FX Daily Strategy: N America, September 24th

RBA Kept Rates on Hold

IFO a focus but EUR resilient to weaker survey data

GBP strength on surveys looks overdone

AUD and NOK represent the best value in risk positive environment

CHF looks the most attractive funding currency.

RBA Kept Rates on Hold

IFO a focus but EUR resilient to weaker survey data

GBP strength on surveys looks overdone

AUD and NOK represent the best value in risk positive environment

CHF looks the most attractive funding currency.

RBA kick starts Tuesday's economic release. The RBA kept the cash rate on hold at 4.35% as the current inflation picture does not support any change of monetary policy. The forward guidance statement has changed to "The Board will continue to rely upon the data and the evolving assessment of risks to guide its decisions.", suggesting the RBA is patiently waiting for the CPI to rotate till their target range before any action. While Q2 CPI came in higher at 3.9% y/y, the latest monthly CPI is showing moderation and we believe target range maybe met by year end 2024. RBA has acknowledged the growth of Australia to be weak and easing wage pressure. To keep a balanced dynamic, the RBA will likely begin easing once headline CPI touches the upper-bound of target range to cushion the weak economics growth. There is not much changes since the last meeting in terms of forecast or economic development.

In the mean time, the Aussie will be supported by push back of easing but there is also little room for tightening. It is just a matter of time before the RBA ease eventually and we see the RBA to begin easing by year end 2024.

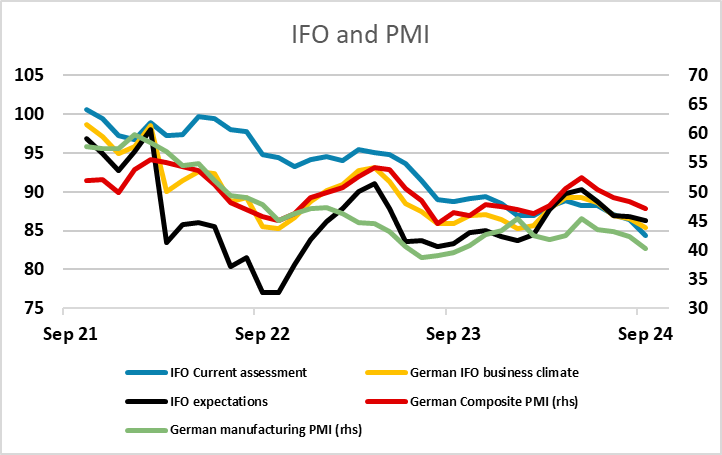

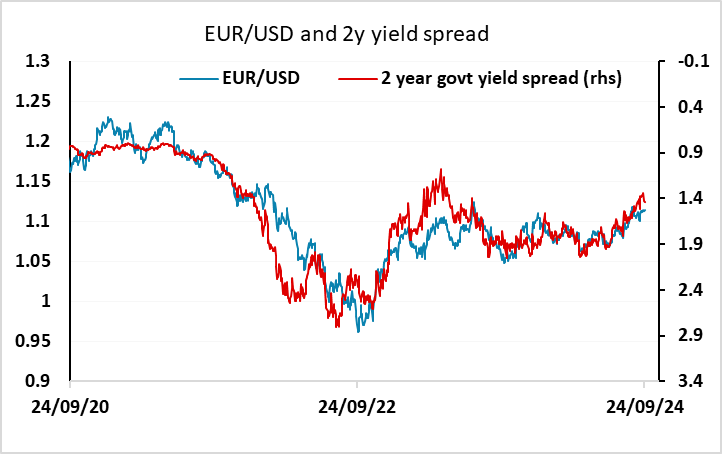

The German IFO survey was broadly in line with expectations even though it came in below the published consensus, as the market would have adjusted its expectations after yesterday’s weak PMI data. The current conditions index is notably weak, falling to its lowest since mid-2020 in the midst of the pandemic, while the business climate index fell to the lowest since January, and continues to decline broadly in line with the composite PMI. German yields are not much moved, with the data conforming to the PMI, and EUR/USD has actually performed well, extending the gains that started soon after the European open and approaching the pre-PMI levels of yesterday. It will be hard to get above these given the soft Eurozone data, but as we have noted before, yield spreads do look supportive in spite of the current weakness, so the upside looks likely to be preferred as long as global risk appetite continues to hold up.

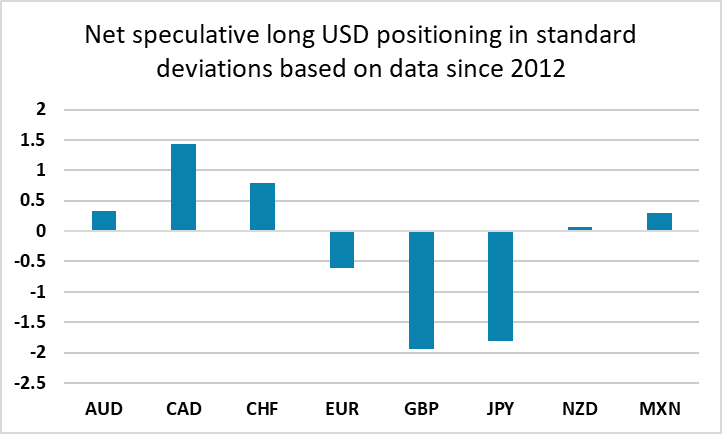

GBP performed best of the majors in response to the PMI data. Even though the UK data was also weaker than expected, it was less weak than the Eurozone data and was at much higher levels. EUR/GBP fell to new 2 year lows as a result. But we have several reservations about this reaction. First, the UK PMI does not have a very strong correlation with UK growth. In particular, the manufacturing PMI has recently had no correlation with UK manufacturing output. Indeed, if anything the correlation has been negative, with the UK manufacturing PMI climbing strongly for the last year while manufacturing output and has fallen both in growth and level terms. Second, even if UK growth is outperforming this year, the UK has still been the worst performing of the G10 economies since the pandemic (counting the Eurozone as one region). Third, GBP is already at high levels, with EUR/GBP approaching pre Brexit referendum lows in real terms, and the recent rise has come without much support from moves in yields. Finally, net speculative positioning remains longer GBP relative to history than any of the other majors according to the latest CFTC data. We consequently wouldn’t expect the EUR/GBP decline to extend below 0.83.

Source: CFTC, CE

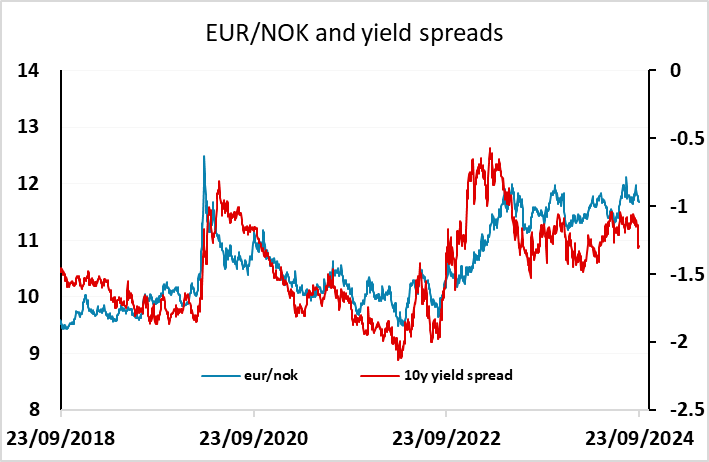

However, the strength of GBP does illustrate a general risk positive tone in the FX market that has been in place since the Fed rate cut. AUD/USD traded to new highs for the year on Monday, helped by the positive tone in equities, and the other risk positive currencies also performed well. After the hiccup in the summer it looks as if the market is intent on renewing risk positive carry trades. If this is the case, the AUD and NOK represent the best value, with the NOK having underperformed all year while the AUD has been held back by concerns about China.

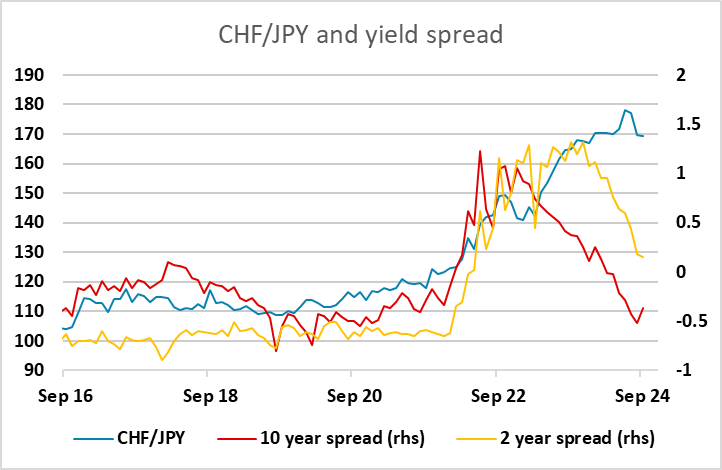

On the other side of the equation, the CHF still looks like the most attractive funding currency, with valuation remaining very high, particularly relative to the JPY. While EUR/JPY recovered almost all its initial dip on Monday, EUR/CHF held close to the day’s lows below 0.9450 at the end of the European session after trading above 0.95 after the Eurozone PMI. As we have noted before, it’s very hard to make the case for the current level of CHF/JPY given the 50% rise in the last 5 years and the yield spread move back to close to zero.