FX Daily Strategy: Europe, March 20th

FOMC may become marginally less dovish…

…but this is likely well anticipated by the market

USD risks may consequently be on the downside

GBP vulnerable to weaker CPI data

JPY weakness overdone after BoJ

FOMC may become marginally less dovish…

…but this is likely well anticipated by the market

USD risks may consequently be on the downside

GBP vulnerable to weaker CPI data

JPY weakness overdone after BoJ

The FOMC meeting will be the main focus on Wednesday. A change in rates from the current 5.25%-5.50% target range looks highly unlikely. Given recent disappointment on inflation the statement is likely to repeat that more confidence on inflation moving towards target is needed before easing. The dots may even become marginally more hawkish, seeing 50bps of easing in 2024 rather than the 75bps projected in December.

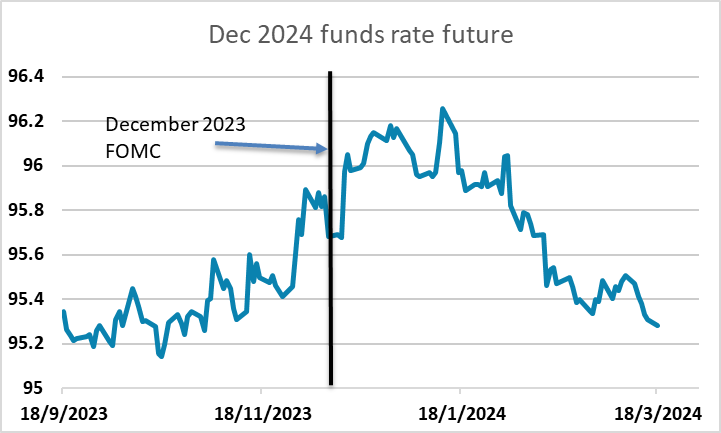

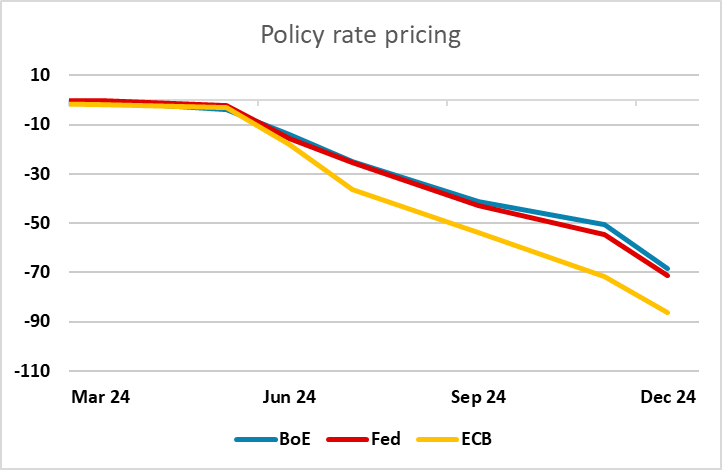

On the face of it this view suggests that the USD might benefit in the aftermath of the meeting. After all, the market is currently pricing in 73bps of easing this year, so in line with the dots from December, suggesting there would be scope for front end yields to rise if the median moved to 50bps. But after the December meeting, the market was pricing in a lot more easing than the Fed envisaged, with the December 2024 Fed funds contract at 95.68, indicating a funds rate of 4.32% against 95.30 now, which suggests a funds rate of 4.7%. Indeed, after the December meeting the market moved to price in even more easing, peaking at around 165bps of easing in mid-January. So a mildly hawkish Fed statement and the Fed dots shifting to a median expectation of 50bps need not lead to any rise in US yields. Indeed, we suspect this is essentially what the market is currently expecting, and shouldn’t have much impact on front end yields or the USD. If anything, the market is a little long USD going into the FOMC anticipating a more hawkish tone, and this may result in a sell on the news reaction. We wouldn’t see much scope for USD gains unless the Fed is more explicitly hawkish, and there is scope for USD/JPY to come back to challenge 150 and EUR/USD to reach back towards 1.09.

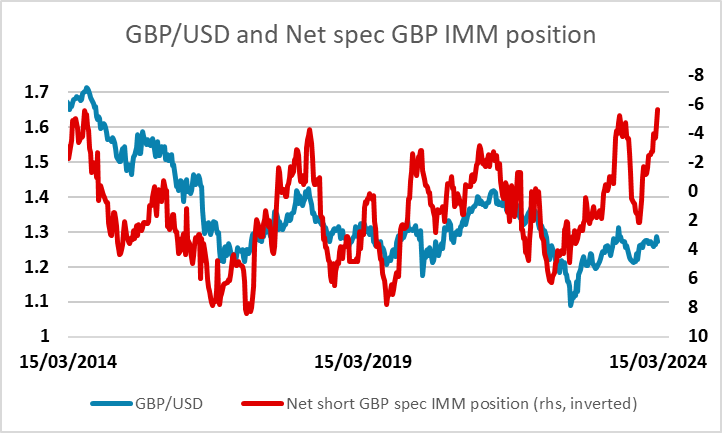

Ahead of the FOMC meeting we have UK February CPI data, with the market anticipating a decline in headline CPI to 3.5% y/y from 4.0% in January, and core to 4.6% from 5.1% in January. We see the headline rate down to 3.4%, a 29-month low and the core down to 4.7%, so broadly in line with the market consensus. Favourable base effects and the drop in the energy cap should bring headline inflation down to even a touch below the 2% target by April, an outlook that the BoE acknowledges, but doesn’t see as significant enough to justify early easing. It would take significant weakness in the core rate to increase expectations of BoE easing at this stage. Even so, we do see some downside risks for GBP, in part because there is scope for the market to price in lower UK rates, in part because positioning in GBP loks very extended in the CFTC data, and in part because yield spreads already suggests some upside scope for EUR/GBP based on the correlations over the last year.

Headline and Core Inflation Drop to Resume?

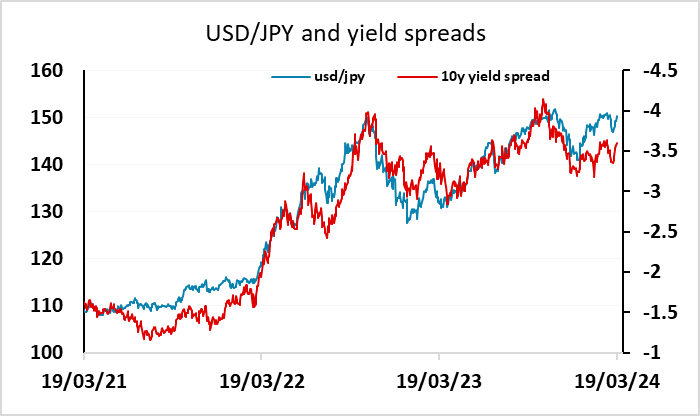

Other than the UK data, there isn’t a lot to excite the market ahead of the FOMC, but there may be scope for the market to reconsider the reaction to the BoJ meeting on Tuesday. The sharp rise in USD/JPY came even though the BoJ hikes rates and removed YCC – moves that the majority didn’t expect to come until April. The case for a weaker JPY seems to be based on the statement not indicating any future tightening was imminent. But this seems to be an overinterpretation. The BoJ has consistently been more hawkish than expected under Ueda, and while they don’t currently anticipate further tightening, this doesn’t rule it out. The market reaction looks to be due more to positioning than any real justification in the statement, and we would see scope for a general JPY recovery from here.