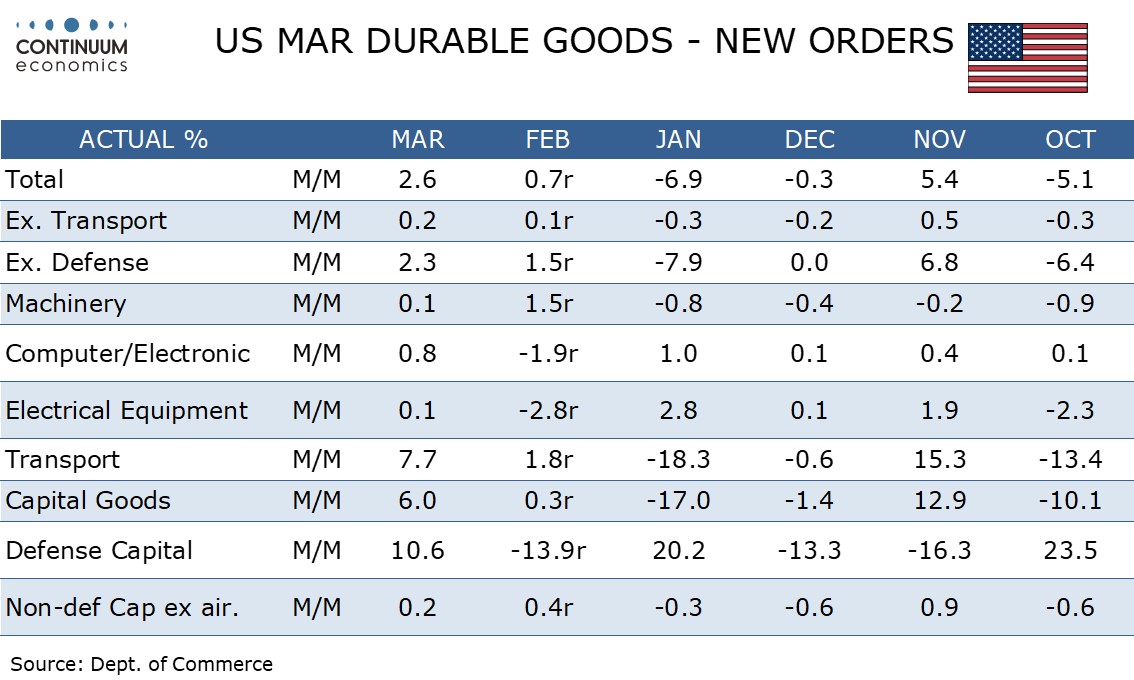

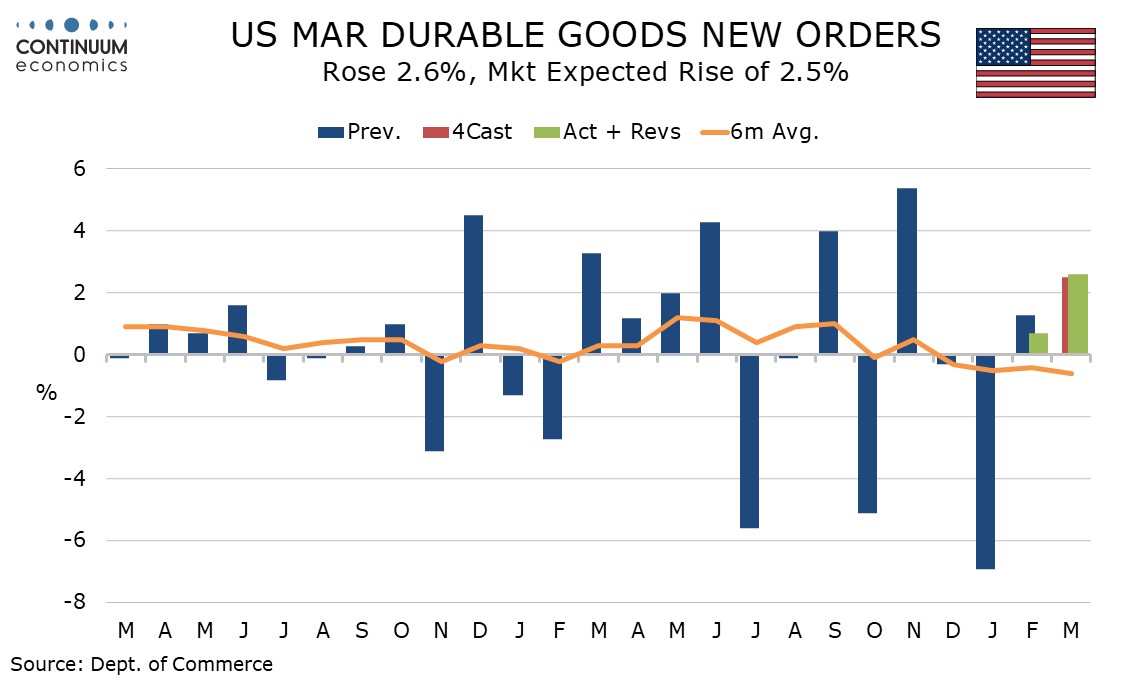

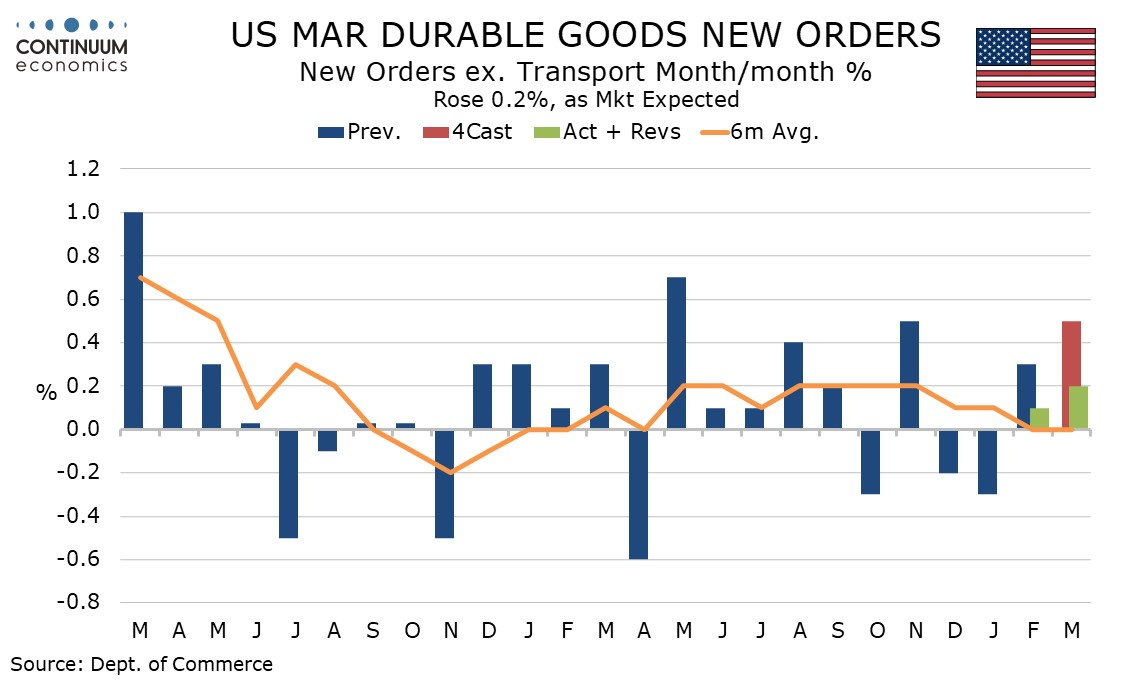

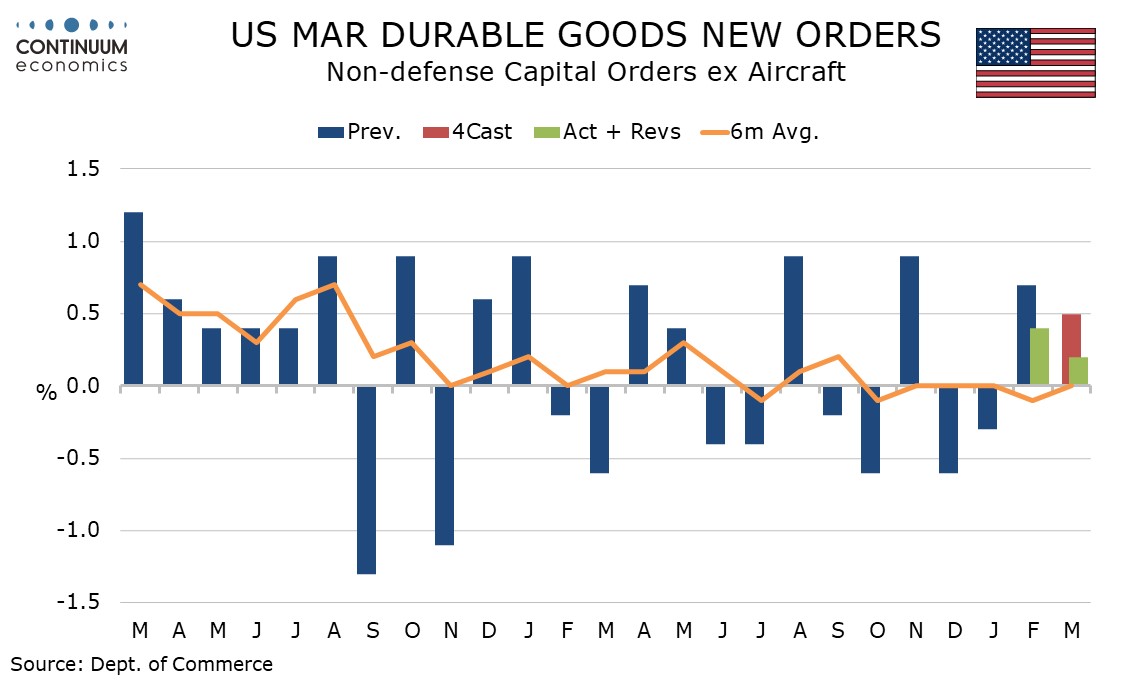

March durable goods orders are in line with expectations with a 2.6% increase overall, 0.2% ex transport, keeping trend near flat, with non-defense capital ex aircraft seeing similarly modest 0.2% increases in both orders and shipments.

The main source of the transport gain was aircraft, as had already been signaled by Boeing data, continuing to correct from a sharp fall in January. Autos also had a positive month. Defense, which has a large overlap with transport, was not a major factor, with orders ex defense up by 2.5%.

With February ex transport orders revised to a 0.1% increase from 0.3% the 0.2% increase in March is neutral net of revisions and the 6-month average is flat. We have now gone two years without a move reaching 1.0% in either direction.

Stronger March ISM manufacturing and manufacturing output data do not appear to be reflected in this report, and a softer April S and P manufacturing PMI suggests a fairly subdued outlook heading into Q2.

The modest gains in non-defense capital shipments and orders ex aircraft do not justify any change to Q1 GDP expectations. Inventories were unchanged after seven straight gains of either 0.1% or 0.2%, which could be a marginal negative, though few if any are likely to fine-tune their GDP view on this.