U.S. January ISM Services index implies continued moderate growth

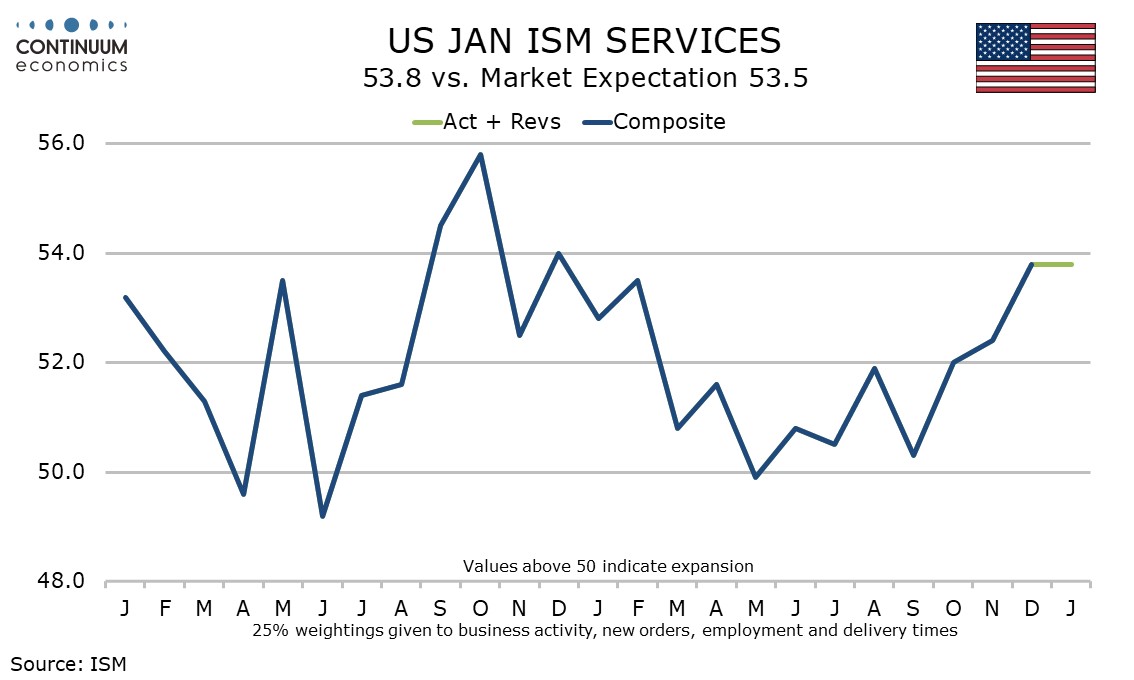

January’s ISM services index at 53.8 is unchanged from December but slightly stronger than expected. December’s index was recently revised down from 54.4 as seasonal adjustments saw their annual revisions.

While the pace of growth implied is still quite moderate, the last two months are stronger than any seen since December 2024, even if less sharply improved than January’s ISM manufacturing index of 54.6. from 47.9 in December.

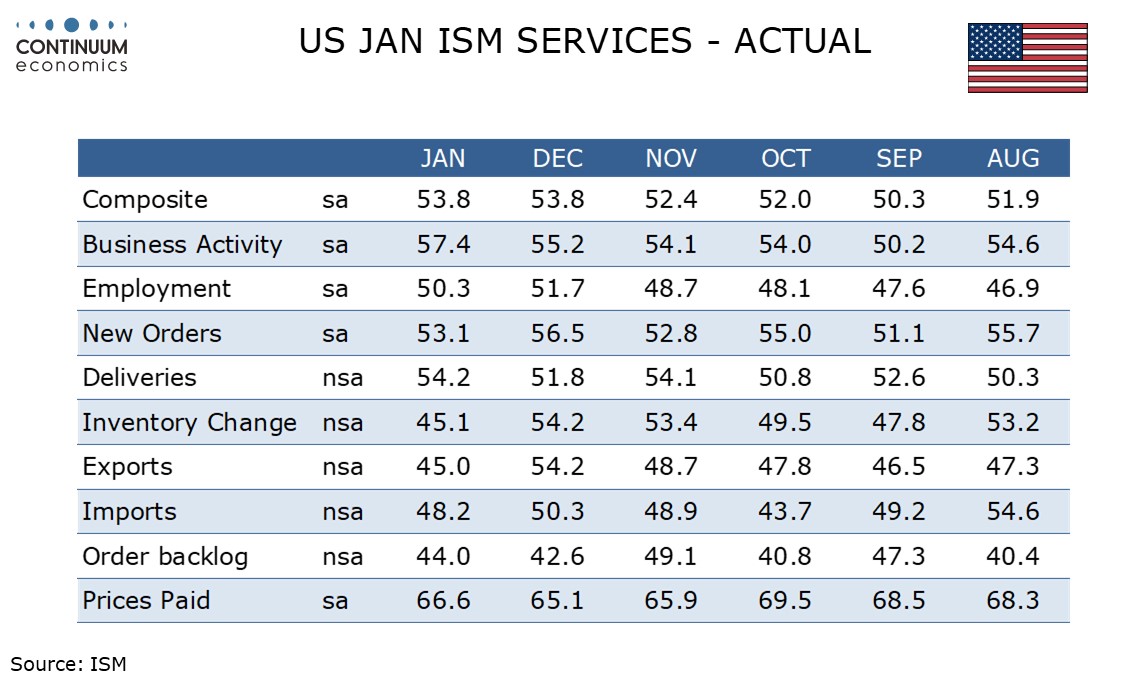

The four components that make up the ISM services index saw improvements from business activity to 57.4 from 55.2 and deliveries to 54.2 from 51.8, but slowing in new orders to 53.1 from 56.5 and employment to 50.3 from 51.7. Employment is still showing a second straight positive after six straight negatives.

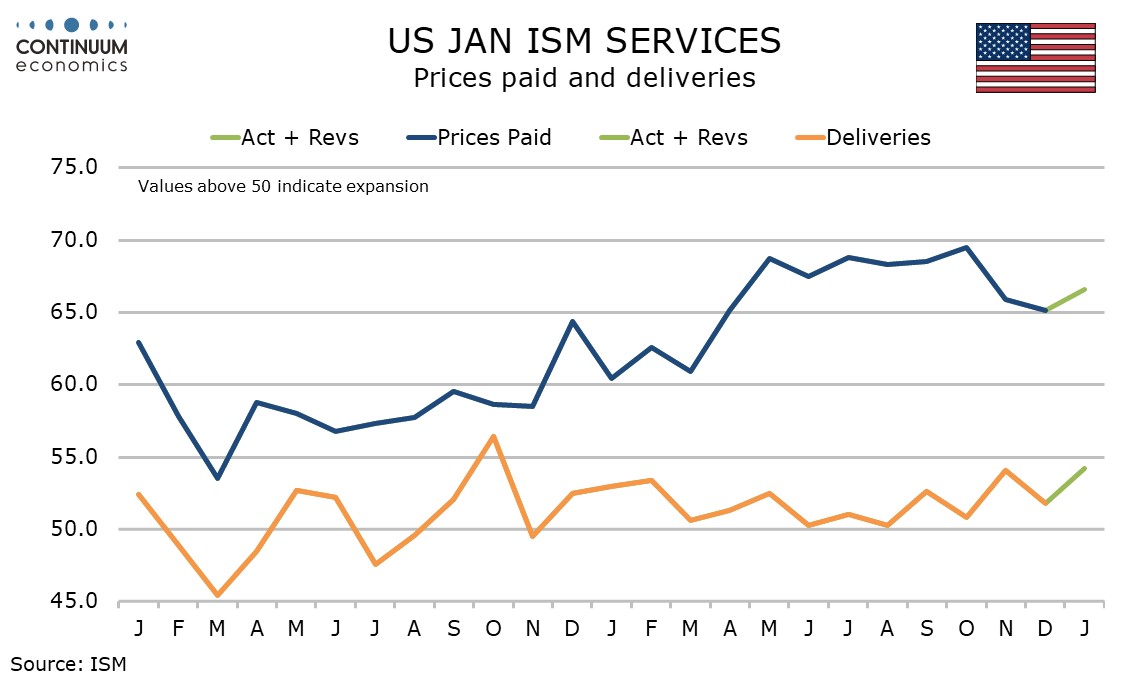

Prices paid do not contribute to the composite and at 66.6 from 65.1 remain in a tight range which has been in the high 60s ever since April’s tariff announcement, though with a slight cooling in recent months.

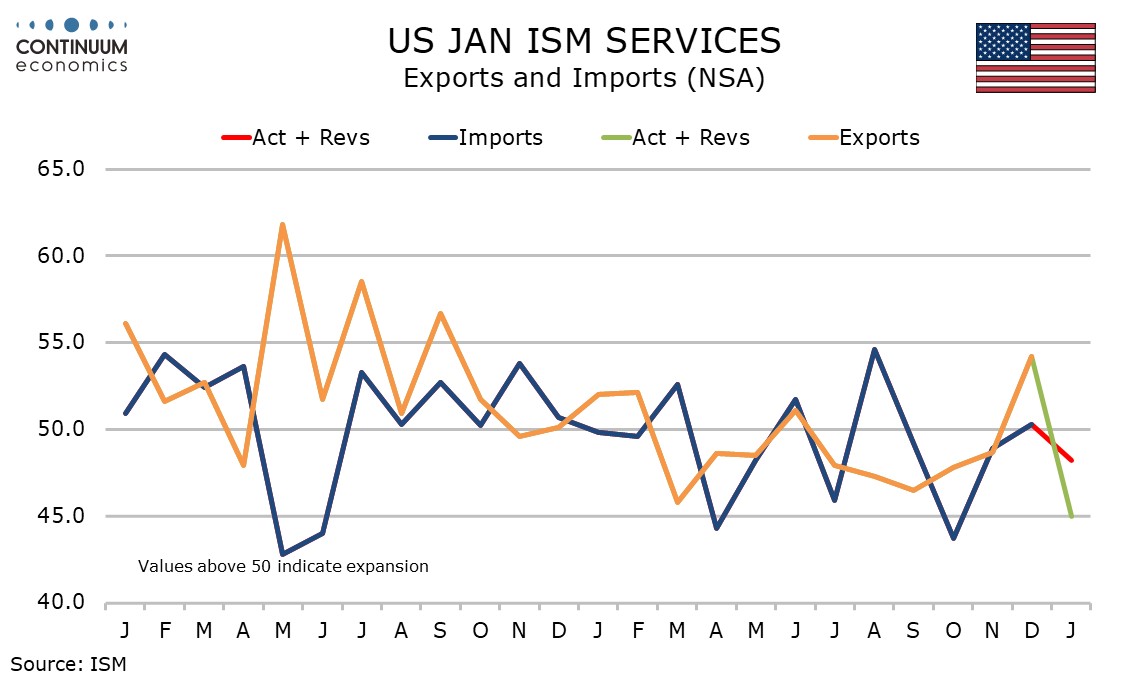

Export and import indices also do not contribute to the composite but more than fully reversed December gains, exports to 45.0 from 54.2 and imports to 48.2 from 50.3. This suggests some cautions should be seen towards January bounces in ISM manufacturing exports and imports data.