FX Weekly Strategy: March 31st - April 4th

USD tending to suffer from higher tariffs

JPY still looks to have the most scope for gains

EUR picture less clear cut

AUD still has potential for an upside break

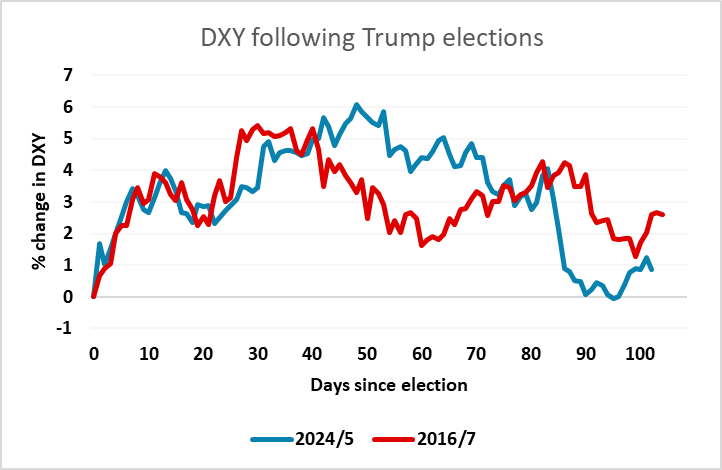

While there is the US employment report on Friday which will as usual attract attention, most of the market interest this week is likely to be on the Trump tariff announcement, with reciprocal tariff measures due to be announced on Wednesday. Having said this, the impact on the FX market of any announcement (even if we knew it in advance) is unclear. While the market view at the start of the Trump presidency was that tariffs would likely be USD positive (in line with theory), in practice tariff announcements haven’t had a USD positive impact. If anything, the opposite is true. The rationale seems to be that tariffs are bad for US growth, and that the Fed will likely focus more on the negative growth impact than the initial inflation boost, so that more tariffs will mean lower US yields, especially at the long end. Initial USD bullishness at the beginning of the Trump presidency saw the USD index gain around 5% after the election, but those gains have now been fully reversed. This is at least partly because the tariff burden is now seen as greater than it was initially, but there is also a loss of optimism on the prospect for tax cuts so that fiscal policy in total is now seen as neutral or even contractionary.

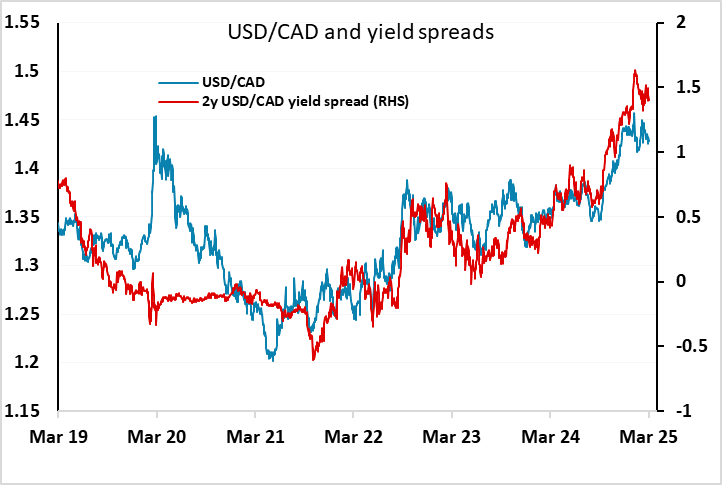

This suggests that aggressive reciprocal tariffs are likely to be seen as USD negative. But the market interpretation so far has very much focused on the impact on the US economy, with much less focus on the likely effects elsewhere. For instance, surprisingly there hasn’t been much change in market expectations of BoC policy, even though the tariffs on Canada may well send the Canadian economy into recession. While there are offsetting impacts on Canadian inflation, both from Canadian retaliatory tariffs and feedthrough from the US tariffs into US exports to Canada, it does seem likely that the risks for Canadian rates are on the downside compared to the pre-Trump tariff environment. But there is now less easing priced for Canada over the rest of the year than the US. Furthermore, the CAD is tending to outperform its recent relationship with yield spreads. Reciprocal tariffs will have more impact on emerging markets, but could be significant for the EU. But the experience of Canada suggests that the FX impact is unpredictable, and if anything we would favour aggressive tariffs proving USD negative.

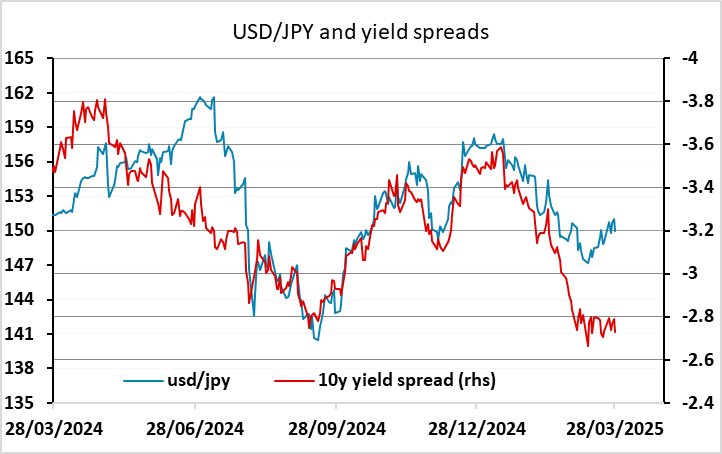

The case for a weaker USD was supported at the end of last week by another big US trade deficit in February, which wasn’t accompanied by as much of a rise in inventories as might have been expected given the big rises in imports (which were likely due to an attempt to avoid the upcoming tariffs). This suggests Q1 GDP could turn out negative. The Atlanta Fed GDPNow nowcast is forecasting -0.5% for the quarter even when the numbers are adjusted to allow for the distortions due to imports of gold. Our forecast is a little stronger, but it is clear that Q1 GDP will be weak. Although most expect a strong Q2 rebound, the risks for US yields in the short run look to be on the downside, especially at the long end. This suggests to us that the USD/JPY sortie above 150 is likely to prove short lived and a very good selling opportunity.

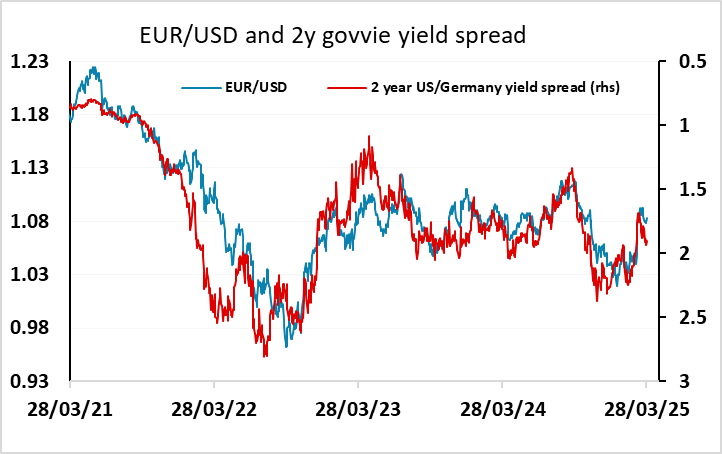

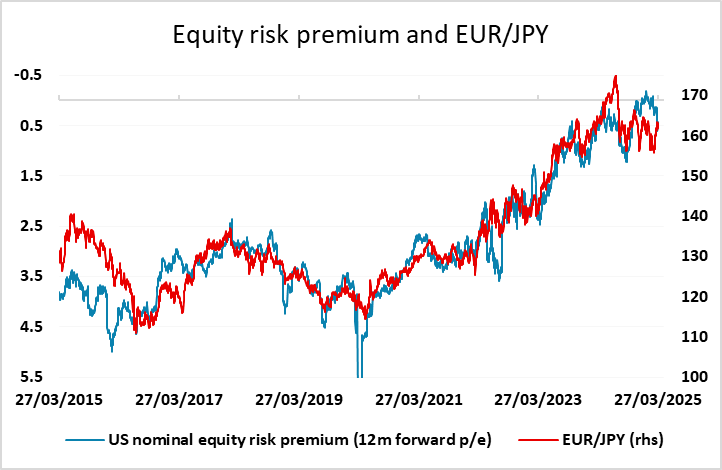

The EUR/USD picture is less clear-cut. Eurozone data was on the soft side at the end of last week, and there were comments from ECB Board member Piero Cipollone acknowledging the weaker trend in the data and suggesting that an April rate cut is very likely. This is already around 85% priced in, so there isn’t a huge amount of further downside for EUR yields, but spreads already suggests that the EUR could come under some pressure. EUR/JPY also looks stretched, particularly if we see a continuation of the theme of lower yields and lower equities that was seen on Friday, as this implies an increasing equity risk premium, which is typically correlated with a higher JPY against the EUR and on the crosses in general.

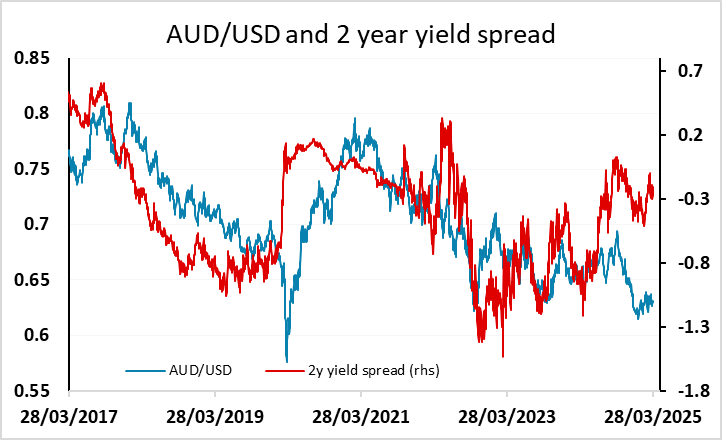

If equity markets continue to struggle, the commodity currencies would normally tend to underperform. But if equity weakness is more centred on the US than elsewhere, due to higher US valuations, commodity currencies could perform better than usual. We continue to see the AUD as having upside potential, with a break out above the 0.64 resistance area possible if Asian equities hold their own. Yield spreads are still suggestive of a higher AUD, and that is unlikely to change at this week’s RBA meeting.

Data and events for the week ahead

USA

The key event of the week will come on Wednesday, when Trump is set to announce reciprocal tariff measures, though it is likely to remain unclear how long what is announced on Wednesday will persist. Friday is also a big day with March’s non-farm payroll due as well as a speech by Fed Chairman Powell, who will then be able to respond to the tariff details and employment report.

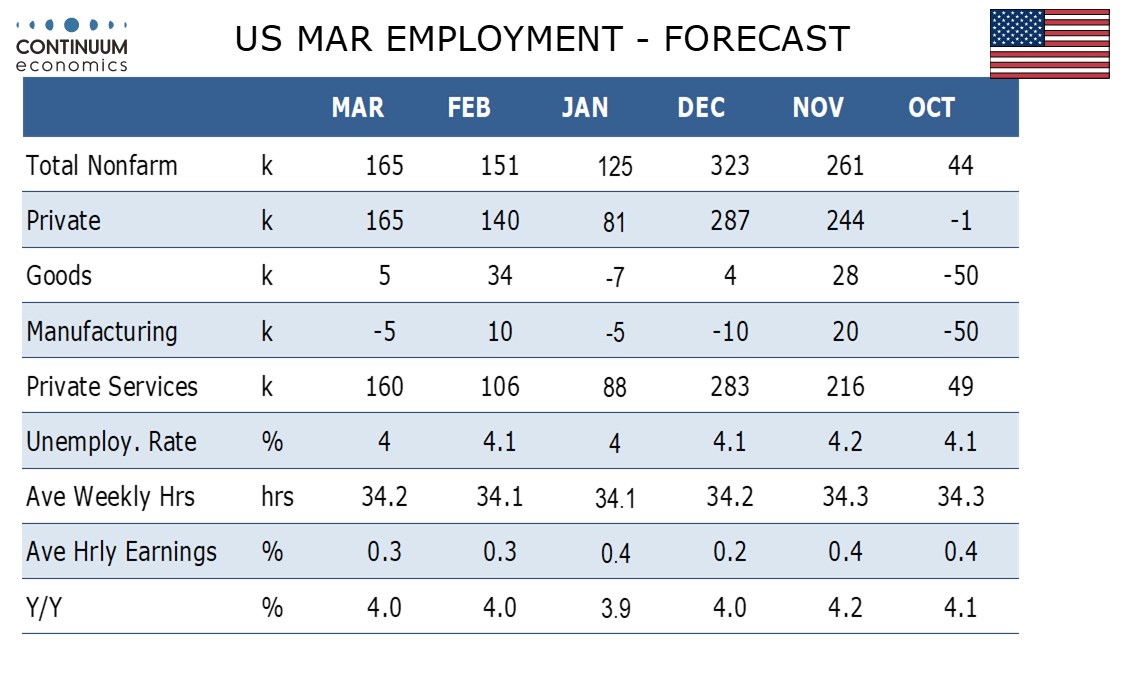

We expect the non-farm payroll to suggest the labor market remains healthy, with a gain of 165k, both overall and in the private sector, with a dip in unemployment to 4.0% from 4.1% and an in line with trend 0.3% increase in average hourly earnings. We expect payrolls to outperform a 125k increase in Wednesday’s ADP report on private sector employment for March. Other labor market signals will come from February’s JOLTS report on job openings on Tuesday and weekly initial claims on Thursday.

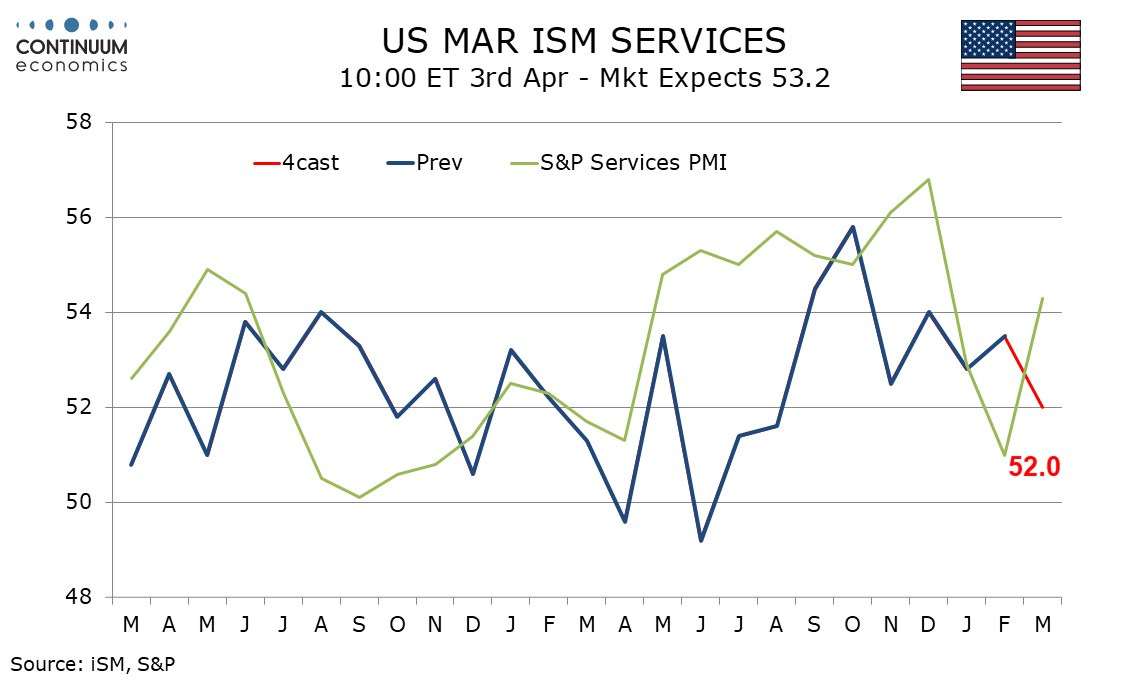

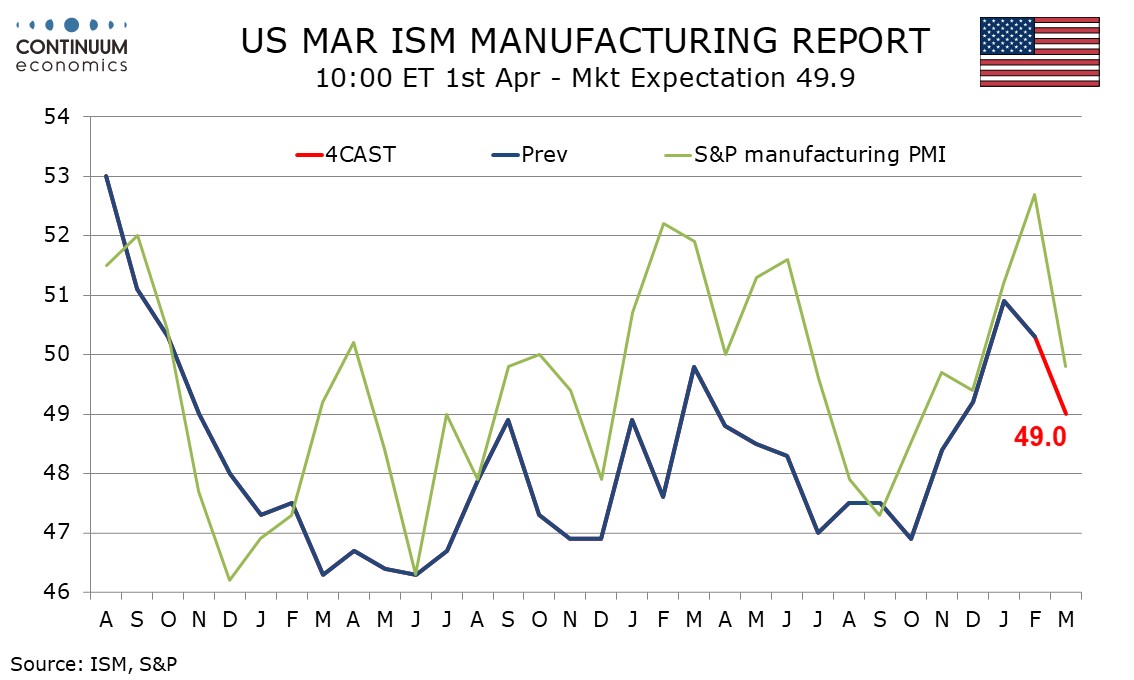

Despite looking for a healthy payroll gains, we expect March ISM surveys will be weaker, manufacturing on Tuesday at 49.0 from 50.3, and services on Thursday at 52.0 from 53.5. Other data releases scheduled include February construction spending on Tuesday and February factory orders on Wednesday. On Thursday we expect February’s trade deficit to fall to a still very large $125bn from January’s record $ 131.4bn. Fed’s Jefferson speaks on Thursday.

Canada

In Canada, focus will be on Trump’s Wednesday tariff announcement. The most significant data release will be March employment on Friday, at risk of showing some adverse impact from trade tensions. March S and P PMIs are due, manufacturing on Tuesday and services on Thursday. Thursday also sees February’s trade balance.

UK

The BoE will release its Decision Maker’s Survey on Thursday, this coming after Monday’s BoE money and credit figures. MPC member Green gives a keynote speech (Tue). Otherwise, final PMI data (Tue, Thu) may highlight downside risks, the question being whether they have spread elsewhere which the Construction PMI (Fri) may reveal.

Eurozone

The week has several PMI updates, including final composite numbers (Tue & Thu) and the even weaker construction equivalent (Fri). Published on Tuesday, labor market data may show a rise in jobless ness but still point to a rising workforce. Tuesday also sees flash HICP inflation numbers may deliver better news and broadly so. Indeed, we see more supportive news in the March flash numbers, with the headline and core down 0.2 ppt (the former to 2.1% and hence the lowest since last autumn), services down perhaps a little more sizeable and the core down (Figure 1) and where adjusted data continue to suggest underlying price pressures are consistent with the ECB target. Ahead of the EZ HICP figures on Monday sees German CPI numbers. We see the headline rate dropping another notch to 2.5% in data due Mar 31 with services and core also lower and more decisively so.

Otherwise, German manufacturing orders numbers (Fri) are likely to see a fresh m/m jump back as there is a likely reversal in bulk orders.

As for the ECB, key speakers perform (Lagarde and Lane) at an AI-based conference (Tue). More interest will be in the account of the March Council meeting. The question is the extent the Council accepted its updated forecasts were already out of date given EZ fiscal and defense initiatives that are brewing. The question of a policy pause may also have been raised.

Rest of Western Europe

There are key events in Sweden, most notably on Friday which sees the monthly flash CPI data which surprised on the upside in both February and January. In Switzerland, Thursday consumer price data arrives where a small rise in the headline is both likely and also consistent with SNB projections.

Japan

Mostly tier two data for Japan next week. We have the unemployment rate on Tuesday, which would be the only eye-catching data. There are also retail sales, industrial production on Monday and other manufacturing PMIs on Tuesday.

Australia

The RBA Interest rate will be decided on Tuesday. We forecast there will be no change to interest rate with little change to forward guidance. CPI remains in the mid rage of target but trimmed mean remains at the upper bound. Until we also see trimmed mean to tread towards mid-range or headline drops past 2%, the RBA is unlikely in any rush to ease further. On Thursday, there are PMIs and Trade balance, those would be less important than RBA’s decision.

NZ

Business confidence and Outlook on Monday and other tier two data by the end of week, neither are likely to direct the Kiwi movement.