NOK, AUD flows: NOK little changed after CPI, AUD firm

NOK reverses initial post-CPI gain, but has upside scope. AUD firmer in better risk environment overnight, gains can extend

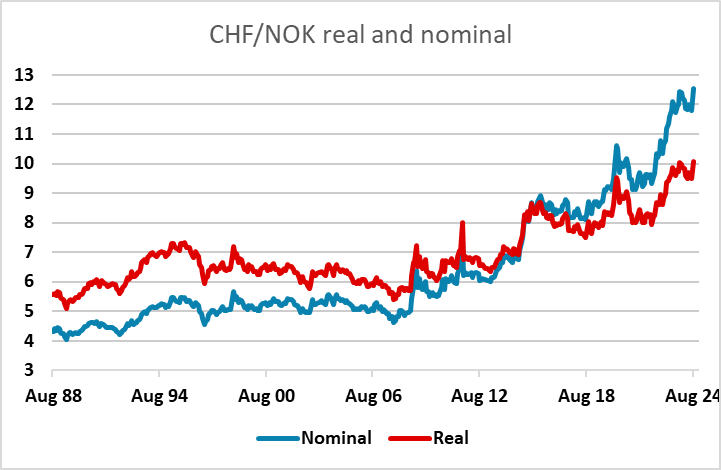

Norwegian CPI has come in very marginally softer than expected, with the 0.5% m/m gain in the headline slightly below the 0.6% consensus, but the y/y rate and the core m/m rate all in line with market expectations. EUR/NOK initially dipped a couple of figures in response but has quickly returned to pre-data levels. However, the mildly risk positive tone seen overnight suggests that there is some upside scope for the NOK after its recent weakness, with CHF/NOK still looking the most clear-cut candidate for declines.

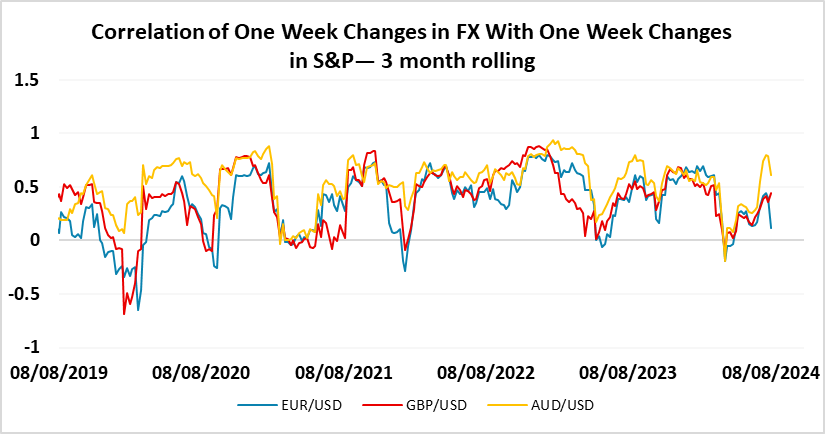

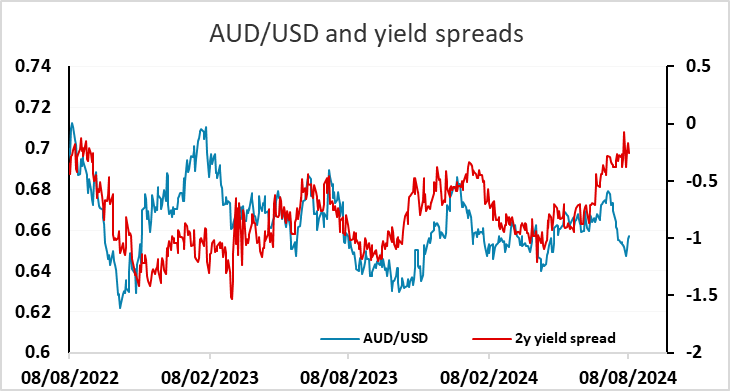

AUD and NZD both managed recoveries on the back of the better risk tone overnight, and they may still have further to go if we continue to see a stabilisation in risk appetite. While we continue to see scope for some decline in US equities due to high valuations in a sluggish economy, this need not mean moves are as sharp as we saw in the last couple of weeks. In a calmer environment, the AUD may manage to crawl back into the top half of this year’s range above 0.66. But the AUD correlation with equities is strong, and if we see a persistent downtrend it will be hard for the AUD to break to the upside, despite the recent favourable movement in yield spreads.