USD flows: Risks to the downside as trade sentiment sours

A quiet calendar, but the ruling out of a trade deal with India before August 1st suggests a risk negative tone

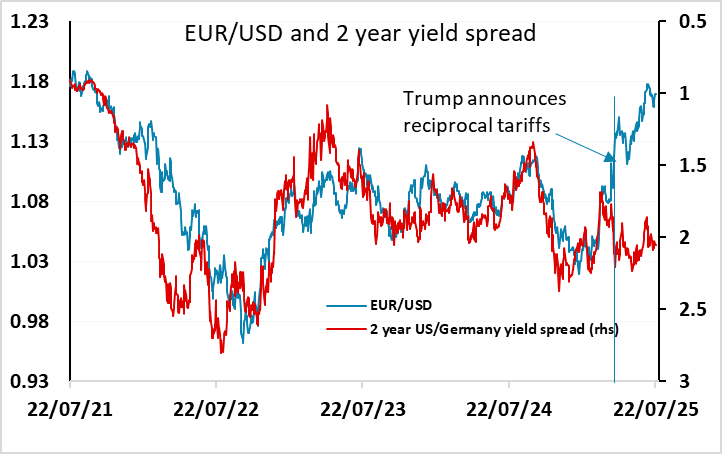

Markets have been relatively quiet overnight, and there isn’t a great deal on today’s calendar to create volatility, but we see some danger of a turn lower in risk sentiment. The report that a US/India trade deal has been ruled out ahead of the August 1 deadline suggests that a deal with the EU is also unlikely before then, with relations between the US and EU less friendly and trade deals more complex than the potential deal with India. Markets will still assume a deal will be done soon after the deadline, or that the deadline will be extended, as has been the tendency with Trump’s trade negotiations. But the chances of a sustained period of 30% tariffs have increased, and that should be negative for risk sentiment.

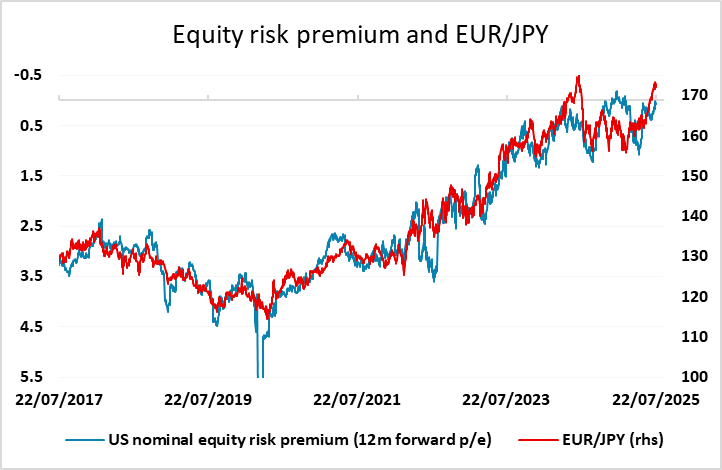

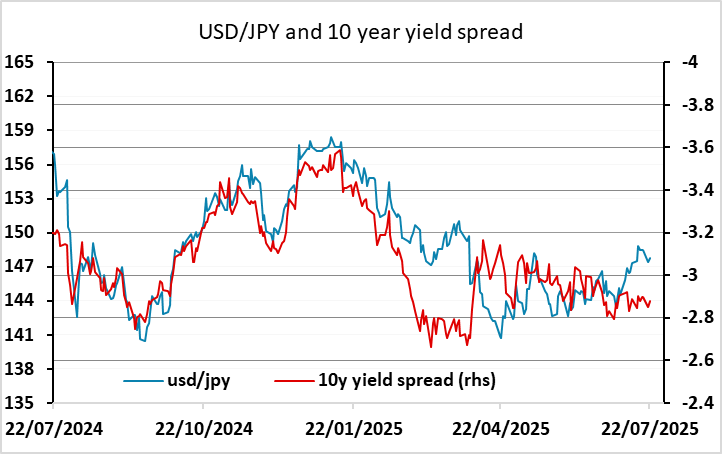

This suggests upside risks for the JPY, with US yields likely to fall in response if tariffs of this size are imposed. The more general USD performance is less clear. The USD fell back in April when reciprocal tariffs were announced, and was weaker yesterday as expectations of progress in trade negotiations with the EU waned, so if the market starts to believe that higher tariffs will be a reality, the USD is likely to be generally weaker. Even so, riskier currencies are less likely to benefit. The EUR, which has gained from a structural shift of institutional investors wince the April announcement, may have seen most of its gains, and while it would likely benefit initially if we see bad news on trade, it could struggle to sustain any rise if tariffs were seen as damaging a recovery.