FX Daily Strategy: N America, June 24th

USD softer after Iran/Israel ceasefire and Fed Bowman July hints

JPY can extend recovery with in the absence of more geopolitical shocks

CAD upside quite limited even though CPI risks are on the upside

EUR/GBP could extend rally if BoE speeches sound more dovish

USD softer after Iran/Israel ceasefire and Fed Bowman July hints

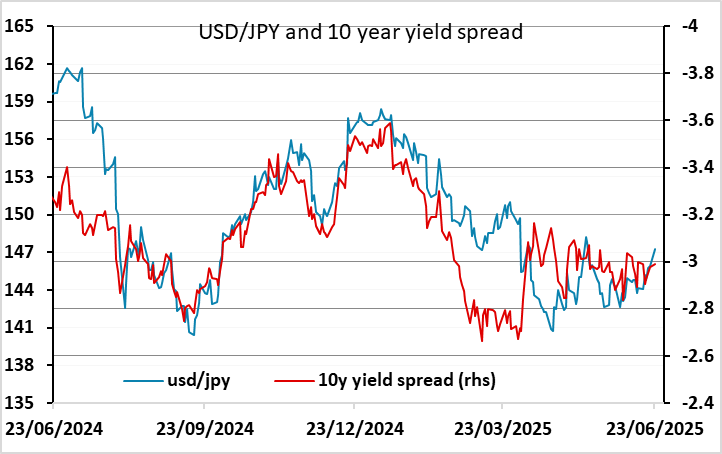

JPY can extend recovery in the absence of more geopolitical shocks

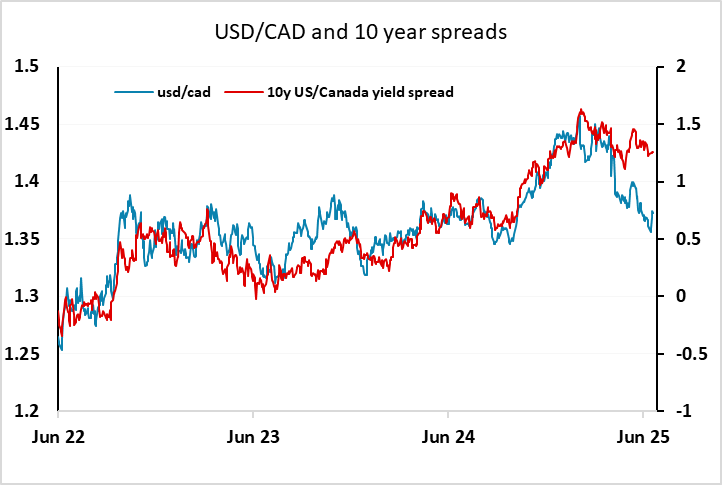

CAD upside quite limited even though CPI risks are on the upside

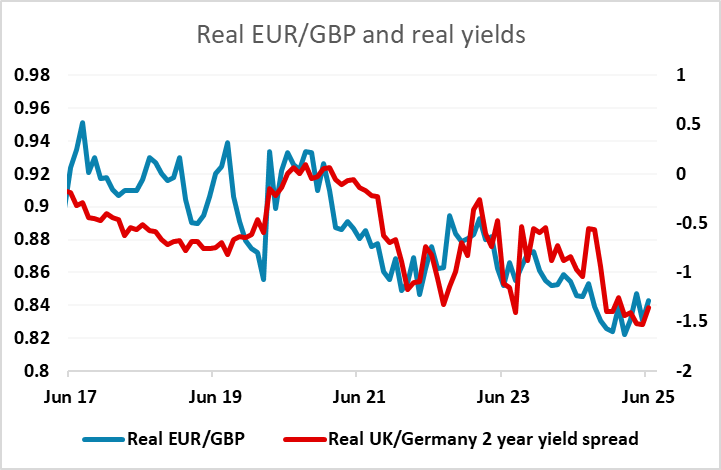

EUR/GBP could extend rally if BoE speeches sound more dovish

The main focus will still likely be on geopolitics, with the announcement of an Iran/Israel ceasefire brokered by the U.S.. The USD has sold off with the decline in oil prices and reduction in global risk. The market is shifting to look at the Fed again, with hawk Bowman having hinted at a July Fed rate cut. Focus will be on Powell to see whether he provide as any hints as well. While the market bias is for further small USD losses in the next 24/48 hours, Powell may not want to shift too radically from the stance at last week's FOMC meeting -- especially with the U.S. employment report next week. USD/JPY can test 145.00, but will likely need fresh USD negative news to break down to 144 and key 143.60 level.

The May Canadian CPI data is also released and could be significant for USD/CAD. As it stands, the market is pricing in a 35% chance of a 25bp rate cut at the July 30 BoC meeting. We expect May Canadian CPI to see a marginal rise to 1.8% yr/yr from 1.7% in April, correcting a fall from 2.3% in March that was fully explained by the abolition of the consumer carbon tax. However, after an acceleration in April, we expect some slowing in the Bank of Canada’s core rates in May. This is consistent with the market consensus, so although the consensus sees an unchanged headline rate, it seems unlikely to have a notably impact. The risks may be slightly to the upside suggesting the CAD could have some scope to rally, but the USD/CAD declines since the announcement of reciprocal tariffs make it harder to see further significant losses.

There isn’t much of significance data out of the US but there are speeches from BoE governor Bailey and chief economist Pill in the wake of last week’s 6-3 MPC vote. Pill has been clearly on the hawkish side so any softening of that position in the wake of the meeting could be taken as a signal that a rate cut is more likely at the August meeting than the 57% chance currently priced in. Although EUR/GBP has run a little ahead of moves in yield spreads in recent weeks, a suggestion of a further contraction in the real UK/Eurozone yield spread would support the case for the EUR/GBP rally extending towards 0.86.