U.S. Q4 GDP delivers another strong quarter but core PCE prices remain consistent with target

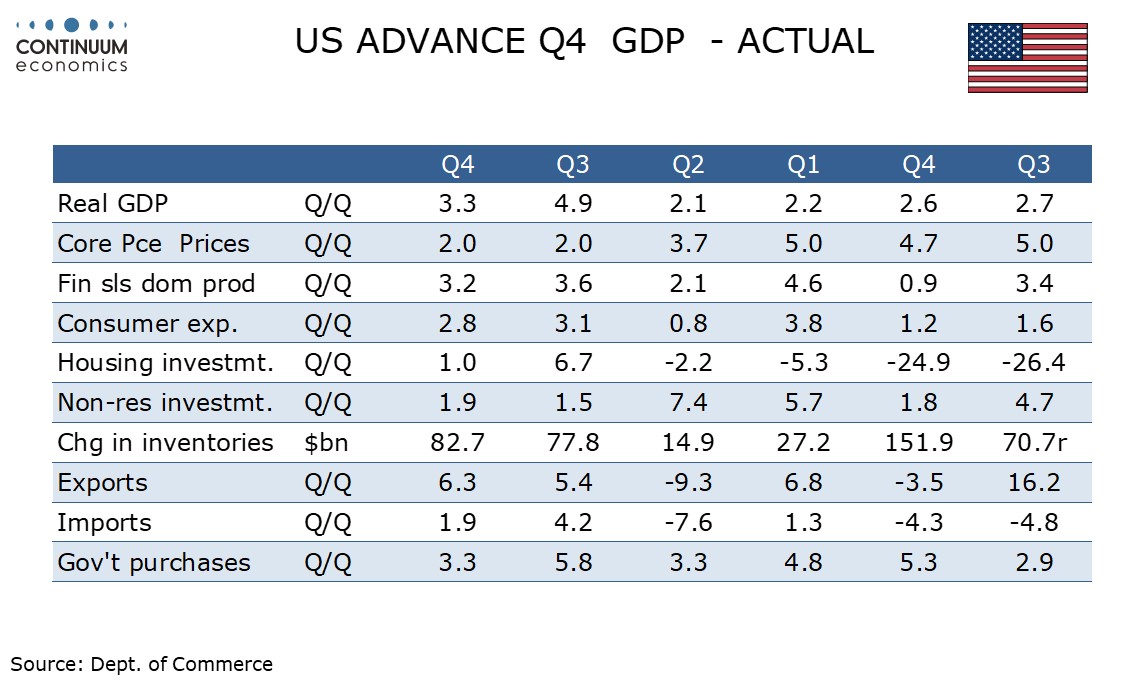

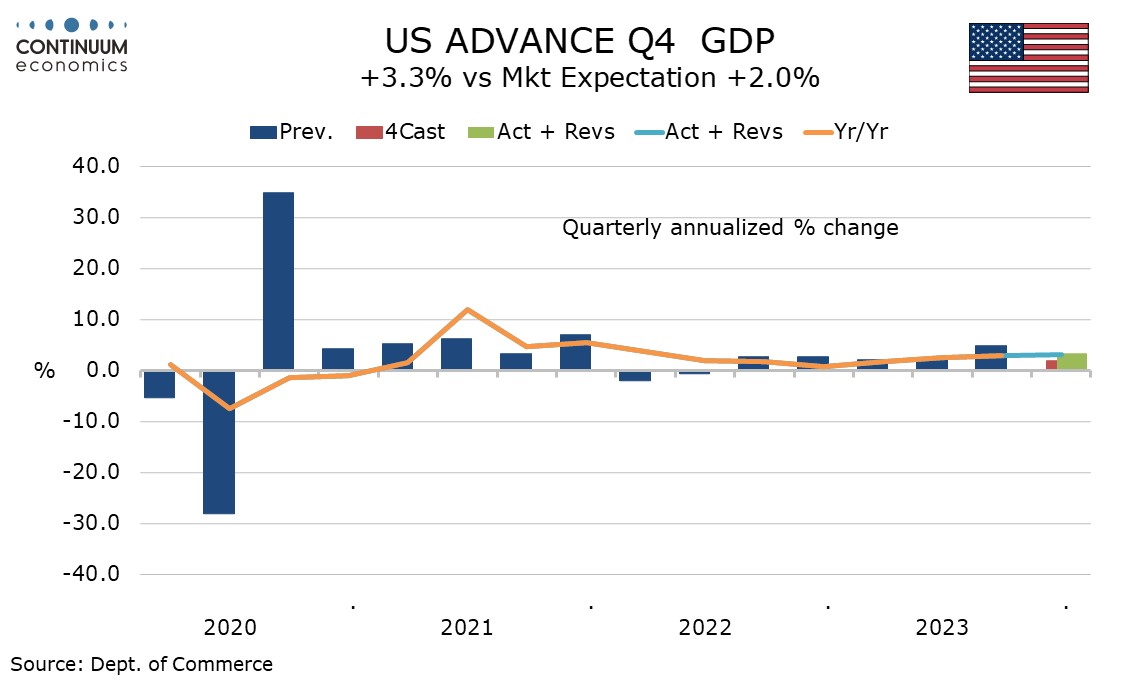

Q4 GDP with a 3.3% rise has come in significantly stronger than expectations and sufficiently so to cause surprise at the FOMC, remaining above long term potential even if slower than Q3’s 4.9%. Initial claims at 214k have corrected last week’s exceptionally low 189k but taking the two numbers together the labor market appears to have seen some improvement in recent weeks.

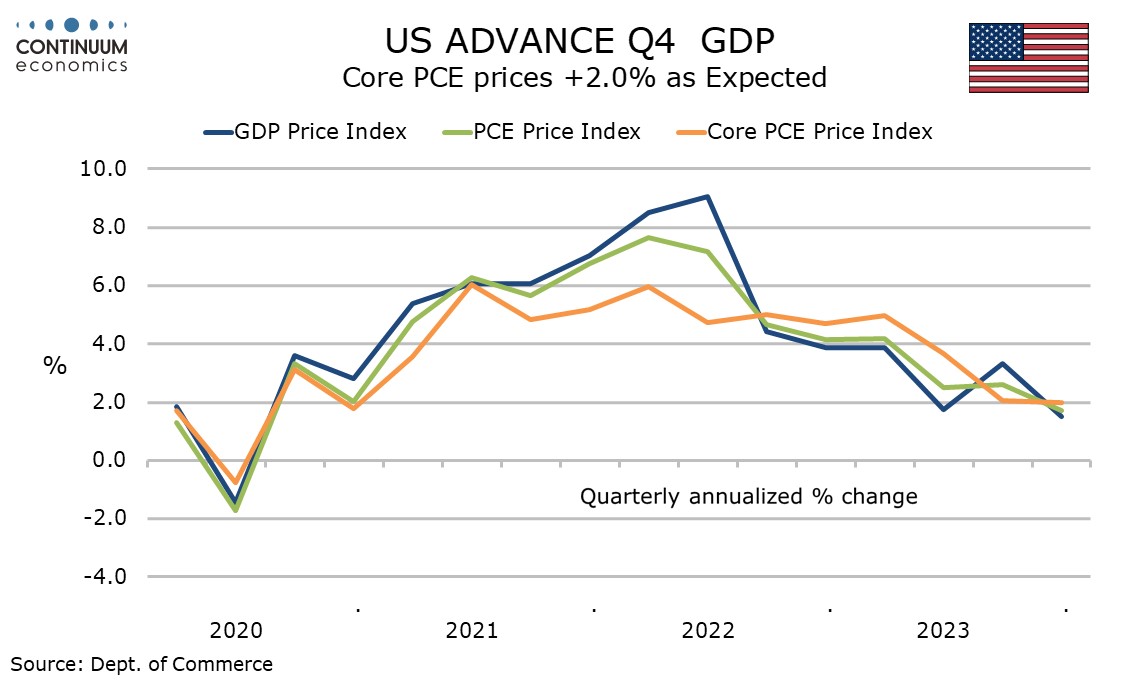

While the GDP data looks strong core PCE prices saw a second straight increase of 2.0% annualized, consistent with the Fed’s 2.0% target if sustained for two more quarters, though this outcome is in line with market expectations. The overall GDP price index at 1.5% was softer than expected however, with overall PCE prices at 1.7% and lower export prices a further restraint.

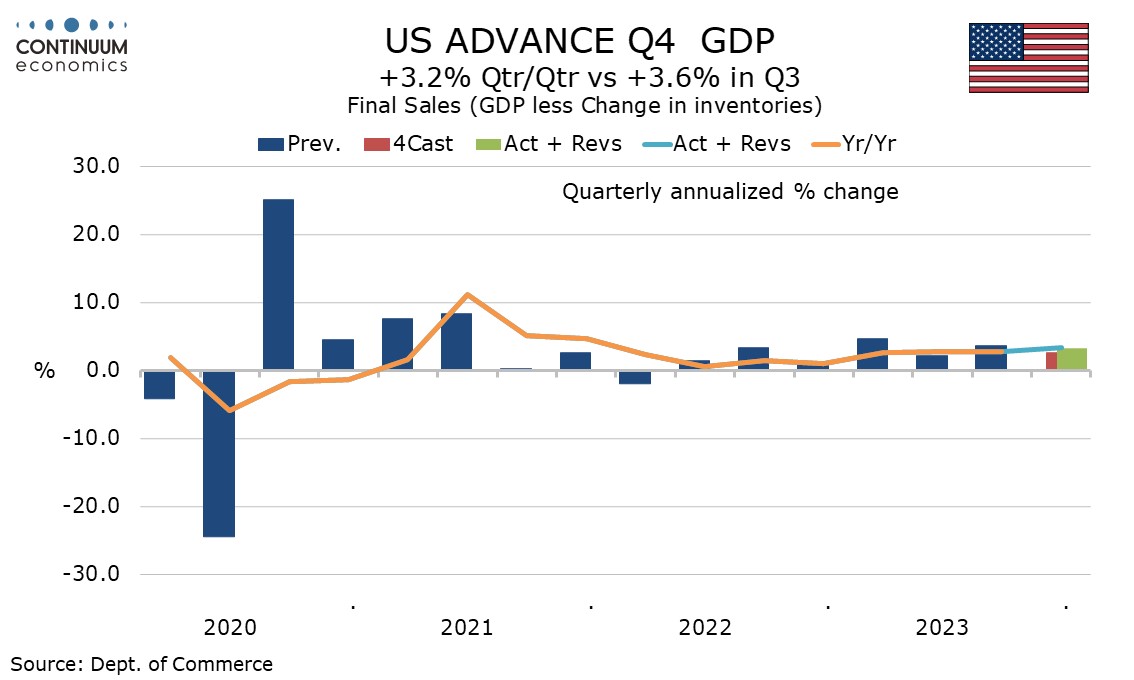

While inventories unexpectedly did not correct a Q3 acceleration, final sales (GDP less inventories) were strong at 3.2% and the strength here was broad based. Exports at 6.5% outpaced imports at 1.9% with final sales to domestic purchasers (GDP less inventories and net exports) up by 2.7%.

Consumer spending rose by 2.8% marginally outpacing a 2.5% increase in real disposable income with retail outpacing a 2.4% rise in services. Fixed investment was relatively subdued at 1.7% though all major components saw modest increases, with housing relatively weak at 1.1%. Government at 3.5% completes a solid breakdown even with defense easing from a very strong Q3.

A narrower December trade deficit and stronger than expected gains in December retail and wholesale inventories contributed to the GDP strength. Unchanged durable goods orders were weaker than expected and consistent with a relatively subdued business investment picture but ex transport saw a stronger than expected rise of 0.6%